While the pace of electric vehicles (EVs) accelerates rapidly, the industry faces numerous challenges as demand starts to plateau.

Speaking during the Motor Ombudsman and Radius Law Automotive Business & Law Conference held in London on May 15, Ian Plummer, Auto Trader’s commercial director, said that, today, there are around 100 EV models available in the market, a nearly 50% increase from just a year ago.

"This significant growth in availability and choice across various price segments is noteworthy," said Plummer.

In the UK, there are around 50 available brands now, which is roughly a quarter more than there were four years ago at the start of the pandemic. "This increase in brands and products introduces more consumer confusion, but it ultimately expands the market."

Plummer said certain fundamental shifts will influence market dynamics. "The type of brand that succeeds and the ones that struggle will change significantly," he explained. "Korean brands, for example, have done exceptionally well by offering quality at competitive prices, taking customers from premium brands."

On the other hand, traditional brands like Ford are becoming less relevant in the context of EVs.

Having recently returned from China, Plummer shared insights from his trip: "China is far ahead of the Western market in terms of EV production and adoption. Chinese-built cars already make up around 10% of all new cars sold in the UK and about a third of all EVs."

Electric vehicles accounted for just over 30% of the new car market in China last year (9.5 million of a 30 million market) with the China OEMs dominating, accounting for 85% of the full electric market.

"Brands like BYD are leading the charge, competing fiercely against established giants like Volkswagen and Tesla," Plummer said.

He pointed out that BYD, which launched in the UK about a year ago, has rapidly increased its brand awareness according to recent research. "They started from almost zero awareness to 17% in a very short time," he notes.

"With strategic sponsorships like the UEFA Euro 2024, BYD's visibility is set to grow even further."

He said Chinese brands are moving at what many are now terming 'China speed', outpacing Western competitors in terms of quality, affordability, and price parity with internal combustion engine vehicles.

Discussing the broader market, Plummer said the affordability of EVs would prove crucial. “We're seeing significant new car discounts, averaging around 11%, which is driving the market forward."

He added that consumer interest in EVs is also growing, with 23% of recent car buyers considering an EV for their next purchase. "This interest needs to be converted into action and the affordability gap must be bridged," he said.

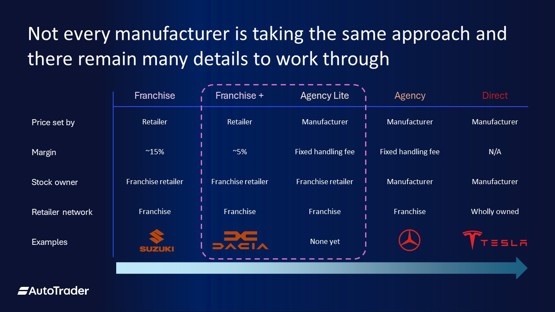

Plummer spoke of the evolving retail landscape for EVs. "Direct selling models, like those used by Tesla, are becoming more common, but they're not without challenges," he said.

"Many brands are exploring agency models, but retailers, who have been selling cars for decades, often feel sidelined in this process." He advocated for a middle ground that combines the best aspects of digital and physical retail experiences.

Plummer said there was a need for collaboration within the industry. "We need to work more openly and in partnership, connecting the various stages of the consumer journey," he said.

"Using data efficiently and focusing on our complementary strengths will help us adapt to the changing market."

Plummer said he believed that an omnichannel approach, integrating digital and physical experiences, would be essential for future success: "Ultimately, these changes will create a more dynamic, data-centric, and sustainable industry."

Login to comment

Comments

No comments have been made yet.