Dealers are selling used cars more quickly than a year ago, perhaps reflecting the norms of stock depreciation, according to the latest Auto Trader data.

The car marketplace has found that in May 2024 the average days to sell was one day less than in May 2023, at 29 days. Within that, stock that was aged three to five years was sold in just 26 days on average, reflecting the high demand for the lower volume of cars that were first registered as the country learned of the emerging coronavirus pandemic.

Nevertheless, its data showed overall used car transaction volumes were up 6% in May.

Dealers are selling used cars more quickly than a year ago, perhaps reflecting the norms of stock depreciation, according to the latest Auto Trader data.

The car marketplace has found that in May 2024 the average days to sell was one day less than in May 2023, at 29 days. Within that, stock that was aged three to five years was sold in just 26 days on average, reflecting the high demand for the lower volume of cars that were first registered as the country learned of the emerging coronavirus pandemic.

Nevertheless, its data showed overall used car transaction volumes were up 6% in May.

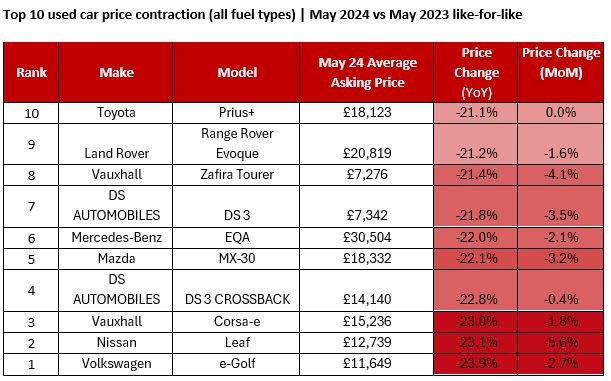

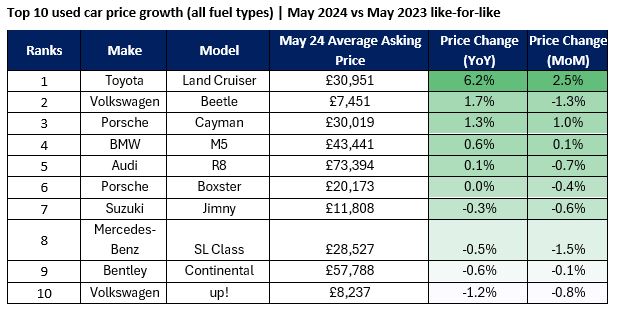

The strong underlying health of the UK's used car market mean that average retail prices have returned to seasonal trends, Auto Trader reports, with a 0.7% drop in month-on-month values recorded in May.

Richard Walker, Auto Trader’s data and insights director, said: “We’ve seen a very robust used car market so far in Q2; retail prices are stabilising, demand is healthy, cars are selling quickly, and critically, transactions are above where they were last year. Any slight month-on-month softening in prices is entirely seasonal.

Richard Walker, Auto Trader’s data and insights director, said: “We’ve seen a very robust used car market so far in Q2; retail prices are stabilising, demand is healthy, cars are selling quickly, and critically, transactions are above where they were last year. Any slight month-on-month softening in prices is entirely seasonal.

"The market is being boosted by economic green shoots, with consumer confidence rising in the wake of falling inflation and anticipation of further tax cuts on household budgets. There may be some disruption in July with the Euros and General Election, but the impact on car buying will be temporary, and our outlook for the year ahead remains positive.”

Rentals and pre-registrations

Analysis of the stock held by the dealer clients of Auto Trader showed a huge 39% rise in cars aged up to one year, which are typically pre-registered, ex-demonstrator or ex-rental cars.

Yet the overall volume of stock in the market fell for the second consecutive month, by 2.2%, which was the largest drop since June 2023.

Auto Trader noted that overall levels are being hampered by the squeeze on the middle of the market - as the circa 3 million ‘missed’ sales during the pandemic continues to flow through the market, supply of 1-5-year-old stock fell 17.3% YoY.

It said this softening in supply, coupled with rising levels of consumer demand, is creating very favourable market dynamics, which is ultimately what’s helping retail prices return to seasonal norms.

Auto Trader’s Market Health metric, which assesses potential market profitability, rose to 11% in May, up from the 10% recorded in April. It marks the highest rate of growth since July 2023. For stock aged 1-5-years-old, it has rocketed 36% YoY.

Despite these favourable market conditions, many retailers are choosing to price very high-demand stock below their market value. Collectively, 9,000 retailers are currently advertising around 70,000 cars with a high Retail Rating score below their market average. This behaviour is eroding retailers’ margins, potentially costing around £35 million, or circa £4,000 per retailer.

Auto Trader publishes a monthly used car Retail Price Index which is based on pricing analysis of circa 800,000 unique vehicles. The same data that powers the index is used by the Office for National Statistics to make the UK’s official measures of inflation more robust, as well as the Bank of England to feed the broader UK economic indicators.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.