Automotive industry analyst GlobalData has claimed that carmakers Tesla and Toyota will prove to be the OEM brands most resilient to the impact of COVID-19 coronavirus following a manufacturing sector review.

GlobalData’s review reminded automotive sector businesses that the industry was already facing disruption from the roll-out of electric vehicle (EV) technology, the impact of new EU CO2 emissions regulations for 2020/21 and a need to shift further in the direction of online car sales, but said that “the COVID-19 crisis will likely accelerate that process and add to volatility in the sector”.

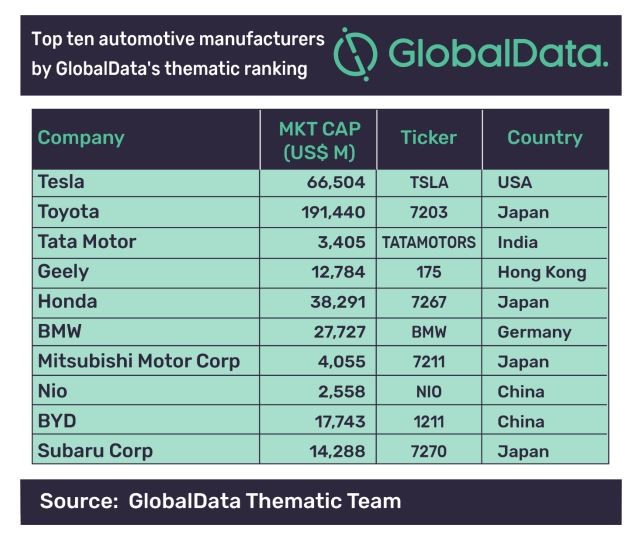

It said that the impact of the coronavirus (COVID-19) crisis will be strongly adverse across the industry this year, with all major companies impacted, but said that its ‘Thematic Research: Automotive Sector Scorecard (2020)’ had found Tesla and Toyota would emerge strongest from a 32-strong field of OEMs.

GlobalData said that trends such as EVs remained just as important for any brand’s medium to long-term prospects, which partly drove Tesla's position at the top of the pile.

GlobalData said that trends such as EVs remained just as important for any brand’s medium to long-term prospects, which partly drove Tesla's position at the top of the pile.

Calum MacRae, Automotive Analyst at GlobalData, said: “Top-of-the-ranking Tesla is fortunate to have only just started production in China. If you didn't have much to lose you can't lose too much. Second-placed Toyota benefits from a pretty diverse geographical footprint.”

This week AM reported that Geely’s Polestar performance brand had begun production of its new Polestar 2 EV SUV in China this week.

Progress for the brand came as China appeared to be emerging from the depths of its COVID-19 coronavirus crisis.

Elsewhere, many countries may yet to feel the full impact of the pandemic, an issue which could hamper global trade and supply lines for months to come.

McRae said: "The COVID-19 crisis is hitting automotive companies hard on both the supply- and demand-side this year.

“Supply chains are being disrupted and market demand has suddenly plummeted across the major regions of the world during March.

“It looks like the market demand crisis and loss of volume for companies will extend into the second quarter before some stabilisation and recovery thereafter.

“However, the sector was under pressure before the coronavirus crisis hit.”

McRae said that the COVID-19 coronavirus crisis had layered on top of already rapidly-growing pressures on company bottom lines arising from the need for increased investment in costly advanced technologies such as electrification and automated drive systems, adding: “In Europe, manufacturers were also facing challenging new CO2 averages that European companies said impeded their global competitiveness.

McRae said: “The industry faces a very difficult year. Some industrial consolidation and restructuring is inevitable. The long-term disruptors pointed to sector transformation anyway.

“The COVID-19 crisis will likely accelerate that process and add to volatility in the sector and company performance in 2020."

Login to comment

Comments

No comments have been made yet.