Auto Trader director of data and insights Richard Walker has stated that suggestions of tumbling used car prices are “unfounded” – but conceded that demand is softening.

Advertised values on the online marketing portal rose for a 24th consecutive month in March, with average value up 32% to £17,946, but the rise represented a month-on-month increase of just 0.1% on February’s 31.9% year-on-year increase.

This was the lowest monthly price increase Auto Trader has seen since November 2020 and comes after a two-year period of strong growth which has seen the average used value grow by £4,400.

Walker said it was important to put the apparent softening of the market into context. He said: “Against a backdrop of ‘once in a lifetime’ levels of demand in 2021, it’s easy to misinterpret the data as a market in decline, but a quick look under the bonnet reveals that any suggestion prices are about to tumble is unfounded.

“Despite growing economic pressures, the appetite for new and used cars remains above pre-pandemic levels, which combined with the ongoing squeeze in supply, will keep used car prices strong for the foreseeable future.”

Consumer demand

In its monthly Retail Price Index report Auto Trader claimed that “plenty” of consumer appetite remained in the market.

Demand remains up on pre-pandemic levels (circa 4% on March 2019) and Auto Trader said that traffic to its marketplace remains very strong, with circa 69 million visits in March.

It added that around 40% of more than 1,600 people it surveyed last month intended to buy in the next two weeks, and 67% want to buy in the next three months.

Auto Trader said that three to five-year-old cars have recorded the largest price movements in recent months, rising 35.8% YoY (£20,445), with cars aged five to ten years old increasing 32.3% YoY (£13,212).

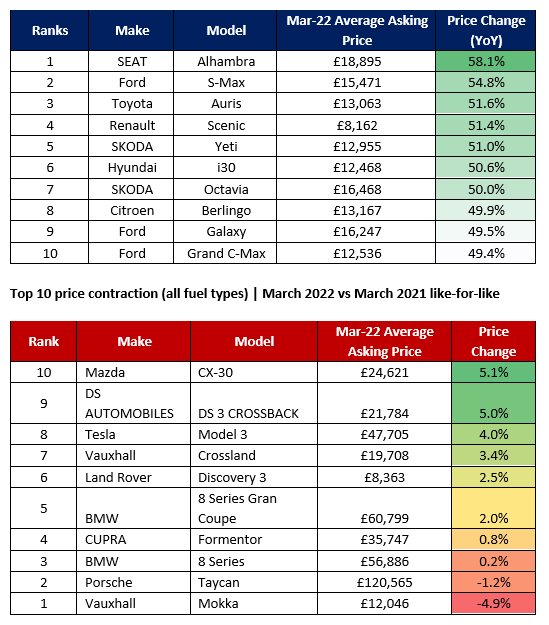

March’s most appreciating and depreciating used cars indicate a pattern of supply and demand.

March’s most appreciating and depreciating used cars indicate a pattern of supply and demand.

As in recent months, the people carrier segment abandoned by most OEMs in pursuit of SUV and electric vehicle (EV) sales remains the hottest part of the sector, with the value of the Seat Alhambra showing a 58.1% year-on-year increase.

At the other end of the spectrum, the Vauxhall Mokka SUV - recently the subject of price cuts by the Stellantis brand - and Porsche Taycan high-performance EV are among the most depreciating vehicles.

EV appetite

In this month’s AM News Show podcast Auto Trader brand director Marc Palmer indicated that interest in EVs remain intrinsically linked to affluence as values remain high.

In the used sector, Auto Trader said that rising fuel prices had triggered a year-on-year rise in demand for premium and volume EVs on its website – up significantly on the 28.8% YoY growth recorded in February – of 79.1% and 120.2% (up from 28.8% and 53% YoY) respectively in March.

Appetite for their ICE counterparts has waned, meanwhile, with demand for used petrol cars down 10.3% on March 2021 (down 4.7% YoY in February), and diesel’s 13.6% YoY decline in interest in February falling to 21.3% last month.

Commenting on the easing of appetite for used cars, National Franchised Dealers Association (NFDA) chief executive Sue Robinson said: “Used car prices remain at high levels despite seeing a level of stabilisation.

“Considering the impact that external factors such as the rising cost of living are having on consumer confidence and taking into account ongoing supply constraints, the latest data shows that underlying demand for second-hand vehicles remains robust.

“It is encouraging to see that appetite for both new and used electrified vehicles continues to be particularly strong.”

Login to comment

Comments

No comments have been made yet.