Registrations in June fell by 34.9%: it is a measure of these strange times that a fall of approximately one-third counts as a recovery after the falls of 97.3% in April and 89.0% in May.

It might seem that, in such chaotic times, no worthwhile trends could be identified. However, the falls in sales have been so evenly spread that underlying market trends are still evident.

In the previous recession, the big winner was the city car segment, which rose briefly above 10% market share. That was due to the scrappage scheme and mainly benefitted Hyundai and Kia.

This has not been lost on the UK Government, which looked briefly at the idea of another scrappage scheme, but decided that (a) it did not really benefit UK manufacturers last time around, and (b) it would not look good to be subsidising petrol engines when it wants to get to zero tailpipe emissions as quickly as possible.

Subsidising only electric cars was not really an option, given only reasonably affluent people buy what are still fairly pricey vehicles.

This article first appeared in the August digital issue of AM magazine. Click here to read it.

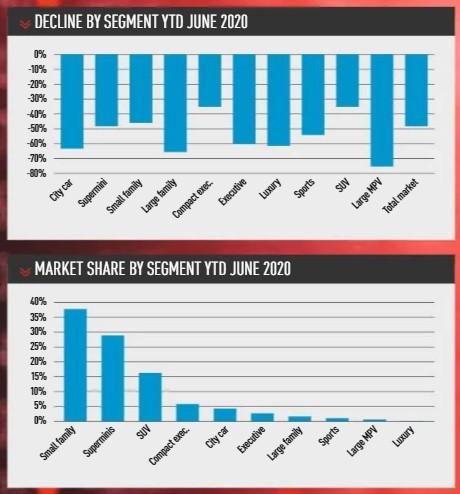

In the crisis, city cars were one of the worst-affected segments with market share year-to-date (YTD) down to just 4.5% (see table). In a way, this is to be expected. City cars are often bought as second vehicles, and most are barely using their first car at present, let alone replacing their second one.

In the mainstream family car segments, the market share of B-segment (superminis) is virtually unchanged at 29.1%.

Slightly surprisingly, B-segment hatchbacks and crossovers are down by almost the same amount (50.1% and 48.1% respectively). B-segment MPVs have almost ceased to exist, with total sales of just 613 YTD, the majority of which were the Kia Soul. In small family cars (C-segment), overall share was also static at 38.1%. Again, hatchbacks (-48.9%) and crossovers (-46.2%) fell by similar sums. C-segment MPVs ‘only’ fell by 53.5%, but they now account for less than 5% of C-segment sales.

Large family cars (D segment) are going the way of the small MPV. Market share was down to just 1.3%, with a majority of what sales there were coming from the VW Group (Passat, Superb, Arteon). Curiously, Vauxhall Insignia sales collapsed by 92.8% to just 484 units, meaning it was comfortably outsold by the Peugeot 508.

PREMIUM EV SUCCESS

PREMIUM EV SUCCESS

More surprisingly, the D-segment’s premium brother, the compact executive, was the second-best performing sector, with market share up to a record 6.0%. Mostly this was due to the success of the Tesla 3 – Tesla, as a company, is having quite a good crisis, Elon Musk’s increasingly bizarre comments notwithstanding.

However, the BMW 3 Series is also doing very well, with registrations the same as the combined figure for the Mercedes C Class and Audi A4.

Sales of larger premium models have not fared as well. Executive models (e.g. BMW 5 Series) saw market share drop to 2.4%, while luxury saloons fell to a record low of just 0.22%.

One notable figure is that the Porsche Taycan was the best-selling luxury saloon in the UK last month, and is in third place YTD behind the Mercedes S-Class and BMW 7 Series. Following Tesla’s success, this is more evidence that luxury saloons are likely to go fully electric before most other segments. The two main disadvantages of battery electric cars (cost and weight) are not big issues in a £100,000 saloon that already weighs 2,000kg with a petrol engine.

No prizes for guessing the segment which has fared best this year. Large/premium SUVs have increased market share to a record 16.7%.

Within the overall figure, small premium SUVs suffered least, with a fall of 30.2%, helped by the new Range Rover Evoque (down only 13.7%) and the Volvo XC40 (actually up 2.6%).

Unsurprisingly, the worst affected sub-segment was large non-premium models which fell 41.9%. There is a general trend towards premium models in this sector (if you are going to be fashionable with an SUV, you might as well be properly fashionable with a premium model), as well as the fact that some non-premium manufacturers may be cutting back on large SUVs which threaten their CO2 fleet average.

FORD REGAINS LEAD

At a manufacturer level, Ford has regained market leadership, having fallen behind VW for the first quarter. The new Puma has got off to a remarkably strong start under the circumstances, and is already No 2 in the segment, behind the Vauxhall Crossland X. The Focus is also fractionally ahead of the Golf, but the new eighth-generation Golf is still to make an impact.

So, Ford will have to fight hard to retain the top spot for the full year. Behind Ford and VW, BMW and Mercedes are in an equally tight race for third spot. BMW is currently shading it, mostly thanks to the success of the 3 Series, which is more than 4,000 units ahead of the Mercedes C-Class.

Audi is some way back in fifth and still cannot seem to make up the ground lost when it could not homologate all its cars to the new WLTP standard. In fact, Audi is only 0.2 ppts ahead of Toyota, which is on a charge.

Possibly the most unlikely stat of the year so far is that the Toyota Corolla has increased sales in absolute terms (by 0.9%), and is now the fifth best-selling small family hatchback. Alas, the same cannot be said of Vauxhall or the Astra. Vauxhall registrations have fallen by more than any other major manufacturer and market share is down to a record low of 5.8%. Sales of the Astra are down by 73.8%, and it is being outsold by models such as the Nissan Leaf and Mercedes CLA.

Overall, the market is behaving completely abnormally in terms of size, but quite normally in terms of manufacturer and model shares.

Companies attributing a poor market share to the effect of COVID-19 may be unwise to count on a sudden improvement when we fully emerge from the coronavirus crisis.

By David Francis

Login to comment

Comments

No comments have been made yet.