UK automotive wasted no time in calling for new Prime Minister Liz Truss to come to the aid of its businesses and car buyers as soaring energy prices posed a bleak outlook.

The Society of Motor Manufacturers and Traders' (SMMT) and the National Franchised Dealers Association (NFDA) want an urgent and joined-up strategy to reduce business costs, save jobs and protect the public’s finances.

As an exclusive AM survey, conducted in partnership with JudgeService, gave an insight into car retailers’ performance expectations for a 2022 trading period in which inflation reached double figures and energy costs soared more than 250%, business leaders were also grappling with their own solutions to staff welfare challenges.

Devonshire Motors dealer principal Nathan Tomlinson faces the renegotiation of energy tariffs in September when its current contract ends.

He told AM: “The potential increases, in gas of circa 250% for a 12-month contract, and electricity of 350%, are causing me to rethink the way we use and control energy, but also how we manage the business.

“You can probably invest yourself in energy and resource management and make more impact on the bottom line than you can by intense involvement in the day-to-day operations.”

Tomlinson (pictured) added: “Running a business during such difficult times is now heavily balanced towards time spent managing cost and resource challenges, rather than operating from a position of stability.”

Tomlinson (pictured) added: “Running a business during such difficult times is now heavily balanced towards time spent managing cost and resource challenges, rather than operating from a position of stability.”

In its September pre-close trading update Vertu Motors highlighted that it would be focused on reduced energy usage in H2 as it, too, faced the daunting task of renegotiating its energy tariffs at the end of September.

Vertu has established an energy buying strategy that includes the sourcing of “off-grid energy solutions” to manage its exposure to volatile pricing changes.

While Devonshire Motors has set up an Energy Saving Task Force and is focusing on solutions, such as switching from gas to LPG in its workshops, Pebley Beach managing director Dominic Threlfall said the solutions may prove more draconian.

Threlfall – who is also awaiting the outcome of an energy contract renegotiation in two months’ time – said: “The reality is that, as a sector, we may reach the point where we have to wear jackets in the showroom (to keep warm), and I fear people will be doing the same at home.”

After Liz Truss was confirmed as the UK's new Prime Minister on September 5, SMMT chief executive Mike Hawes said she "faces immense challenges, not least the urgent need for measures to mitigate the crippling effect of skyrocketing energy prices on businesses and households.

"Reducing the cost of doing business must be a priority," he said.

"Reducing the cost of doing business must be a priority," he said.

The NFDA has already written to both the then Chancellor of Exchequer Nadhim Zahawi and secretary state for business, energy and industrial strategy Kwasi Kwarteng urging Government support for the industry to combat the ongoing energy crisis.

The NFDA proposes a subsidy that would comprise of 25% in the value of the increase in a dealership's electricity bill over the past six months that would last for a year.

AM Awards GM/DP of the Year winner Andrew Iveson, Livingstone Motor Group’s managing director, said: “In a way I count myself very fortunate that I don’t have a bodyshop and I renewed early on a fixed energy tariff that expires in June next year, but I cannot see how many businesses will be able to continue to make ends meet if things continue as they are.

“The operator of a bodyshop we collaborate with is literally petrified of the impact of energy costs on his business. It’s hard to see.”

Truss told Parliament that domestic energy bills would be capped at £2,500 for two years, with businesses supported for six months. The level of that support has yet to be clarified.

Iveson (pictured above right) said he would welcome previously mooted plans to lower VAT.

He suggested some automotive businesses may not have enough in their “war chest” to see them through a tough winter if sufficient help does not come.

Respondents to AM’s cost-of-business survey suggested a wide range of potential outcomes from 2022’s trading.

Two-fifths (40.4%) said they had increased turnover during H1, with 15.4% reporting growth of up to 10%, 17.3% stating it was up by 11% to 25% and 7.7% claiming growth of 25%-plus.

Two-fifths (40.4%) said they had increased turnover during H1, with 15.4% reporting growth of up to 10%, 17.3% stating it was up by 11% to 25% and 7.7% claiming growth of 25%-plus.

More (44.2%) cited further declines compared with a COVID-impacted H1 2021; the largest proportion of those (19.2%) stated they had seen declines of 11% to 25%.

After a supply recovery failed to materialise, almost half (48.8%) of respondents said they expected their business’s turnover to decline in 2022, with a quarter (the largest proportion) stating that the dip would be between 11% and 25%.

But more than 30% said they expected to grow turnover in 2022, with 11.5% stating it was expected to remain “about the same” and 7.7% choosing not to comment.

Growing business expenses look set to hit any hopes of profit growth in the same period.

More than half (51.9%) of respondents expected their pre-tax profits to decline in 2022, with 19.2% expecting that decline to be in the region of 11% to 25%. Just a quarter expected to grow their profits.

Worryingly for franchised retailers, it appears that new car sales leads are on the slide, leaving many at risk of relying on order books filled in a post-COVID lockdown period.

More than half of AM’s survey respondents (55.8%) said they had seen new car sales leads decline year-to-date in 2022, while just 3.8% had seen an increase.

In used cars, 51.9% had seen a decline in leads in the same period, but 23.1% reported an increase.

Supporting staff

All the car retailers AM spoke with were grappling with the challenge of supporting staff at a time when their business’ finances were under threat.

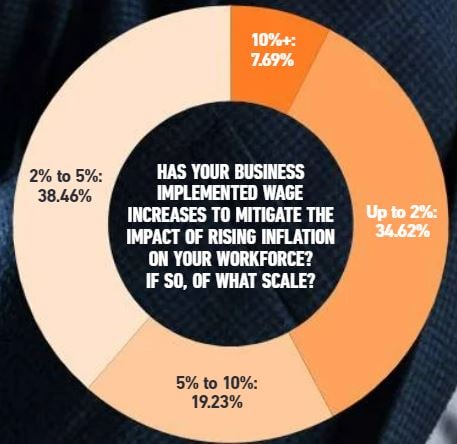

More than a third of survey respondents said they had implemented initiatives aimed at alleviating the impact of soaring costs of living on their workforce, while 8% had delivered inflation-busting pay rises of 10%-plus.

Iveson said he had consulted with staff individually over their finances.

While he has guaranteed some on-target earnings and offered overtime, he said: “With inflation as high as it is, car retail businesses can’t just throw money at the problem to make it go away. It’s not sustainable. Ultimately, you’ve got to make it to give it.”

MHA has advised car retail businesses to "flex" staff bonuses and salary sacrifice schemes to mitigate against the impact of the cost-of-living crisis.

Its employment tax director Nigel Morris said bonuses could be the best way to help staff cope. He said: “The answer is to balance pay increases, which are sticky, with bonuses which can support any temporary issues along with balancing remuneration and taking advantage of salary sacrifice and flexible benefit packages to help employees’ net pay go further for things like cars and shopping vouchers.”

Lookers chief people officer Chris Whitaker told AM an overhaul of its terms of employment to make it an “employer of choice” had been completed in August, resulting in a “Lookers living wage”.

Backdated to July, the scheme ensures all but the PLC’s apprentices now earn above the National Living Wage. Its apprentices are paid around 55% more than the statutory level in year one of their training.

Backdated to July, the scheme ensures all but the PLC’s apprentices now earn above the National Living Wage. Its apprentices are paid around 55% more than the statutory level in year one of their training.

“It’s extremely tough at the moment,” Whitaker said. “But we have made considerable changes to our pay structure and we’re working hard to help staff make their wage go further with our range of company benefits.

“The biggest commitment we can make is that of maintaining a sustainable business.”

Tomlinson said his consultations with staff had revealed that some face a £500 per month increase in their household bills.

He asserted that the welfare of staff is intrinsically linked to the success of the business and vowed to do all he could to support his team.

“There is a cost pressure on the business, but the cost pressure on each individual within the business may be a bigger problem if we don’t find ways to support people,” he said.

“It’s still easy to make a difference – probably even easier than ever – and those that do will be very well rewarded no matter what the future holds. Same as always.”

MWigginton - 06/10/2022 09:31

Remember that Ben (the automotive industry charity) is here to support people when they're struggling, or in crisis. The impact of cost of living increases is adding to an already struggling workforce. Our recent survey showed that 1 in 2 people in the motor industry have suffered from poor mental health in the past 12 months - twice the national average. Finances are an important part of overall wellbeing, but they're not the only thing. Make sure that people who are not struggling in the same way don't fall through the gaps with other struggles. Check out our website for tips, advice and tools for a whole range of wellbeing issues: https://ben.org.uk/how-we-help/for-me/