The UK car market - as one of the largest in Europe - is set to become a critical battleground for Chinese automotive brands following the EU's new tariffs on Battery Electric Vehicles (BEVs).

Owen Edwards, head of downstream automotive at Grant Thornton, sharing his insights in Cox Automotive’s latest Insight Quarterly. said

"Europe has traditionally been an attractive market for Chinese brands due to its size and lower import tariffs."

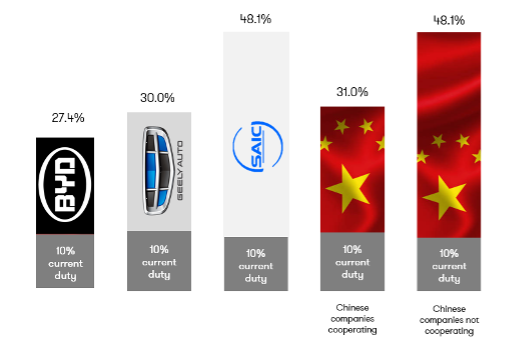

"However, the newly proposed EU tariffs on Chinese BEVs, ranging from 19% to 46.3% based on cooperation levels with the EU's research, could significantly disrupt these expansion plans."

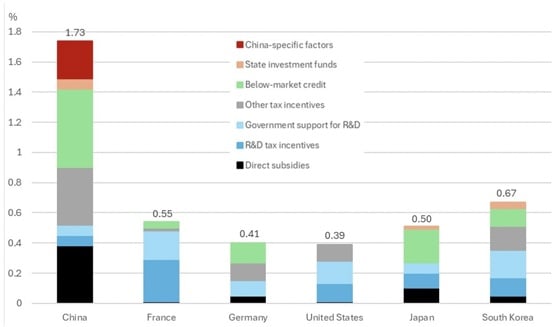

The EU’s measures target the substantial government support Chinese BEV manufacturers receive, which the EU believes may distort competition and impact the local industry.

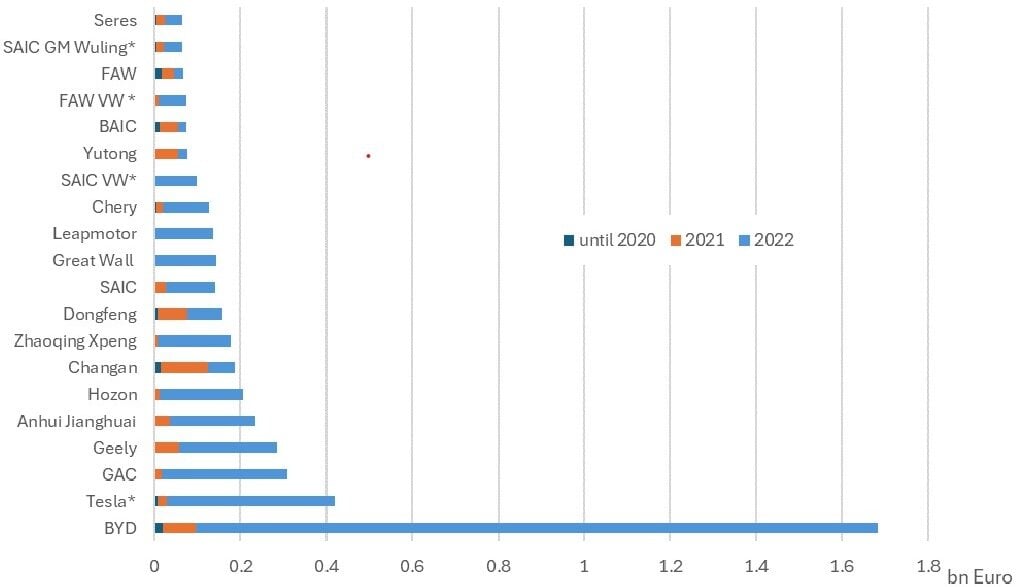

With over 30 million new vehicles and 350 million used vehicles sold annually in China, Chinese Original Equipment Manufacturers (OEMs) view both the UK and Europe as key markets for growth.

The UK, being the second-largest new car market in Europe, is poised to be a significant arena for these brands.

Philip Nothard, Cox Automotive’s insight director, adds: "The implications for the UK market are still unfolding, as the UK government has not yet clarified its position on import tariffs for Chinese BEVs.

However, as identified by Owen and the Grant Thornton team, the potential impact on consumer pricing and brand acceptance could be substantial."

Edwards noted that: "Some Chinese brands, like BYD, have shown a willingness to absorb the increased costs, while others may pass them on to consumers, possibly slowing their growth in the region."

He further explains, "In the short term, we may see a dip in sales for some Chinese BEVs due to the new import tariffs. However, brands capable of absorbing the costs may be less affected.

By producing locally, Chinese OEMs could avoid some tariffs, reducing costs and enhancing their competitive edge in the European market.

BYD and others are already planning to establish manufacturing facilities in the EU, with battery plants in Hungary and vehicle plants in Turkey, while Chery is considering manufacturing support in Spain.

Despite these challenges, Chinese brands remain committed to capturing market share in Europe.

Recent research by JudgeService suggests that of car buyers shopping for a premium-brand vehicle, 41% would consider a Chinese brand if priced £3,000 more cheaply, while 27% of customers shopping for volume brands would consider a Chinese brand if the vehicle was £3,000 cheaper.

As Nothard concluded: "Factors such as brand acceptance, dealer networks, parts supply, and residual values will be crucial in determining their success. It will be interesting to see how much market share Chinese brands can secure and how quickly they can do so."

Login to comment

Comments

No comments have been made yet.