The Society of Motor Manufacturers and Traders (SMMT) has warned that the car manufacturing sector must not endure the “further shock of a ‘no deal’ Brexit” as it fights back from COVID-19 lockdown.

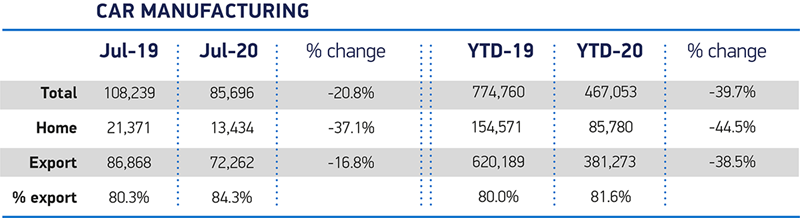

The industry body reported this morning (August 27) that the UK’s car manufacturing volumes had declined 20.8% year-on-year in July with 85,696 units made as factories struggle to ramp up output and global demand recovers slowly.

Production for UK buyers was down 37.1%, with 85,696 units leaving production lines, with exports showed a 16.8% decline in the period, accounting for eight-in-10 vehicles produced (72,262).

The result leaves the sector’s output 307,707 units down (37.9%) year-to-date after the coronavirus crisis forced markets and plants to close.

SMMT chief executive, Mike Hawes, is keen to avoid any further setbacks for the sector as reduced demand and social distancing efforts continue to pose challenges.

SMMT chief executive, Mike Hawes, is keen to avoid any further setbacks for the sector as reduced demand and social distancing efforts continue to pose challenges.

He said: “As key global markets continue to re-open and UK car plants gradually get back to business, these figures are a marked improvement on the previous three months, but the outlook remains deeply uncertain.

“With the sector now battling economic recession as well as a global pandemic, it has neither the time nor capacity to deal with the further shock of a ‘no deal’ Brexit.

“With the sector now battling economic recession as well as a global pandemic, it has neither the time nor capacity to deal with the further shock of a ‘no deal’ Brexit.

“The impact of tariffs on the sector and the hundreds of thousands of livelihoods it supports would be devastating, so we need negotiators on both sides to pull out all of the stops to ensure a comprehensive free trade deal is agreed and in place before the end of 2020.”

Last month the SMMT said that UK car manufacturing could lose up to £40 billion in lost revenues by 2025 in the event of a 'no deal' Brexit.

It expects 32% fewer cars to be produced in UK factories in 2020 after volumes declined by 48.2% in June.

It said at the time that 11,349 jobs had already been cut across manufacturing and retail during the COVID-19 pandemic, with more at stake without dedicated restart support as firms fear double whammy of Brexit tariffs.

It said at the time that 11,349 jobs had already been cut across manufacturing and retail during the COVID-19 pandemic, with more at stake without dedicated restart support as firms fear double whammy of Brexit tariffs.

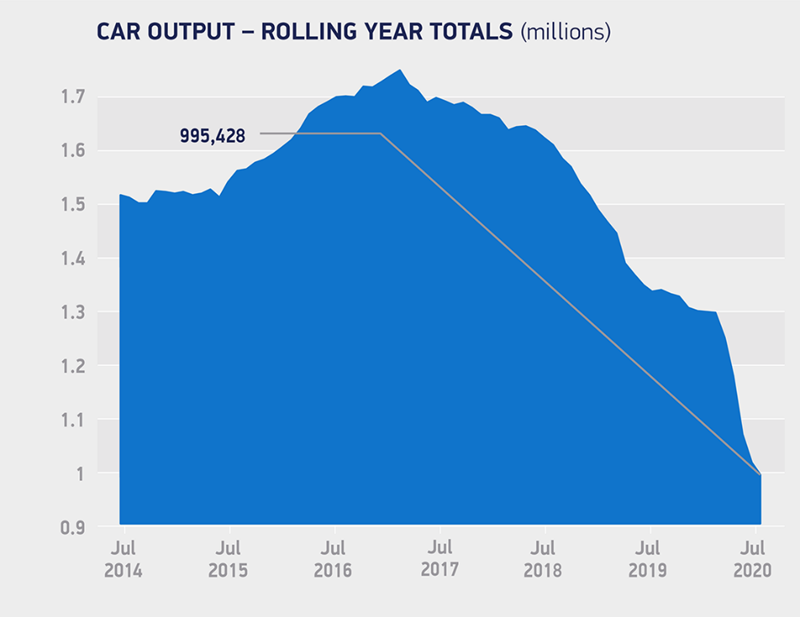

SMMT analysis suggests car production losses could total 1.46 million units by 2025 – worth just over £40bn – if no FTA is in place by the end of 2020, forcing the sector to trade on WTO terms with full tariffs applied.

Hawes said: “These figures are yet more grim reading for the industry and its workforce and reveal the difficulties all automotive businesses face as they try to restart while tackling sectoral challenges like no other.

“The critical importance of an EU-UK FTA is self-evident for UK Automotive. Our factories were once set to make two million cars in 2020 but could now produce less than half that number, a result of the devastating effects of the pandemic on top of already challenging market conditions and years of Brexit uncertainty.”

Commenting on today's SMMT statement regarding July's vehicle production decline, Andrew Burn, KPMG’s head of automotive, said: “Whilst production volumes are 20% down when compared to July 2019, if you look at it the other way, manufacturers are producing around 80% of last year's volumes, so even though uncertainty continues, the direction of travel is positive.

“However, whilst it’s great for car manufacturers who serve a global market, with around 80% of vehicles manufactured in the UK for export, we cannot forget that at a domestic level there are a number of challenges.

"Many manufacturers of components are highly operationally geared and therefore in many cases, small changes in volumes mean the impact is felt on the bottom line more directly than in other sectors.

"Also, given that the UK was the hardest hit economically, out of major economies, by the pandemic in the three months to June, a longer recovery time for many sectors is to be expected.”

Login to comment

Comments

No comments have been made yet.