The March registration figures were harder to read than usual. Those with a glass half-full approach would say that, at 474,000, the total was the fourth-best in history. Those of the opposite disposition would say the market fell by 15.7% compared with March 2017.

The truth is that the registrations figure is about what one would have expected, given that March 2017 was a boom month before the introduction of new VED rates. If you compare last month’s figure to March 2016, which is a more representative baseline, the drop was a more moderate 8.6%.

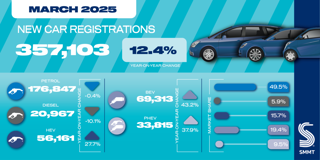

However, even the most optimistic observer would fail to find any cheer in March’s diesel registrations – down 37.2% year-on-year.

Analysis of the figures for the first three months of the year show huge variances in manufacturers’ diesel proportions. Fiat’s diesel registrations fell by 65% year-on-year and Nissan’s fell by 52%.

One has to wonder if the rate at which each manufacturer’s diesel registrations are falling correlates with their attitude to diesel engines. Will companies such as Fiat and Nissan continue to offer diesels in the medium term, or are they steadily weaning their dealers and customers off the fuel?

Certainly, the development of a new generation of diesel engines would be hard to justify given these volumes (which are also reflected by registration figures across Europe). That is rather ironic in Fiat’s case, as it literally engineered the diesel boom after 2000 by inventing the now-universal common rail injection system.

Vauxhall falls from second place

At a manufacturer level, Ford had a pretty torrid month, with a market share of 10.6%, down from 12.8% in March 2017. The main culprit was the Focus, which fell by 45% as the introduction of the new model approaches. The only bright spot was the Kuga, which rose to number six (just one place behind the Focus), with a fall of only 6.2% – considerably better than the overall market.

Immediately behind Ford is Volkswagen – after so many years of Vauxhall being in second place, that statement still seems strange. VW had an excellent month, with registrations falling only 4.2% and the Golf now pretty firmly established as the second-best-selling car in the UK. It will be interesting to see if the Mk4 Focus can overtake the Golf – that could turn out to be a very hard fight, especially with a new Golf due in late 2019.

In third place, Vauxhall did slightly better than Ford compared with 2017 – until you remember that March 2017 was itself a terrible month for Vauxhall. Compared with March 2016, its market share has dropped from 10% to 7.8%. At least the Corsa re-entered the Top 10 at number four, albeit with registrations 39% below the Fiesta. However, that was the only Vauxhall in the Top 10, the Mokka X having dropped out of the list.

The next three places were taken up by the German premium brands, as is becoming traditional – although with Mercedes-Benz now less than half a percentage point behind Vauxhall YTD (7.59% vs 7.12%), that tradition could change. Year-to-date, Mercedes has built a useful lead of more than 3,000 units over Audi and BMW, who are running almost neck-and-neck. Mercedes also has the distinction of providing two of the Top 10 best-selling cars in the UK, in the A-Class and C-Class.

French losing ground to Asian brands

Rounding out the top 10 manufacturers are four Asian brands. Nissan is still in seventh place, although its registrations have fallen by a worrying 34.8% YTD. The Qashqai is down only 12.5%, but the rest of the range is suffering. Toyota, Kia and Hyundai all outperformed the market, so have closed most of the gap to Nissan. Kia can be delighted with a 10th place in the March registrations charts for the Sportage – when the first generation of Sportage trickled on to UK roads in the mid-1990s, not even Kia would have guessed at how far it would come. Meanwhile, Hyundai will be happy that it effectively maintained volumes in March despite a sharply falling market – registrations were actually up by a marginal 0.4%.

One of the striking aspects of the top 10 group of manufacturers is the absence of French brands – 15 years ago, Renault was in third place, Peugeot fourth and Citroën sixth. Today, Peugeot is in 11th position, Renault in 14th and Citroën in 18th (regardless of whether DS is included in the Citroën figures, which shows the terrible performance of Citroën’s premium sub-brand). To be fair to Peugeot, the fact that it cannot sell as many cars in the UK does not seem to bother it unduly, as the parent company is now very profitable – Vauxhall managers speak of the incredible focus of Carlos Tavares of PSA, whose attitude to manufacturing is: “Every day, hit the production numbers, improve quality, reduce costs – everything else is management nonsense.”

Below even Citroën is Fiat, now in 20th place – a sad reflection on one of Europe’s major car manufacturers. In the first three months of 2018, more than 80% of its registrations came from the city car segment (500/Panda). The larger 500X is not performing well (down 69% in Q1 year-on-year) and the 500L is barely selling at all.

In contrast, brands that are part of the Volkswagen Group can do no wrong at present, despite the wrongs committed in the ‘Dieselgate’ emissions-cheating scandal.

Škoda is one place ahead of Renault in 13th position and Seat is one place behind in 15th. However, Seat is the only major brand to be growing significantly in absolute terms (9.6% up YTD) so, if present trends continue, it could be outselling Renault by the end of the year.

Corporately, the VW Group now takes 20.9% of the UK market across its six biggest brands (VW, Audi, Škoda, Seat, Porsche, Bentley) – a UK share not seen for a single corporation since the 1990s. DAVID FRANCIS

Login to comment

Comments

No comments have been made yet.