With the Government setting out its Zero Emission Vehicle (ZEV) mandate last year requiring all new cars sold in Britain to be zero emission by 2035,car dealerships have had to step up the installation of new green infrastructure to support the move.

The move towards greener transport is evidenced by the fact that electric vehicle (EV) registrations increased by 3.8% this year, according to the Society of Motor Manufacturers and Traders (SMMT), with carmakers offering enticements such as 0% finance and deposit, as well as packages that include servicing and maintenance to attract customers.

Today, there are more than a million fully electric cars on the UK roads and that will only increase with the push towards the 2035 net zero target. Motor retailers have responded by investing in building new infrastructure and repurposing their existing sites.

With the Government setting out its Zero Emission Vehicle (ZEV) mandate last year requiring all new cars sold in Britain to be zero emission by 2035,car dealerships have had to step up the installation of new green infrastructure to support the move.

The move towards greener transport is evidenced by the fact that electric vehicle (EV) registrations increased by 3.8% this year, according to the Society of Motor Manufacturers and Traders (SMMT), with carmakers offering enticements such as 0% finance and deposit, as well as packages that include servicing and maintenance to attract customers.

Today, there are more than a million fully electric cars on the UK roads and that will only increase with the push towards the 2035 net zero target. Motor retailers have responded by investing in building new infrastructure and repurposing their existing sites.

For example, Arnold Clark last year announced it would be spending £23million on 150kW EV rapid chargers at its 80 sites across the country, as well as opening its first Electric Car Centre in Sydenham, London, with another being opened in Altrincham.

Others have followed. In March, Lookers opened its first £6m new and used multi-franchise Car Hub retail concept in Middlesbrough, focused on EV sales through its EV Experience Centre. As well as providing six 150kW EV rapid chargers, the EV Experience Centre offers knowledgeable, free and unbiased advice about electric driving.

Others have followed. In March, Lookers opened its first £6m new and used multi-franchise Car Hub retail concept in Middlesbrough, focused on EV sales through its EV Experience Centre. As well as providing six 150kW EV rapid chargers, the EV Experience Centre offers knowledgeable, free and unbiased advice about electric driving.

Bowker Motor Group has also invested £1m to improve its EV charging infrastructure. The Lancashire-based firm has outlined plans for as many as 50 new charging points across its networks in the coming months after making initial installations at its BMW and Mini site at Preston Docks.

There has also been an influx of new entrants into the market. Chinese EV brand BYD is planning to establish a UK retail network of 100 dealerships by the end of 2025, while one of its competitors, GWM Ora, has already formed more than 30 customer service points across the country, encompassing sales, aftersales and test drive centres.

“The dealerships in general have done a good job of getting ready for ramping up EVs,” says motor industry expert Mike Jones, the former boss of ASE.

“They have put the infrastructure in place and have been busy training their staff up on the technology.“

But there are many dealers who are still contemplating the move to EVs and what’s required to ramp up their operations. Considerations include: upgrading electrics to install adequate charging points; adding in renewable energy systems and solar panels where possible; revamping large dealerships to add in a second franchise or kitting out the workshop.

Charging point installation

The ease of charge point installation depends, to a large extent, on a dealer’s location. If the mains electricity source to the site doesn’t have enough power or capacity it can be costly and time consuming to upgrade local sub-stations. Then there is the issue of more space being needed in the car park due to long charging times.

Before installing the equipment, though, dealers must first carry out a thorough assessment of their electrical infrastructure and then determine what they need in terms of additional power source, number and type of chargers. They also need to decide where the chargers will be installed, including the parking lot, showroom, delivery and service bay.

Currently, most chargers are used for test drive vehicles, staff and visitors, but, as the push to meet the 2035 net zero target accelerates, there’s a greater need for more public charging points, including in dealerships.

To cater for this, they will have to install superchargers to deliver fast charging.

Going a step further, dealers should look to manage their use of EV charging points through the adoption of software to monitor the consumption and make efficiency changes accordingly. That way they can keep an eye on who is using which chargers, how regularly and for what period of time.

Going a step further, dealers should look to manage their use of EV charging points through the adoption of software to monitor the consumption and make efficiency changes accordingly. That way they can keep an eye on who is using which chargers, how regularly and for what period of time.

Some dealers have also installed renewable energy systems and solar panels to become more energy efficient and sustainable. This will eventually become mandatory as manufacturers’ corporate social responsibility reporting requirements extend to their retail channels.

There are, however, challenges on sites which are not geared up for or will find it difficult to install the infrastructure because of the design or situation of the buildings. Several dealers have added a second franchise to their sites in order to balance the books and become more profitable. That enables them to offer wider range of EVs.

The complexity of adding a second franchise depends on both parties ‘requirements. Some degree of physical separation is expected, with both wanting a separate external entrance and some level of brand-dedicated staffing.

“The new investment can usually be easily justified on a marginal costing basis – if the whole site costs are later allocated more precisely across the two brands based on sales volume or revenue, for example, then the economics look more normal,” says Steve Young, managing director of ICDP.

“We do, however, expect multi-branding to expand due to a combination of evolving strategies from the OEM multi-brand groups and the desire of all OEMs to reduce cost of distribution while maintaining geographical coverage.“

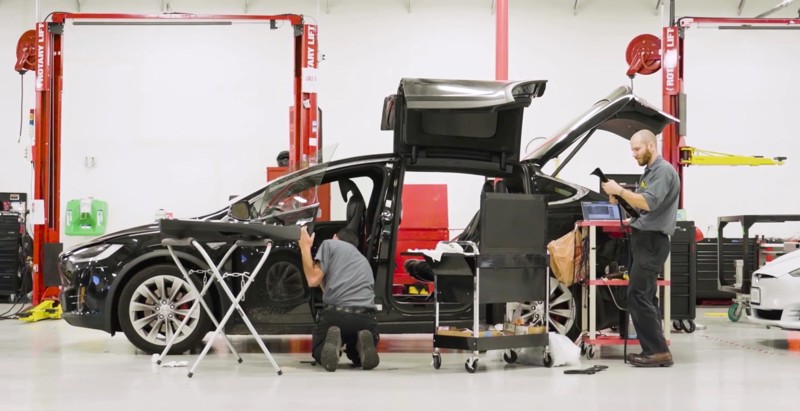

Workshop fittings

The equipment needed to lift batteries and store them in safe locations to prevent fire risks also requires space that many workshops don’t have. For those that do, the workshop needs to be prepared so it conforms with health and safety laws.

To support the technology, dealers also need to regularly train and upskill their staff to sell and service and repair EVs.

While 34% are planning more staff training on how to sell EVs, only 43% have undertaken formal training, according to a recent Starline Used Car Tracker. The research also found that 18% of dealers have gaps in their knowledge, while 10% say their staff are nervous when answering buyers’ questions about EVs.

“The tougher elements – and the most neglected – are those related to sales people,” says Young.

“Retail customers, in particular, are not queuing up to buy BEVs. So, while they may be curious, even open to a purchase, they are also seeing daily headlines that put them off related to unreliable and patchy charging infrastructure, battery fires and battery life.

“They are also getting a contrary message from Government that ‘things are not so urgent so we’ve delayed the cut-off for ICE sales by five years’, and wonder whether they can continue to run internal combustion engine (ICE) cars indefinitely. The sales task is, therefore, much more about answering questions, addressing concerns and explaining what life with a BEV is like – planning charging stops, finding suitable locations and the impact of cold weather. The sales staff need to have lived with a BEV for an extended period before they will be able to answer these questions convincingly.”

The number of qualified technicians able to safely work on EVs also rose to 39,000 by the end of 2022, with more than 14,800 obtaining the Institute of the Motor Industry’s (IMI) TechSafe professional recognition. However, the IMI itself has warned of a 16,000 shortfall in technicians by 2032 if EV skills training isn’t accelerated.

“Skills and training are the biggest challenge,” says Jose Pereira, director– client advisory services, mobility group Europe at Frost & Sullivan.

“Skills and training are the biggest challenge,” says Jose Pereira, director– client advisory services, mobility group Europe at Frost & Sullivan.

“There are not enough skilled technicians. There are safety requirements and certifications that must be gained to enable technicians to work on high-voltage batteries as well as use the specific workshop equipment required to test and diagnose issues.”

An unintended consequence of the use of EV technology has been it has opened up roles to a more diverse set of people, says Jones. A couple of dealers he has been working with have recruited more female staff as a result, he adds.

“They have seen a big change in the make-up of service departments recently,” says Jones.

“As we continue to move towards the more widespread roll-out of EVs, so it appears, we’re starting to see a much improved gender balance too.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.