Used car sales surged by 19.4% last week as strengthening consumer confidence delivered strong online leads and “a consistent level of footfall at retailer showrooms”, according Cazana.

In his latest market analysis, Cazana's director of insight Rupert Pontin said that customer activity was expected to deliver some degree of stability in the coming weeks, despite the supply issues that continue to dog the new and used car retail environment.

For a second week running the used car market has seen improved consumer activity after a run of four weeks of declining sales.

From a new car perspective, the industry continues to learn how bad the supply of new cars is going to be over the coming months and the likely impact that will have on retailer performance and financial budgets, not to mention the wider impact on the used car market over the next couple of months.

The question is what has moved the needle over the past couple of weeks and made a difference to consumers in a period that is quite often subdued due to summer holidays and family leisure events.

There has been an increase in digital sales leads which has been supported by what is at best described as a consistent level of footfall at retailer showrooms.

It would seem that the sales teams have been working hard to convert sales to leads although anecdotally the feedback would suggest that those consumers that come on site are not just window shopping but actually keen to buy which is encouraging news, and there are expectations that this position will remain steady for the coming weeks.

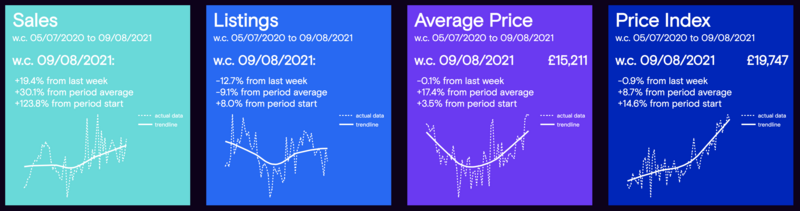

The panels below highlight the market dynamics during the week commencing August 9 in comparison to the previous week.

Insight in the sales data panel above emphatically shows the uplift in used car sales over the previous week to be a very healthy 19.4%.

Insight in the sales data panel above emphatically shows the uplift in used car sales over the previous week to be a very healthy 19.4%.

This combined with the 11.3% improvement the previous week means that the market is on its way to recovering the sales lost during the “Euros” period and this boost may also be related to the end of the Olympic games on August 8.

However, where sales have improved it is important to note that the volume of new retail adverts coming to the market has declined by 12.7%.

This reflects the continued shortage of used cars reaching the market and it is a problem that needs to be interrogated very carefully to understand where lower vehicle volumes may impact on the ability to increase retail price and improve on profit per unit.

Putting the lens on retail pricing and the raw average retail price of a used car in the market had a tiny downward move of 0.1% in comparison to the previous week taking the price to £15,211.

The Cazana Used Car Retail Price Index also declined by a nominal 0.9%, although it is important to note that the index has increased by 14.6% since this time last year which is quite an impressive improvement.

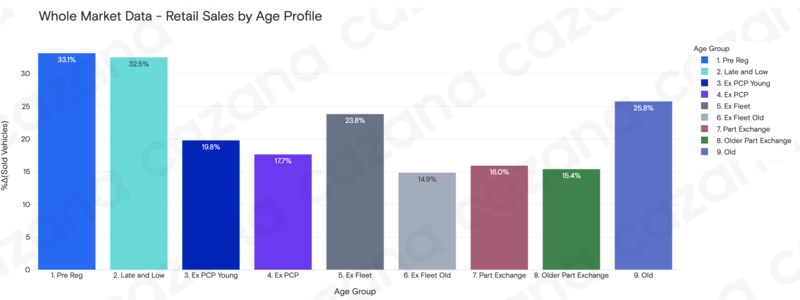

Given the significant increase in the number of used car sales week on week, the chart below looks to identify which age profile has gained the most:

This chart clearly shows the key market activity, and it is surprising to see a 33.1% increase week on week for pre-reg sales.

However, this represents just 2.3% of the total used car sales volume for the week.

The late and Low sector records the second largest increase in sales week on week at 32.5% and this age profile represents 9.4% of the weekly sales volume.

It is the part exchange profile that has the largest share of weekly sales taking 38% of all sales and a lower increase of 16% in sales volumes week on week.

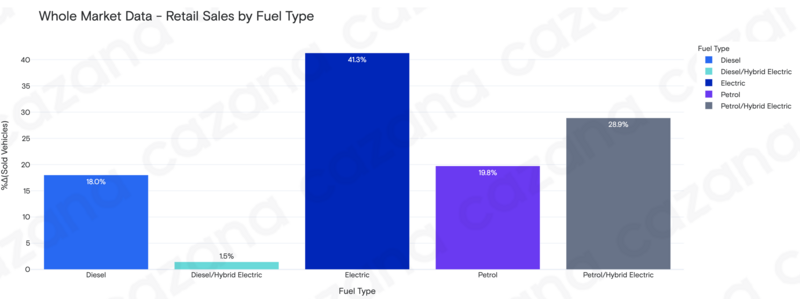

It is also of importance to see how sales of different fuel types have been affected and the chart below looks at the performance of used car sales week on week: The insight in the previous chart is interesting as it shows that it is EVs that have seen the largest upturn in sales week on week rising by a notable 41.3%. This represents 0.9% of the total used cars sold during the week.

The insight in the previous chart is interesting as it shows that it is EVs that have seen the largest upturn in sales week on week rising by a notable 41.3%. This represents 0.9% of the total used cars sold during the week.

The leader in this table is petrol vehicles which took 54% of all used car sales some 14ppts more than diesel powered cars in second place in market share terms.

Petrol/hybrid cars also saw quite a jump in volumes week on week, at 28.9%.

This insight suggests good demand from an environmentally aware consumer at the moment.

In summary, the market has been better than anticipated particularly from a used car perspective.

Digital sales leads have been consistently good with footfall on the used car forecourts a little lighter than the retailers would like although online transactions have taken a slight upturn.

The question of the depth of the problem with the supply of new car stock remains a hot topic although it is clear to all that the supply of used cars to the wholesale market has not improved.

The coming week could be challenging as the holiday season heads towards the August bank holiday when many retail buyers tend to take a well-earned rest and that often means lower new and used car demand.

Login to comment

Comments

No comments have been made yet.