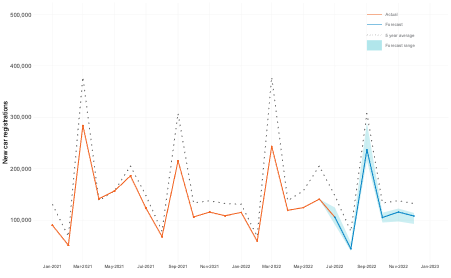

Cox Automotive predicts that the UK’s new car market will end 2022 on 1.62 million registrations after downgrading its forecasts to acknowledge the “reality” of the sector’s global supply crisis.

The automotive services provider now expects a 1.4% decrease year-on-year, which would leave registrations 29.7% down compared to the 2000 to 2019 average and 29.7% down on pre-COVID 2019 after downgrading its previous forecast by 11.3%.

A worst-case scenario for the year would see by 1.43m registrations, it said, representing a 12.9% decrease year-on-year to leave the sector 37.9% down on the 2000 to 2019 average and 37.9% down compared to 2019.

Despite the contracting market outlook Philip Nothard, Cox Automotive’s insight and strategy director, suggested that the company’s revised forecasts reflected “a resilient market”.

Despite the contracting market outlook Philip Nothard, Cox Automotive’s insight and strategy director, suggested that the company’s revised forecasts reflected “a resilient market”.

“We’ve been consistently commenting on the sector's headwinds for some time, and retailers and manufacturers respond resiliently,” he said.

“However, we must be realistic about the reality of the situation; new car production issues continue to affect most manufacturers, and there is a considerable shortfall in vehicles entering the market.”

Nothard added: “Although we believe output will increase as time goes on, this will certainly not make up for lost vehicles. Therefore, it remains unclear whether we will ever reach the circa 90m vehicles produced yearly again.”

Earlier this month AM reported how Kia, MG, Hyundai and Dacia were among the car brands defying the automotive sector’s supply issues to swell sales in H1 2022.

Supplies remain a key factor, though, with MG among the carmakers suspending the sale of certain models as it struggles to meet demand.

Cox Automotive also set out upside, baseline, and downside scenarios to predict the best, middle, and worst-case outcomes for the new vehicle market in its latest AutoFocus report.

The company predicts that Q3 2022 will end on 471,565 registrations, a 19% increase year-on-year, but 25.7% down compared to the 2000 to 2019 average and 20.5% on 2019.

The best-case scenario for Q4 is 351,171 registrations, a 6.2% increase year-on-year.

Nothard took time reflect on the future of the new car market in the Autofocus report, questioning whether UK car retailers would have to work with a push or pull market when supply chains eventually recover.

“Some commentators believe that the industry won't learn, and as soon as supply improves, we will return to old ways,” said Nothard.

“The reality, in my opinion, is more nuanced and is likely to be somewhere in the middle. But, as ever, one size does not fit all, and while some businesses will return to what they know, others will remain demand-driven with a focus on profitability.”

Login to comment

Comments

No comments have been made yet.