December was another challenging period for the UK vehicle retail sector, according to data released by global automotive solutions provider Cox Automotive.

A relatively positive start to 2019 led to what several dealers have called a “topsy-turvy year,” with turbulence in new and used car markets generating a situation in which many businesses held onto their stock over the festive period.

With new car registrations ending the year -2.4% down, recording a six-year low according to Society of Motor Manufacturer and Trader (SMMT) data, vendors and retailers wait with interest to see whether a new “normal” is emerging.

Wholesale

Following a surge in average prices in November, the final month of 2019 saw a return to the lower levels which have marked much of the year. With many vendors and retailers holding onto stock until the new year, an average sold price at Manheim of £6,360 saw the year close out with the expected seasonal decline, down -3.1% MoM and -5.6% YoY.

Average age and mileage remained relatively stable in December, showing little movement either MoM or YoY, with vehicles continuing to hover around the 6.5 to seven-year age bracket and just under 10,000 miles per year.

Supply and demand continue to represent a fine balancing act, with first time conversion rates declining slightly in December, down -1.5%, but showing a positive +3% increase on the same period in 2018.

Data from NextGear Capital, the stock funding arm of Cox Automotive, told a similar story, with average mileage declining marginally MoM to 61,014 and age remaining broadly stable at 6.2 years, the same as the previous month. Average holding days rose +2.6 MoM, up to 65.6 while average cost per unit was +2.2% YoY, closing the year on £7,679.88.

Meanwhile, for trade-to-trade auction platform Dealer Auction.co.uk, volumes sold remained static YoY while conversion rates increased by +1.5% and Cap Clean performance also increased by +1% YOY.

Philip Nothard, customer insight and strategy director for Cox Automotive, said: “Vendors and retailers could be forgiven for feeling a bit queasy following the ups, downs, twists and turns of the past 12 months.

“Indeed, this turbulent year has presented significant challenges for businesses, who’ve had to contend with several major external economic and political headwinds far outside of their control.”

Nothard said that while 2020 will see the UK enter a largely unknown business environment, the past year has shown that the sector can be remarkably resilient.

Considering the economic and political uncertainties, the rapid falling out of favour experienced by diesel, and the introduction of WLTP, Nothard said “things could have been a lot worse”.

He said: “Clarity on vehicle taxation for company cars was long awaited but finally came through in 2019, providing slightly more certainty to the market.

“However, the recent implementation of Corporate Average Fuel Economy (CAFE) legislation and the focus of many of the manufacturers on their electric vehicle (EV) volumes and offering, sometimes at the expense of existing models, will continue to feed through into volatility at the wholesale end.”

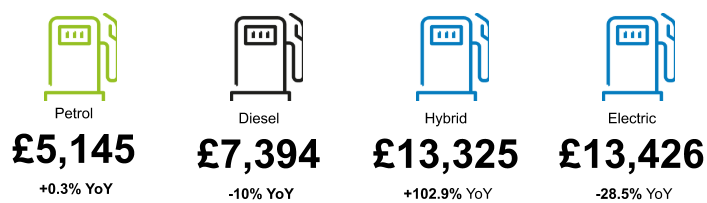

Wholesale fuel comparison year-on-year

Average diesel values in the wholesale market continue to decline, according to data from Manheim, with the reduction in newer used diesel models entering the sector a trend which is likely to continue for the foreseeable future. Indeed, the MoM declines for both petrol and diesel are reflective of the market.

With relatively low volume and the influx of new entrants, the fluctuations in alternatively fuelled vehicles (AFVs) are likely to be high; and this can be seen in December’s significant YoY average price increase for Hybrid, up +102.9% to £13,325. While down on last December’s figures, EV reflected a +9.4% increase in average price compared to the previous month.

Retail

The latest dealer sentiment survey from Modix, the digital marketing arm of Cox Automotive, reflects a challenging month for dealers in December, with over a third (36%) reporting a decline in margins and almost half (48%) citing a decline in footfall for the month.

However, with one in five dealers (20%) seeing an increase in consumer demand, while just over half (54%) reported that online activity had risen compared to the same period in 2018.

An overall positivity permeates the results, with half (50%) confident that the economy will improve over the coming months, and over a third (35%) suggesting it will remain the same and not worsen.

Nothard said: “Margin pressures were the most dominant topic of conversation throughout 2019, with the almost daily news of consolidations, restructures and closures reflective of the turbulent times being faced by UK automotive retail.

“More so than ever before, the consumer market has been impacted by politics, policy and legislation, with buying patterns disrupted significantly across the High Street as well as for big ticket items like vehicles and housing. Until more is known about the impact of the new UK government’s decisions on savings, investments, asset values and disposable incomes, we can expect retail to remain volatile.”

While the headline figure from the SMMT for 2019 was a -2.4% decline in new car registrations for the year; December, traditionally the quietest month, saw significant levels of activity, up +3.4% overall and with several brands marking 20-40% growth.

Nothard said: “Although it is certainly positive to see a boost to the end-of-year new car figures, we need to be careful not to attribute pre-CAFE registrations to an overall upward trend. In addition, the significant uplift for some marques was matched or exceeded by large declines for other brands.

“This is clearly a market in flux, and we have yet to see what the new ‘normal’ will look like. However, all signs for the start of 2020 so far are positive, with reasonably high prices and conversions which are set to continue under current supply constraints and a strengthening retail demand.

“As ever, quality is key. If cars are presented and priced correctly, they will generally find a buyer in the auctions. As always, retail-ready standard vehicles will perform well, as buyers look to maximise turnover and reduce days in stock.”

Login to comment

Comments

No comments have been made yet.