Used car dealers have been urged to remember that consumers ultimately dictate the price a car can be sold at as wholesale values continue to place pressure on stocking levels.

In his latest market analysis, Cazana director of insight Rupert Pontin discusses the latest pricing fluctuations and a shifting stock profile as dealers aim to respond and adapt to the hyper-competitive trading climate.

Read on for his report:

The car market in June 2021 has so far proven to be extremely exciting, and last week was no exception.

Perhaps because of the hot and dry conditions, incoming queries and subsequent sales were a little lower than they had been of late for many retailers.

This came as a surprise, although the real concern was that in the face of some very high wholesale pricing, the retail market prices were in fact a little weaker for some cars than in recent weeks.

There is little doubt that retail used car pricing will remain strong for some time to come, but it is also prudent to remember that just because wholesale pricing is high, it does not automatically mean that retail prices will go up accordingly.

The retail consumer dictates at what price a used car can be sold in the market and is not based on what the retailer has paid to bring the car into stock.

However, real-time insight from the whole market will give confidence to retailers to push pricing upwards which is a reality in today’s market.

Being aware of the prevailing market conditions is essential but it is also critical to use the insight to move with the market and keep profits healthy wherever possible.

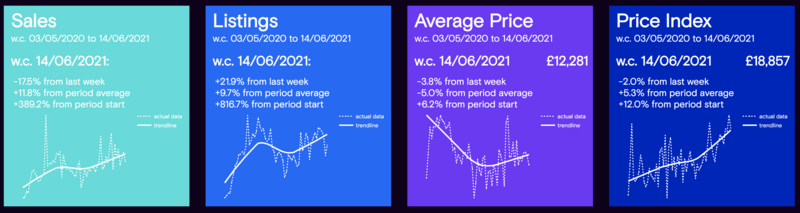

The charts below qualify the market dynamics during the previous week with the full year trend of the data shown at the bottom of each panel.

The data in the charts above confirms that used car sales were in fact down 17.5% in comparison to the previous week.

The data in the charts above confirms that used car sales were in fact down 17.5% in comparison to the previous week.

It is worth considering that during the previous week, the number of Live Retail Listings had dropped 2.9% and the number of new listings was down 29.3%, and these data points may well have impacted the volume of desirable cars on sale, hence contributing to the drop in sales for the week commencing June 14th.

On a more positive and directly related note, the number of new vehicle listings for the week commencing June 14 increased 21.9%. This increase may well help to fuel higher sales for the current week.

From a pricing perspective, the Cazana Used Car Retail Price Index decreased by 2% which somewhat negated the previous week’s increase of 2.5% and may well be indicative of the drop in sales levels week on week.

The change in the last 12 months still shows a healthy increase of 12%.

The average price of a used car also declined 3.8%, taking the figure to £12,765.

This is probably a reflection of the number of either older cars in the market or a drop in the quantity of premium cars in the later plate market and is a subject worthy of deeper analysis.

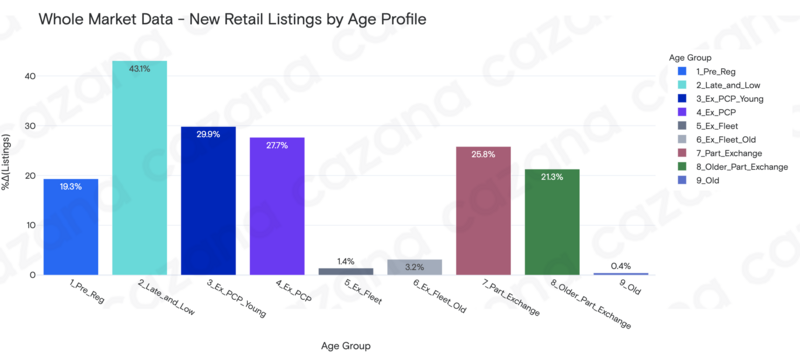

Using a different lens on the market, the chart below looks at new retail advert listings by age profile as a percentage week-on-week change to the previous week.

Given the whole market increase was 21.9% over the previous week, this is an interesting snapshot of where the volume came from.

The standout data point in the chart above shows that there was a 43.1% increase in the number of new Late and Low retail adverts that hit the retailer websites during the course of the week.

The standout data point in the chart above shows that there was a 43.1% increase in the number of new Late and Low retail adverts that hit the retailer websites during the course of the week.

Of equal note is the low level of ex-fleet product but also more importantly the minimal 0.4% increase in Old Car profile adverts.

On this basis, it would be logical at a high level to connect the profile of Late and Low cars being advertised to the OEM brand profile of these new adverts.

Given the drop in the Average Price, the suggestion here is that it is probably vehicles from mainstream OEMs rather than premium brands that have come to the market.

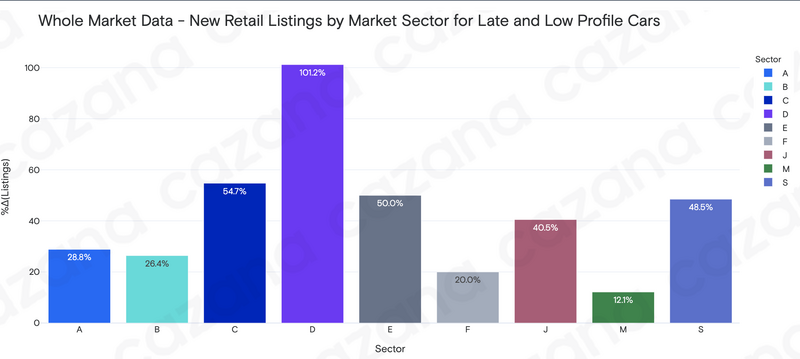

The above chart is interesting as it shows where the boost in the numbers of newly listed Late and Low adverts came from.

The above chart is interesting as it shows where the boost in the numbers of newly listed Late and Low adverts came from.

The biggest jump has come from the D or Large Car sector which saw an increase of 101.2%.

This jump is almost 50% more than the C-sector or medium-size cars that recorded a jump of 54.7%.

This data is exceptionally useful when looking at the market dynamics to decide on what used car stock needs to be bought and offered to the retail market.

To conclude, the week commencing June 14th when compared with the previous week brought a few surprises to the industry and a bit of a red flag around the assumption that retail prices will jump up in line with wholesale pricing.

This has been proven not to be the case, and that the retail consumer is the driver around retail price inflation.

It is likely that the dip in sales for the last week will be short-lived and it was probably due to the good weather distracting customers.

Login to comment

Comments

No comments have been made yet.