Used LCV prices increased in November, as demand grew steadily for vehicles to service the online shopping and home delivery sector in the run-up to Christmas.

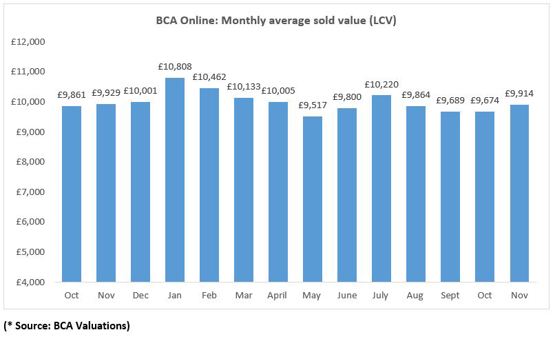

The month-on-month figures rose by £240 (2.5%) in November 2022, compared to October, to reach £9,914, the highest monthly value recorded since July of this year.

Wholesale values declined by £15 in October as demand remained well balanced against supply.

Looking in detail at the weekly values shows that demand kept average values above £10,000 for much of November. Seasonal factors ensured that there was high demand for any vehicle suitable for the home and hub delivery sector with average values climbing as a result. There was continued interest in the 4x4 doublecab sector, reflecting the need for sure-footed commercial vehicles in the worsening winter conditions.

Stuart Pearson COO BCA UK, said: “Demand for LCVs responded to seasonal pressures and we saw average selling values improve at BCA during November. Values increased for light commercials suitable to service the hub delivery, courier and final mile home delivery sectors ahead of Christmas and there was sustained interest in 4WD commercial vehicles as the weather worsened during November.”

There was substantial competition for any commercial vehicle offered in Grade 1 or ready to retail condition. There also continued to be a shortage of late plate, low mileage commercial vehicles reaching the wholesale sector, reflecting the issues affecting the new LCV market which declined by 22.2% in November - the lowest level for the month since 2013. This dearth of stock at the front end is likely to mean that used van values should remain resilient and BCA is expecting this to continue into the New Year.

Pearson added “All sales at BCA remain exclusively online and we continue to enhance the BCA Buyer app – the most widely used transactional mobile app serving the wholesale used vehicle sector - making it even easier for our professional buyer customers to acquire stock efficiently and profitably. BCA will be operating a substantial online programme between Christmas and the New Year, meaning dealers can continue to source stock over the Festive period.”

The Society of Motor Manufacturers and Traders (SMMT) expected 2022 to end with 290,000 new van registrations – down 18.5% on 2021 and 20.8% on 2019. The figures are due to be published this week.

While the LCV market is expected to rally in 2023 to 330,000 units, and up to 351,000 units during 2024, these totals would still be below pre-pandemic levels.

Login to comment

Comments

No comments have been made yet.