Following clarification on car dealers' ability to trade during the COVID-19 coronavirus lockdown Cazana's director of insight, Rupert Pontin, asks whether 2020 used car demand could actually be higher than 2019.

And also explains why he sees a “glimmer of hope” in the sector’s vehicle pricing and online sales activity from the past seven days in his Weekly Retail Price Watch report:

The last week has seen further retail price movements across the UK automotive market as the dealer sector begins to realise that online sales are beginning to improve.

With the recent confirmation that under controlled conditions cars can be handed over to customers, there has been an upturn in enquiries and the number of deposits being taken online.

Indicators show that there has been a significant increase in the number of franchised and independent dealers refining their online presence and including the crucial “buy online” feature that so many were missing at the beginning of the lockdown period.

- AM is urging retailers to share their experience of trading during the COVID-19 coronavirus outbreak via its two-minute, quick-fire ‘COVID-19 car retail recovery survey’. Click here to take part.

Online transactions will be enhanced by effective messaging and support from the finance sector.

The final part of the sales journey is the vehicle handover, which is not an easy task to complete under the current market conditions, but following guidance from the government and shared by the NFDA (National Franchised Dealers Association) many small to mid-size logistics companies are preparing for a post-lockdown environment where social distancing will be essential to help counter the further spread of COVID-19 coronavirus.

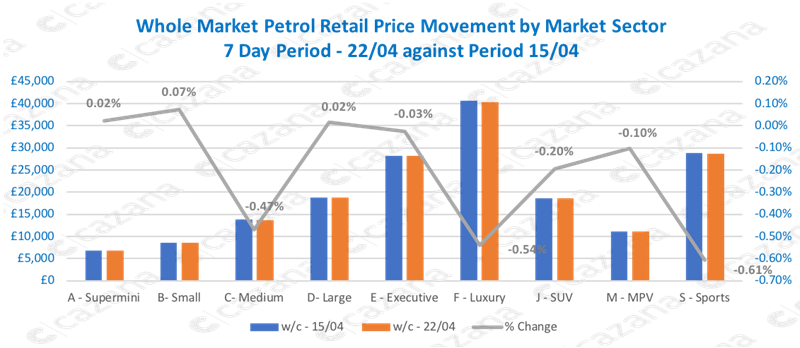

Looking at the retail market price movements, the data displayed in the first chart looks at average pricing performance for petrol cars by market sector for the whole retail market between the period commencing on April 22 and the previous period commencing April 15.

During the previous week, petrol powered cars experienced a total downward market shift of 0.29%, which is marginally more than the 0.2% for the previous week.

During the previous week, petrol powered cars experienced a total downward market shift of 0.29%, which is marginally more than the 0.2% for the previous week.

The biggest pricing move for petrol cars came from the Sports Car sector with a drop of 0.61% when compared to the previous week.

This was followed closely by a 0.54% drop in the Luxury Car segment reflecting perhaps the sensitive nature of this higher priced sector where the average cost new is £40,381.

The slower depreciating cars come from the smaller car segments and highlight that for petrol powered cars searches and therefore demand may be stronger across the Supermini, Small and Large car sectors.

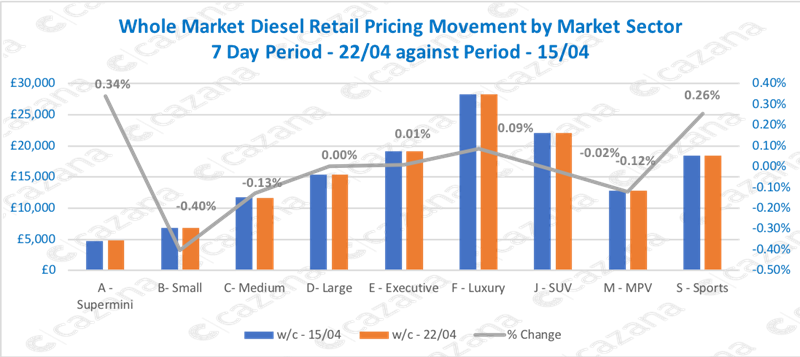

Diesel prices moved far less in the last seven-day period with an increase of just 0.02% as highlighted in the chart below. This is a return to stability after the drop of 0.9% in the previous period which had come as something of a surprise.

The biggest diesel-powered pricing move came for the Small car sector with a price reduction of 0.4% – a real terms is a drop of £27 per unit given that the average price is now £6,774.

The biggest diesel-powered pricing move came for the Small car sector with a price reduction of 0.4% – a real terms is a drop of £27 per unit given that the average price is now £6,774.

This may be reflecting the apathy towards small diesels in the market as noted in previous weeks.

Prices for diesel powered Superminis and Sports cars increased by 0.34% and 0.26% although it is important to note that these sectors account for just 0.03% and 2.65% of the total retail market.

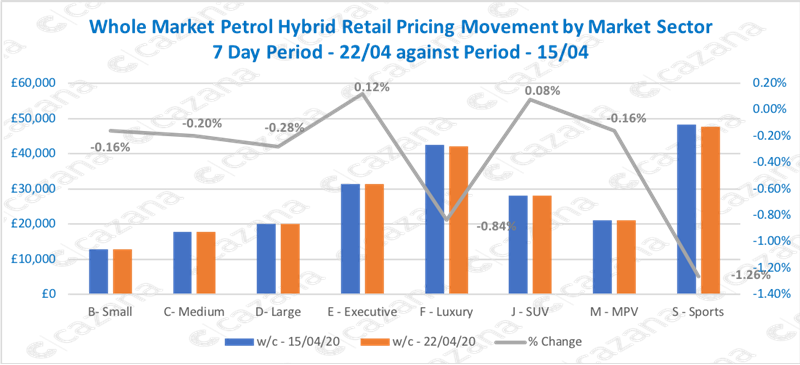

Pricing in the petrol hybrid sector saw a fall in the last seven-day period as shown in the chart below:

Only the Executive and SUV sectors showed a minimal increase in retail pricing where all others recorded a drop.

Only the Executive and SUV sectors showed a minimal increase in retail pricing where all others recorded a drop.

The total sector was down 0.47% which greatly influenced a dip of 1.26% for the Sports sector – reflecting a drop of £603 per car although this sector only represents 0.06% of the total retail market.

SUVs represent the largest total market share for petrol hybrid powered cars at 1.51%. The largest rise in prices, at 0.12%, came for petrol hybrid Executive cars.

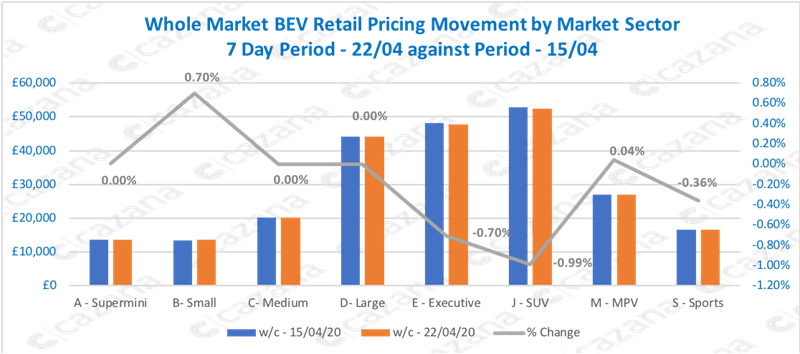

For the pure electric vehicle (EV) propulsion type, there was also a slight drop in retail pricing.

The total shift in this fuel type was a decline of 0.34% although this average figure masked some larger shifts emphasizing the need to look deeper into the data.

The chart below highlights the peaks and troughs by sector:

The most significant uplift in values came in the small car sector, which is the keenest area of the EV market right now, perhaps due to the size and usability of this type of vehicle.

The most significant uplift in values came in the small car sector, which is the keenest area of the EV market right now, perhaps due to the size and usability of this type of vehicle.

Prices increased by 0.7% or £96 per vehicle where the average market retail price is currently £13,621.

This positive was offset by downward moves for the Executive, SUV and Sports sectors although these do represent a very small part of the total retail market at sub 0.01% each.

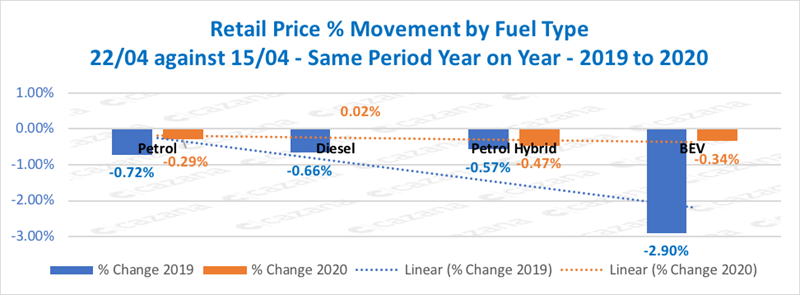

The last chart looks at the performance of the last seven-day period in comparison with pricing activity during the same period in 2019.

This is important to understand how the COVID-19 pandemic may be affecting pricing movement when compared to a normal active market:

Data in this chart clearly shows that in 2019 retail pricing by fuel type was moving downwards whereas in 2020 the decrease in pricing is far lighter and diesel-powered cars have shown a very small increase.

Data in this chart clearly shows that in 2019 retail pricing by fuel type was moving downwards whereas in 2020 the decrease in pricing is far lighter and diesel-powered cars have shown a very small increase.

Two reasons can be concluded form this. Firstly, there is a perception of greater consumer demand for cars in 2020, which despite lockdown could be true.

Secondly, it is possible that dealers are not changing their pricing.

Cazana data indicates that whilst there has been a drop in the number of dealers moving prices, between 55% and 60% of dealers are still altering their price position weekly.

To summarise, the UK market is still active from a pricing perspective week on week.

With clear guidance on how vehicles may be handed over the volume of sales has now increased.

Coupled with an uplift in the number of businesses that have improved their sales operations to offer an online buying facility, it appears that the industry is beginning to see a glimmer of hope and understand the shape of things to come post-lockdown.

Login to comment

Comments

No comments have been made yet.