Used car dealers had begun to reduce the value of their forecourt stock as the UK transitioned from normal trading into a Government-imposed COVID-19 coronavirus lockdown, according to Cazana.

The car valuation provider said that it had continued to analyse pricing data from across the sector’s advertising platforms as dealer’s sales management teams worked on marketing strategies to remain competitive in the market during the COVID-19 crisis.

Rupert Pontin, Cazana’s director of insight, said that retail pricing is still moving as businesses “jostle for the most competitive online presence for the myriad of retail consumers currently confined to their homes and relying on the internet to research new and used cars”.

He added: “This position will continue and the need to understand what is happening with retail pricing will be a critical part of the current market.”

In his regular market insight report, Pontin said that, in overall terms, Retail Pricing for newly-listed cars had dropped by 3.1% between the third and fourth week of March.

Here he delivers further insight from the third and fourth week’s of the heavily-disrupted sales month of March, 2020:

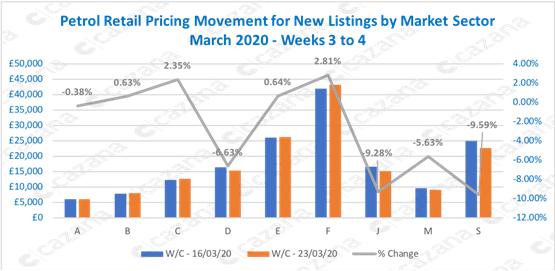

This chart shows that for new petrol car adverts prices have been on the move.

Unfortunately, this is a downward shift of on average 2.8% although the chart highlights the sectors facing the greatest challenges.

There are marked declines in the lower volume higher-priced S or Sports sector with a perhaps surprising 6.6% dip for the D or Large car sector and also a noticeable 9.2% drop for new retail adverts for the J or SUV sector.

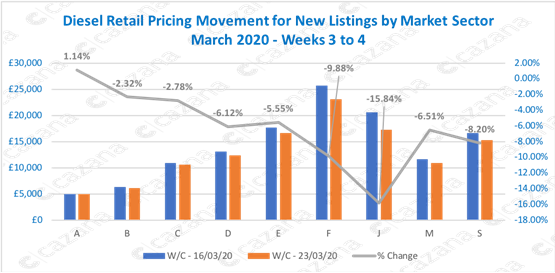

Looking by diesel propulsion and the retail pricing movements have shifted since last week’s data with an average drop of 6.2% across the sector.

This drop has largely been impacted by a large drop in the J or SUV sector pricing which is a similar position to the petrol retail pricing.

However, it is interesting to note that all sectors other than A sector Superminis cars have recorded a downward movement as seen in the next chart.

It is wise to remember that the A sector accounts for just 0.02% of the total market and the J sector 15.6% down by 2.59% from the previous weeks data.

It is wise to remember that the A sector accounts for just 0.02% of the total market and the J sector 15.6% down by 2.59% from the previous weeks data.

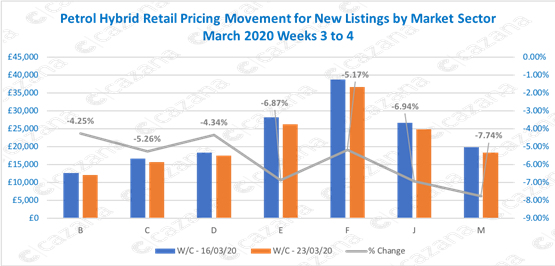

Data for hybrid-propelled vehicle by sector is lower in volume by far, although the following charts give a view of what is happening in the market.

These fuel types do not have representation in all market sectors and particularly not when looking at new retail adverts on a week by week basis:

The average retail price movement for this sector is a drop of 5.8% over the previous weeks new listings.

The average retail price movement for this sector is a drop of 5.8% over the previous weeks new listings.

Once more one of the biggest shifts has come from the J or SUV sector with a drop of 6.9% and in this fuel category, this accounts for 0.74% of the total market.

It is important to note that this is the largest market sector for newly-listed petrol hybrid cars.

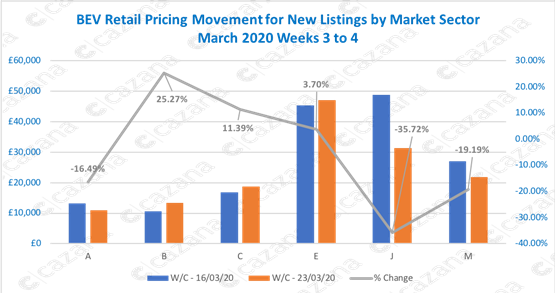

For the BEV market, the volume of data is also an issue as can be evidenced by the performance in the J Sector in the chart below:

This data is very volatile and with new retail advert listings reducing this should not come as a surprise.

This data is very volatile and with new retail advert listings reducing this should not come as a surprise.

Although it is of note that once again the J or SUV sector has been the biggest mover in terms of the drop in retail price.

This may well be a common trend in the coming weeks and will need to be monitored.

This sector includes the compact 4x4 or crossover SUV sub-sector and there have been concerns and warnings over what has been happening in volume terms for some time.

Login to comment

Comments

No comments have been made yet.