Used car buyers who paused their purchase to focus their attention on England’s route through the European football championships may have triggered a 26.8% boost to retail sales last week.

That’s the opinion of Cazana director of insight, Rupert Pontin, who has analysed the vehicle valuation providers data and found evidence of an uplift in trading.

Read on for his full Weekly Pricing Insight Report for the week of July 19.

New and used car market activity in the last four weeks has been more challenging than retailers had expected and experienced for some time.

The good news is that matters have improved considerably with a big boost in volume in the last week when compared to the previous week, although sales enquiry levels have been a little slower to recover.

This was not entirely unexpected given the recent distraction posed to the consumer by the delayed Euro 2020 tournament that England came so close to winning.

When national interest lies with a major sporting event, it is not uncommon for the automotive industry and other retail sectors to be adversely affected.

The question is whether this really is what has happened to impact consumer demand or will sales dip again in the coming days.

It is wise to consider that the country is now in the holiday period with children off school and parents likely to take time out for family pursuits that may well not include looking for and buying a car.

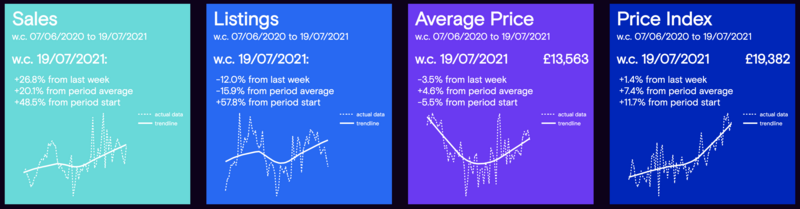

The charts below summarise and qualify the market dynamics during the week commencing July 19 compared with the previous week, with the full-year trend shown at the bottom of each panel.

For the week commencing July 19, in comparison with the previous week, used car sales increased by 26.8%.

The last month may well have shown a decrease in sales volumes but this latest data is quite a boost.

Even looking at the full year period, it is wonderful to see that sales today compared with sales at the beginning of June 2020 show an uplift of 48.5%. There are high hopes that sales performance will now stabilise over the coming weeks.

From a new retail advert listing perspective, it is disappointing to see the numbers of new adverts listed are dropping.

This is the direct impact of the shortage of used cars in the market and is likely to continue until the latter part of Q3 and perhaps see recovery during late September. However, it is positive that new listings have improved by 57.8% since this time last year.

Looking at the Cazana Used Car Retail Price Index and the news is also positive with a marginal increase of +1.4%, taking the normalised average price of a used car up to £19,382.

This offsets around half of the drop in the index last week but from a year-on-year point of view, the Cazana Used Car Retail Price Index has increased by 11.7%.

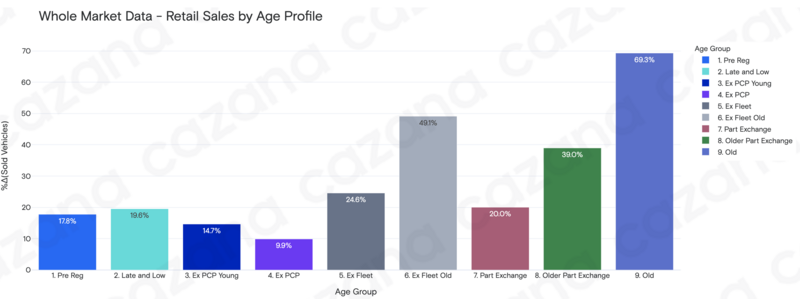

Given the healthy jump in the used car sales volume week on week, the chart below looks at the percentage increase by age and mileage profile.

This chart shows some interesting insight into the detail behind the 26.8% whole market increase in used car sales.

This chart shows some interesting insight into the detail behind the 26.8% whole market increase in used car sales.

The 69.3% increase in the chart above for old car profile sales is really interesting as this sector of the market has been very volatile for some months now, swinging from increase to decrease week on week in a really inexplicable manner.

The number of new retail listings has been dropping for the last few weeks, although the volume of live retail listings had not tailed off significantly until the last week.

The biggest point of interest is that the average retail price of an old car has jumped by £475 since the beginning of July which represents 10.3% gain.

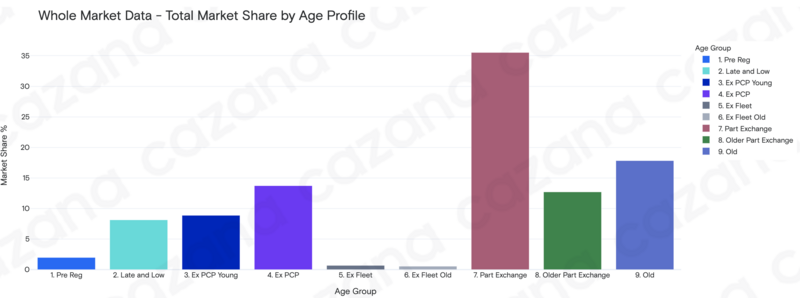

Taking a closer look at the market as a whole, the chart below shows the sales market share by age profile for the previous week.

Of specific note here is the volume of sales of Part Exchange profile cars which take 35.5% of the market overall, and combined with the knowledge from the previous chart that this sector saw an increase of 20% in sales week on week and it is evident that this age profile remains a very influential part of the used car sector.

Of specific note here is the volume of sales of Part Exchange profile cars which take 35.5% of the market overall, and combined with the knowledge from the previous chart that this sector saw an increase of 20% in sales week on week and it is evident that this age profile remains a very influential part of the used car sector.

The largest increase in sales came for the old car profile and the chart highlights that this represents 17.8% of the whole market share and is the second largest tranche of the used car sector, hence the importance of the week-on-week market swings mentioned earlier.

Of note is the low market share that pre reg cars have of the used car market, which is important to acknowledge due to new car shortages and this now seems to be reflective of the new car rhetoric in the press over supply constraints.

All eyes will be on the supply chain in coming weeks to see whether this position can be improved upon.

Login to comment

Comments

No comments have been made yet.