Competition for used hybrids and EVs listed on Dealer Auction surged in June, indicating strong dealer demand for Alternative Fuel Vehicles (AFVs) even though supply is constrained.

According to the digital platform’s new EV Performance Review, trade-to-trade transactions thrived throughout the month despite a reduction in the overall volume of these vehicle types compared to May.

Listings for EVs decreased by 29% and hybrids by 11%, yet bids per vehicle rose by 13%. The proportion of EVs sold increased by 32% from May, while hybrid vehicles sustained their previous level of interest.

Competition for used hybrids and EVs listed on Dealer Auction surged in June, indicating strong dealer demand for Alternative Fuel Vehicles (AFVs) even though supply is constrained.

According to the digital platform’s new EV Performance Review, trade-to-trade transactions thrived throughout the month despite a reduction in the overall volume of these vehicle types compared to May.

Listings for EVs decreased by 29% and hybrids by 11%, yet bids per vehicle rose by 13%. The proportion of EVs sold increased by 32% from May, while hybrid vehicles sustained their previous level of interest.

Kieran TeeBoon, Dealer Auction marketplace director, commented, “We observed a significant decline in the number of hybrid and electric vehicles listed in June, but there was a notable increase in bids for the available vehicles, resulting in more EVs sold. This clearly indicates that dealers are eager to stock these vehicles and are willing to compete for them.”

“It’s too early to draw definitive conclusions about the fluctuations in the used EV market, but I speculate that dealers are increasingly retaining these vehicles for retail on their own lots.

“As EVs gain traction in the used market while new volumes stall among private buyers, this is a likely scenario we are monitoring closely. We are striving to counter this by introducing new fleet AFV stock to Dealer Auction, including over 50 EVs a month from Novuna.”

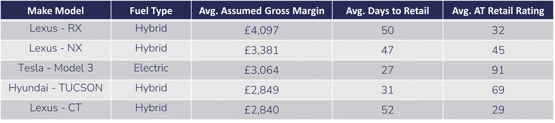

Hybrid vehicles dominated the top 10 retail margin league table, with Lexus securing the first, second, and fourth places with its RX, NX, and CT hybrid models. The RX led with an average assumed gross margin of £4,124.

Tesla’s Model 3 climbed to third place, absent from the list in May, with a margin potential of £3,095. The Model 3 also set a new benchmark for days-to-retail at 25 days, half the time estimated for the leading Lexus RX and well below the top 10 average of 41 days. The Model 3 boasted the highest Auto Trader Retail Rating among the top 10 at 92.

Hybrid vehicles also led Dealer Auction’s AFV CAP performance league table, occupying nine of the top 10 spots. The Tesla Model 3 was the only EV variant on the list, while Toyota’s RAV4 topped the table at 117.8%, significantly up from the 96.6% recorded for the same model in May.

The average CAP performance of the top 10 increased from 97.9% in May to 100.7% in June. The average sold price for AFVs remained steady, just 0.4% higher than May’s figure, despite the volume change, while the average age of vehicles decreased slightly to 4.9 years.

TeeBoon said: “This is only our third monthly EV Performance Review, but it already paints a picture of a market that is establishing itself, with month-on-month movements highlighting how nascent this space still is. It’s becoming evident that there is demand for used EVs and hybrids, and their margin potential is comparable to ICE equivalents.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.