Dealers' frustration with Jaguar Land Rover has started to ease with the latest NFDA Dealer Attitude Survey revealing the greatest improvement in rating among all brands following its low rankings in recent editions.

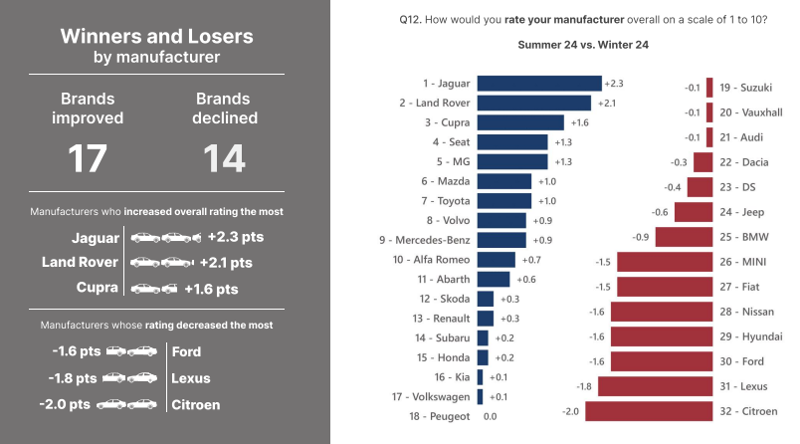

The latest NFDA survey, which reflects dealer sentiment on manufacturer relationships, shows that Jaguar saw a 2.3-point increase since its last six-monthly snapshot.

Similarly, Land Rover rose by 2.1 points, pulling it out of the lowest tier and into a stronger standing.

The improvements in overall satisfaction among dealers of both brands indicates strategic adjustments that have started to resonate positively within the dealer network.

The National Franchised Dealers Association (NFDA) represents franchised car and commercial vehicle dealers across the UK.

The National Franchised Dealers Association (NFDA) represents franchised car and commercial vehicle dealers across the UK.

NFDA’s Dealer Attitude Survey (DAS) is a biannual survey examining the relationship between franchised dealerships and manufacturers and serves as a barometer in understanding the relationship between franchised dealerships and their respective manufacturer partners.

The latest Summer 2024 edition of the survey was carried out over six weeks, from the start of August and concluding in the middle of September, surveying 2,238 sites across 32 franchised networks, equating to a response rate of 62 per cent.

The upward trajectory is notable for JLR as it reflects positive changes that resonate with dealers, especially in light of the challenging conditions for profitability and margins that persist across the automotive industry.

JLR’s increased scores indicate efforts toward better dealer relationships, possibly reflecting responses to past dealer feedback which led to efforts to enhance support for the brand.

Key areas of Improvement included the brand’s electric vehicle offerings: Land Rover's rise from 28th to 3rd in EV-related scores, with a rating of 8.1, indicates improvement in terms of competitive and support for EVs.

The NFDA said this is particularly relevant as EV adoption and profitability remain critical areas in the survey, especially under the ZEV (Zero Emission Vehicle) mandate.

While challenges in profit margins are ongoing, Jaguar’s 3.3 score here ranked as one of the lowest compared to Kia’s score of 8.9 - followed by Mercedes-Benz with 7.4 and Toyota, just edging MG and Honda, with 7.2 -

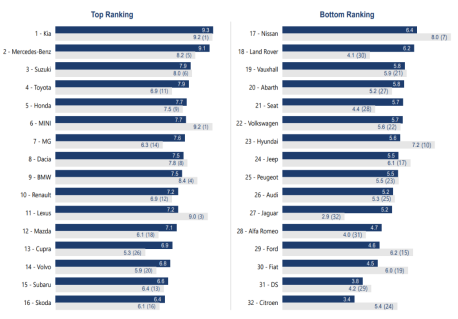

Kia once again stood out as a leader in the survey, achieving top scores across multiple categories, including the overall manufacturer rating with an impressive score of 9.3, marking a slight increase from the last edition.

Kia once again stood out as a leader in the survey, achieving top scores across multiple categories, including the overall manufacturer rating with an impressive score of 9.3, marking a slight increase from the last edition.

Paul Philpott, president and CEO of Kia UK, said: “A huge amount of energy goes into ensuring our customers are always kept at the forefront, which is why together we continue to invest heavily in our staff and training. We opened the new Kia Academy at the start of this year to educate and upskill the next generation of technicians, and just last month we hosted around 1,000 dealer staff from across the UK at our Kia Masterclass event at Silverstone, which provided unparalleled access to, and hands-on experiences with, our latest EV products.

Read AM's Brand Insight with Paul Philpott, president and CEO, Kia UK

“We have just recorded our best-ever September, and year-to-date we are the fourth best-selling brand in the UK. This isn’t isolated growth but the culmination of years of hard work, consistent investment in our people, trust in our product and faith in our loyal customers.”

Cupra had the biggest increase in ranking, climbing thirteen places to the thirteenth spot with a score of 6.9, while Ford saw the biggest decrease in ranking, dropping fourteen places to the twenty-ninth spot with a score of 4.6.

Citroen saw the biggest decrease in terms of average score, dropping by -2.0 points, while also posting the lowest score with a 3.4. The previous high flyer Lexus dropped the second highest amount (-1.8)..

Sue Robinson, chief executive of NFDA, said: “This edition of the survey shows advancements in key areas, particularly regarding electric vehicles and apprenticeships. However, significant challenges persist, especially with increasing concerns about current profit returns, which have also raised doubts about future profitability. The survey also reveals that despite progress in electric vehicle offerings, profitability in the EV sector remains a significant concern, with dealers highlighting limited product range as a major issue."

Login to comment

Comments

No comments have been made yet.