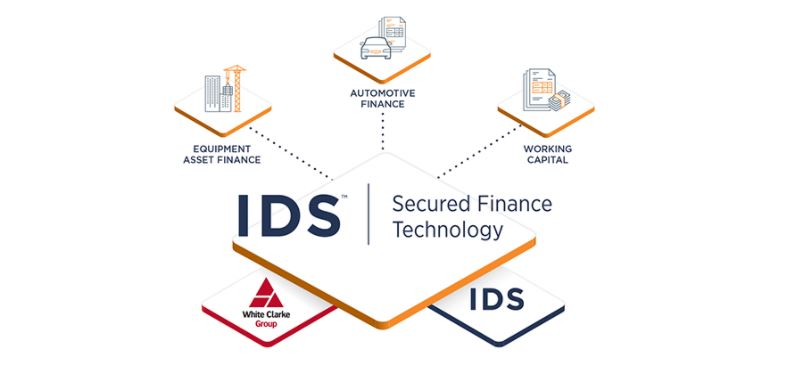

Automotive finance provider White Clarke Group has been acquired by US-based IDS to form a single entity claiming to serve a $7 trillion secured finance end market.

IDS has announced its signing of an agreement to acquire the Milton Keynes-based automotive retail, fleet, wholesale and asset finance operation in a deal expected to be completed by the end of Q2.

White Clarke Group chief executive, Brendan Gleeson, said: “Our industry is being disrupted by a global shift in consumption. Consumers and businesses want utility and outcomes, not ownership.

“This has created an opportunity for financing firms to tap into emerging technologies including digital and AI to create new business models like subscription and car-sharing.

“As these trends accelerate, these firms will need the support of a global technology vendor that can deliver innovation at scale.

“Combining our companies provides the ability to innovate at the pace of change while delivering exceptional value to our combined customer base.”

IDS is acquiring White Clarke Group from Five Arrows Principal Investments, who originally invested in the business in 2016 and will remain a shareholder in the combined company.

White Clarke Group was initially launched by co-founders Ed White and Dara Clarke in 1992.

Five Arrows Principal Investments, the European corporate private equity business of Rothschild Merchant Banking, acquired shares in the business in 2016 following the sudden death of Clarke in 2014.

Since then, CEO Gleeson has grown the profitability of the business from a base of £1m in 2016 to £9m in 2019.

A joint statement issued by White Clarke Group and IDS said that the two companies would combine to create a multi-asset class secured finance technology powerhouse supporting banks, independents, OEM captives and specialty finance firms globally.

Together, the combined company will serve more than 300 customers across North America, Europe and Asia Pacific and will be co-headquartered in Minneapolis, MN and Milton Keynes, it said.

Among its portfolio of products is CALMS, and automotive finance solution for retail, fleet, and wholesale, claiming to offer a full lifecycle system including point-of-sale, loan origination, loan servicing, and floorplanning capabilities.

IDS said that that CALMS currently serves serving eight of the top 10 car manufacturers, representing 25 brands.

IDS chief executive, David Hamilton, said: “Global business has entered a new long-term investment cycle driven by the rapid evolution of technology.

“Smart factories, connected-assets (IoT), green-energy, and many other technology innovations will bring about exciting new economic growth opportunities which will require access to capital from secured finance firms.

“With a comprehensive and flexible technology foundation, these finance providers will be able to support new funding models accelerating the move to digital, servitization, and mobility.

“Supporting this fast-changing market need is the motivation for bringing our two great companies together creating an unmatched range of secured finance solutions and the ability to support customers globally.”

Login to comment

Comments

No comments have been made yet.