Car retailers must be ready for the challenge of stocking and selling cars while respecting consumer concerns and observing Government legislation after the COVID-19 coronavirus lockdown.

While most car sales have stalled in the name of public safety amid the UK lockdown of all non-essential retail operations, Cazana director of insight, Rupert Pontin, has warned that trading will not return to normal with a sudden lifting of all retail restrictions.

Here, Pontin gives his latest view of how online vehicle pricing has been affected by the temporary “cessation” of sales and offers insight on the recovery period:

This cessation of activity gives time for the dealer sector to review current operations and plan ahead for the resumption of trading, as the post-lockdown market will be a very different environment.

The most important thing to remember right now is that the retail consumer has not disappeared.

Just because the showroom doors are closed, does not mean buyers are not looking at cars, in fact, Cazana can demonstrate this through the activity seen on a daily basis through the Car & Classic website.

Activity has shifted online, and the dealer websites have become the focus of attention.

As such it has never been more important to ensure that the shop window is working well, is informative and up to date, the cars on sale are competitively priced and once a customer is hooked they must have the ability to reserve or buy the car they want, even if delivery does not take place for some weeks.

Make no mistake, retail pricing is still moving.

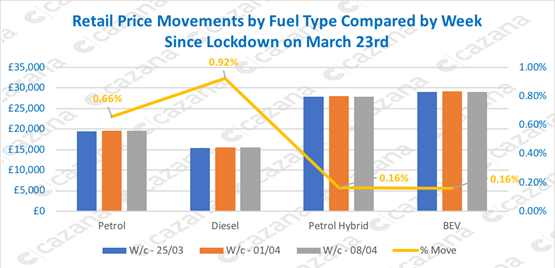

The chart below demonstrates retail pricing movements by fuel type since the lockdown was announced on March 23rd:

Since the lockdown was announced, retail pricing by fuel type has increased, although it is important to understand that week by week data and analysis by market sector will give greater granularity and highlight exactly where pricing nuances are at play.

Since the lockdown was announced, retail pricing by fuel type has increased, although it is important to understand that week by week data and analysis by market sector will give greater granularity and highlight exactly where pricing nuances are at play.

However, the news is good from this viewpoint and reinforces two key points. Firstly, the automotive industry has not been drawn into a retail price race to the bottom in the face of adversity, and secondly ensuring pricing on the websites and virtual shop windows is exceedingly important.

Also key, is to remember that replacing stock post lockdown will be very difficult as the wholesale sector is all but dormant and the supply chain will take some weeks to get up to speed again.

Looking forward though it is prudent to acknowledge that post lockdown the way people buy cars will need to change in the short term and in all probability the way consumers research and buy cars will change permanently.

As an example, and guide, China has relaxed isolation in recent weeks and the automotive sector has returned to a semblance of normality with figures suggesting that within a short period sales activity returned to 70% of pre-COVID levels.

Sales distancing

But social distancing is still evident, and the way people interact has changed.

This will also be the case here in the UK and it is this change that needs to be acknowledged and planned for if new and used car sales are to return to pre virus levels swiftly.

Many consumers are going to be more used to searching and buying things online, period.

Post-lockdown it is likely that there will still be concern over large numbers of people in confined spaces such as shops and also at public events.

Depending on circumstances still beyond our control, a return to isolation for short periods may also be necessary and as such the automotive sector must be ready to cope with change.

As such new and used car sales operations will need to adapt to a more flexible distant way of selling to the public.

In the first instance, greater importance will be placed on the web presence and the virtual shop window.

The time that consumers spend at the dealership will probably decrease.

The industry may see a drop in the need for a buyer to test drive a car or conversely more test drives at home may need to be provided which is more time consuming and costly but actually may be more successful.

Where customers come into the showroom, a greater element of distancing will need to be planned for and at times screening may need to be in place for the safety of both the customer and dealership staff.

In summary, there are so many different factors to consider, but get these right and it will define what short to mid-term success will look like.

Pro-active dealers and dealer groups are already planning how they will maximise the return to full operational capacity to get profits as close to the original budget as possible.

But it seems likely that online presence, up to the moment retail pricing and adapting to a greater level of social distancing will be the key factors.

Login to comment

Comments

No comments have been made yet.