Car makers are on track to meet their zero-emission vehicle (ZEV) mandate targets for this year, despite many falling short of the electric vehicle (EV) sales targets.

The ZEV mandate, which compels automakers to sell a specific percentage of electric cars annually, imposes fines of £15,000 for each car sold below the target. In 2024, the target is set at 22%, gradually increasing to 80% by 2030.

By the end of July, electric vehicle registrations had increased by 10% to 195,000, according to the Society of Motor Manufacturers and Traders (SMMT).

Car makers are on track to meet their zero-emission vehicle (ZEV) mandate targets for this year, despite many falling short of the electric vehicle (EV) sales targets.

The ZEV mandate, which compels automakers to sell a specific percentage of electric cars annually, imposes fines of £15,000 for each car sold below the target. In 2024, the target is set at 22%, gradually increasing to 80% by 2030.

By the end of July, electric vehicle registrations had increased by 10% to 195,000, according to the Society of Motor Manufacturers and Traders (SMMT).

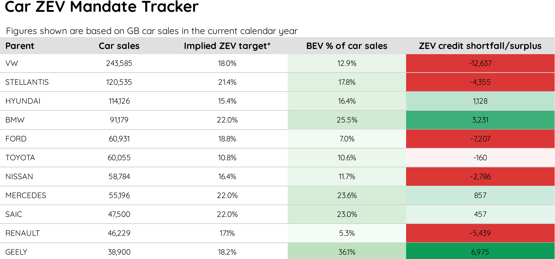

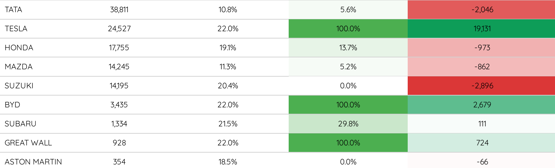

However, this still represents only 16.8% of the market share. New AutoMotive, an industry analyst, predicts that overall EV sales will reach just 18% by the year's end, yet manufacturers are expected to comply with the ZEV mandate through various strategies.

It said that the top five car manufacturers by volume all gained on or have already exceeded their targets in June. Stellantis group increased its share of BEVs in the year to date from 16.8% to 17.8%, helped by a strong July for Peugeot and Vauxhall, whose EV sales were 28% and 22% respectively. VW Group also closed the gap, increasing its share of BEVs in the year to date from 12.3% to 12.9%.

It estimates that to meet the 2024 target, manufacturers only need to sell 1,400 EVs more a month - down from 1,800 last month.

Ben Nelmes, CEO of New AutoMotive, noted that the UK is experiencing a resurgence in EV sales after a challenging year. "The UK's ambitious ZEV targets are driving investment in EV production and battery manufacturing," he said, urging the government to resist any pressure to soften the mandate.

Lagging

While some automakers like BYD, Polestar, and Tesla are ahead of the targets due to their exclusive focus on electric vehicles, others, including Ford, Mazda, and Suzuki, lag far behind, with EV sales under 5% year-to-date.

The ZEV mandate offers several mechanisms for manufacturers to meet targets without achieving the full EV sales percentage. A credit system allows companies to bank credits for exceeding targets, which can be used in future years or sold to underperforming brands.

Large automotive groups, such as Stellantis and Volkswagen, can also pool their registrations across different brands to offset the weaker performances of constituent brands.

Emissions credits for low-emission vehicles like plug-in hybrids also add another layer of flexibility. Manufacturers can convert reduced CO2 emissions into credits against their ZEV targets, though this is capped at 65% of the 22% target for 2024.

A Department for Transport spokesperson confirmed to AM’s sister title Fleet News that manufacturers are expected to take advantage of this flexibility, which means the actual proportion of new electric cars sold could be significantly lower than the 22% mandate target.

Most EVs sold this year have been to fleet customers, accounting for 55% of registrations, while retail sales have dropped to just 19%. Private buyers have been slow to adopt electric vehicles, with only 9% of total private registrations being EVs.

Discounts

Despite price cuts from brands like Lexus and Vauxhall, and average discounts of 10.6% on EVs, 86% of private buyers continue to opt for petrol or diesel vehicles.

Rental companies have also shown little interest in electric vehicles this year, leading manufacturers to offload excess stock through the Motability channel and increase the volume of pre-registered vehicles.

Mike Hawes, CEO of SMMT, has expressed concern over the weakening private demand for EVs, despite the growing overall market. "The pace of market transition needs to accelerate to meet the UK’s climate goals and ensure manufacturers can hit regulated targets," he said, calling for greater consumer support and improvements in infrastructure.

Ford, despite supporting the ZEV mandate's introduction in 2023, is struggling to meet this year’s target with only one electric model currently available. The company plans to introduce new electric models like the Explorer and Capri, but these won't see significant sales until 2025.

Despite its recent strength in EV sales, Stellantis, whose brands include Citroen, Peugeot, and Vauxhall, has voiced concerns about the UK's EV policy. CEO Carlos Tavares criticised the policy as "terrible," warning that it could push carmakers toward bankruptcy by forcing them to sell vehicles at a loss to avoid fines.

Tavares stressed that staying profitable is crucial for survival and hinted that Stellantis might scale back its presence in Britain if the financial risks become too great.

Advanced ICE

While many car makers have rushed to phase out combustion engines, German car manufacturing giant BMW has maintained that these engines still have a critical role to play, particularly when powered by innovative low-CO2 fuels.

Speaking at the recent half-year results conference, BMW chairman Oliver Zipse said that with more than 250 million ICE vehicles still on European roads, policy makers should not overlook advanced ICE technology that could immediately reduce emissions.

BMW has heavily invested in advanced hybrid systems such as the X3 and low-CO2 fuels like e-fuels and HVO100 which could help ease into a full transition to electric vehicles especially in regions where EV infrastructure is still developing.

“At the moment, however, we see a significant risk of eFuels being politically instrumentalised in the debate about the ban on combustion engines from 2035. There are currently many indications that the EU Commission is striving for a bogus solution in which the ban on combustion engines is relaxed simply by ostensibly opening up to eFuels.

“However, if it then does nothing to accelerate the ramp-up of low-CO2 fuels and make their use practicable, this would be a deliberate ban on combustion engines through the back door. We continue to believe that a categorical ban on combustion technology is wrong.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.