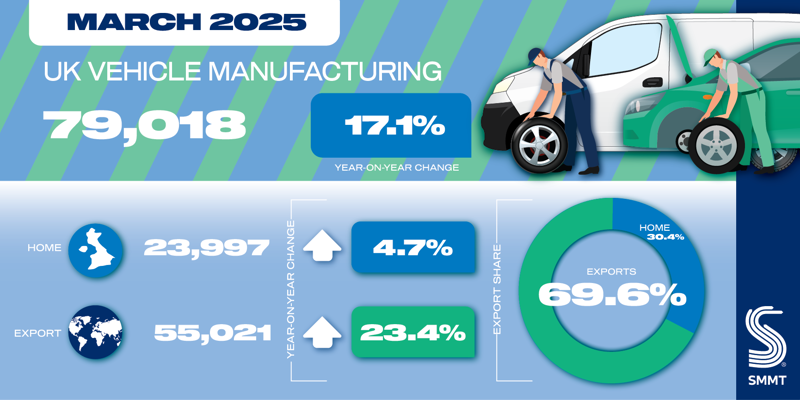

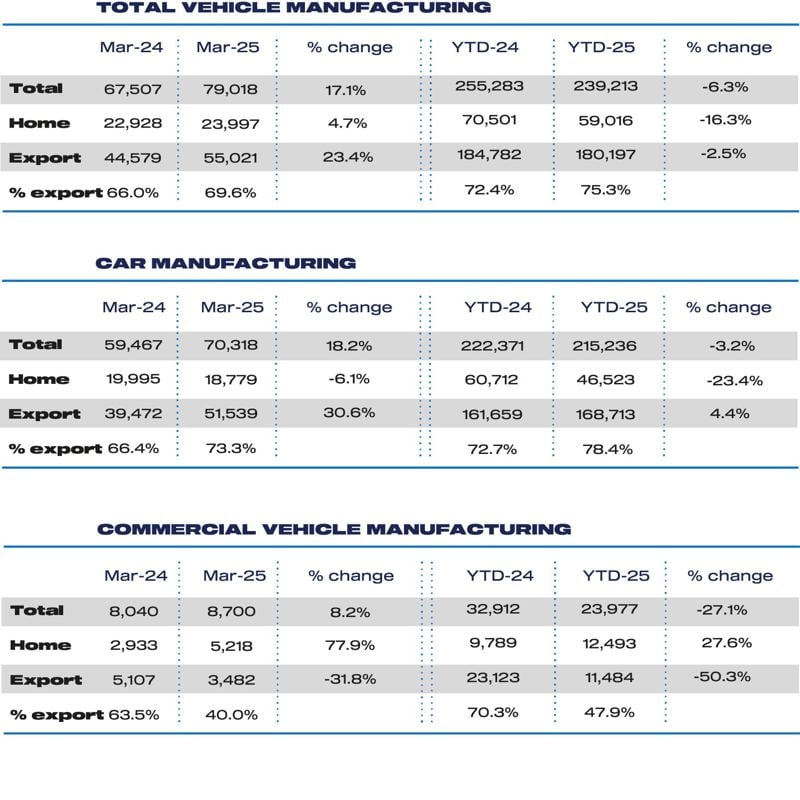

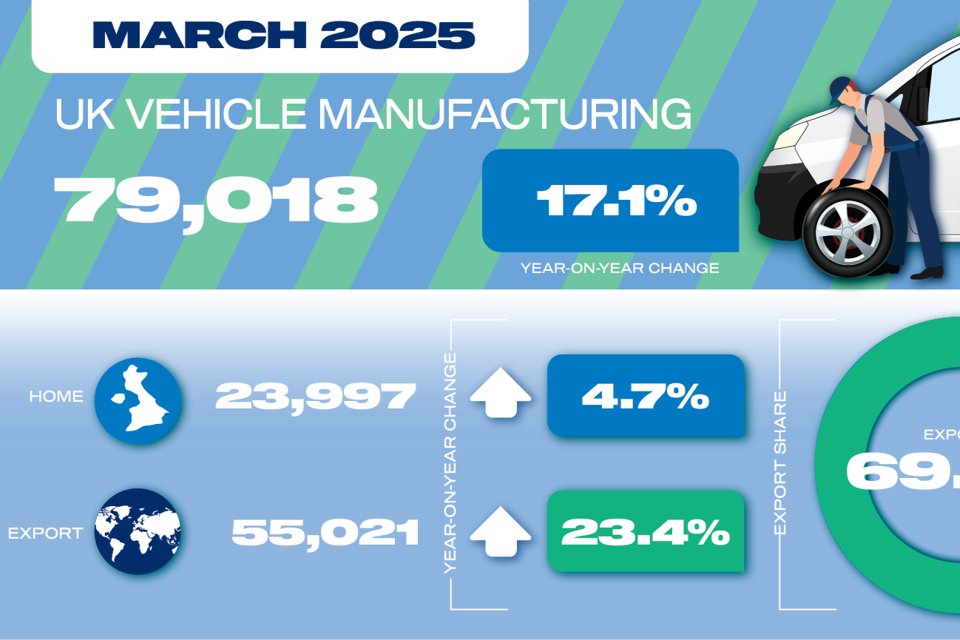

UK vehicle manufacturing marked a rare upturn in March, rising 17.1% compared with the same month last year, as production rebounded from a subdued 2024.

However, optimism across the sector is being dampened by the spectre of escalating trade tensions - most notably the imposition of steep US tariffs on British-made cars and parts.

According to the Society of Motor Manufacturers and Traders (SMMT), 79,018 vehicles were produced in March, including cars, vans, trucks, buses and coaches.

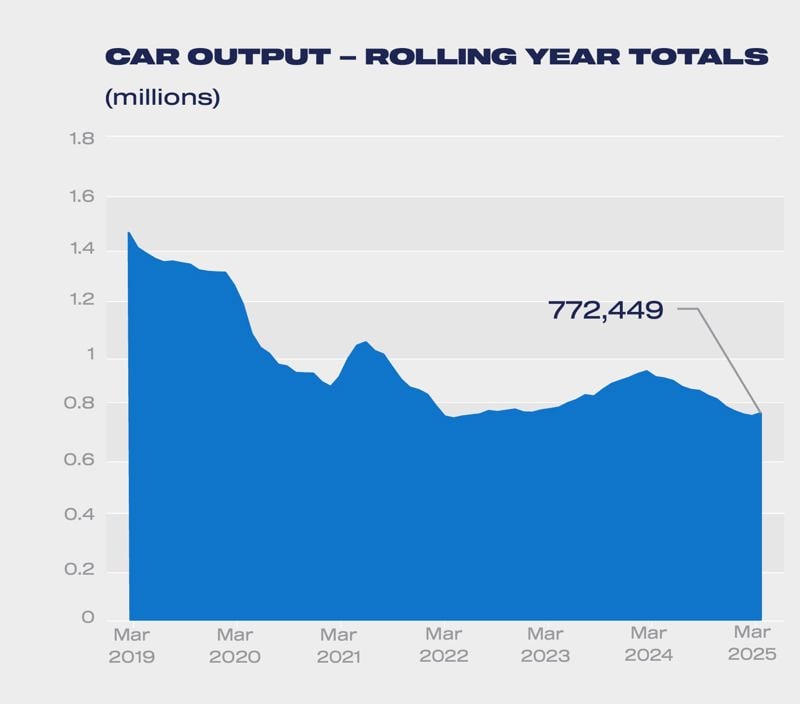

But while the monthly figures show recovery, total output for the first quarter of 2025 fell by -6.3% year-on-year.

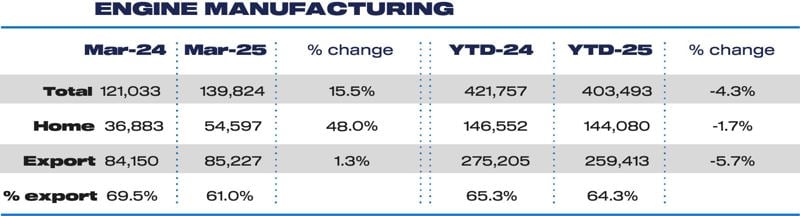

The US, the UK’s second-largest car export destination, accounted for 15% of all shipments in March, up 36.1% year-on-year, indicative of pre-emptive stockpiling ahead of the anticipated 25% tariffs on UK vehicles, which came into effect on 3 April. Further duties on car components are set to follow in May.

The tariffs, imposed as part of a wider US protectionist strategy, are already hitting confidence in British automotive exports.

“Navigating trade uncertainty - particularly with the US - is now our greatest challenge,” warned Mike Hawes, SMMT chief executive. “The government must act decisively to secure a deal that supports competitiveness and ensures the UK remains a global hub for automotive manufacturing.”

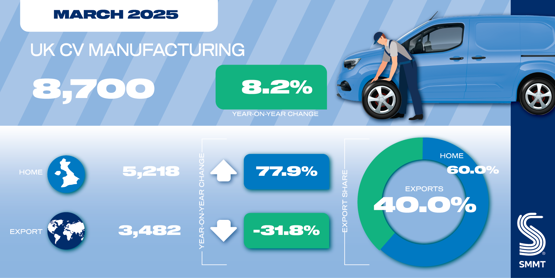

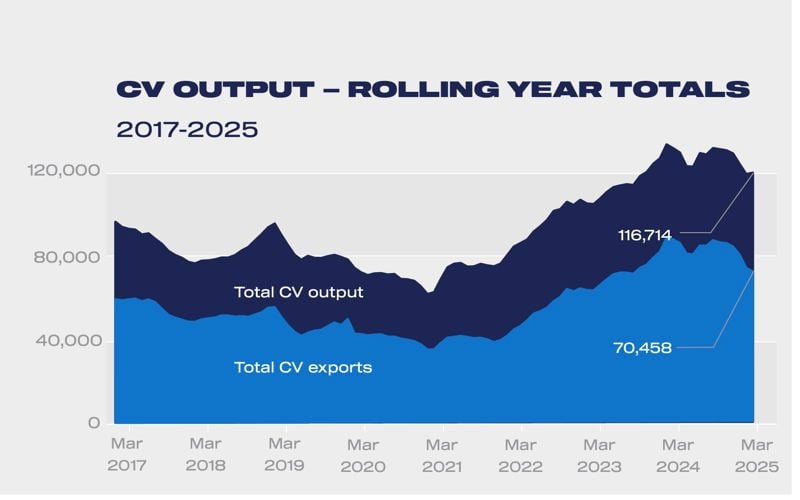

March also brought positive news for commercial vehicle (CV) production, which rose 8.2% to 8,700 units, bolstered by strong domestic demand (+77.9%).

March also brought positive news for commercial vehicle (CV) production, which rose 8.2% to 8,700 units, bolstered by strong domestic demand (+77.9%).

However, CV exports fell by -31.8%, a concerning figure given that the EU accounts for more than 94% of CV exports.

CV production for Q1 is down -27.1% overall, with exports plunging by more than 50%. Analysts believe this reflects a post-pandemic cooling of demand, but add that new trade barriers could deepen the decline.

Looking ahead, the picture is mixed. The SMMT’s most recent forecast, made before the US tariff implementation, predicts a -7.8% drop in light vehicle production for 2025 to 818,200 units, followed by a modest recovery in 2026.

With a supportive government strategy, the SMMT believes production could rise to 834,900 next year - but this would require swift action.

Manufacturers are calling for urgent clarity on trade policy, alongside further incentives for electric vehicle adoption to offset falling domestic demand.

The government’s recent revisions to the ZEV Mandate and extension of plug-in vehicle grants have been cautiously welcomed, but industry leaders warn that more is needed to ensure long-term competitiveness.

Login to comment

Comments

No comments have been made yet.