Competition from emerging EV manufacturers means brand loyalty can no longer be taken for granted, according to a survey of over 5,000 European car buyers.

Research by European online classified group Adevinta reveals significant shifts with the EV transition levelling the playing field.

It reports that while brand reputation remains crucial in purchasing decisions - with 45% of respondents citing it as the top consideration and 31% historically buying vehicles from the same brand - many consumers are willing to switch brands.

Competition from emerging EV manufacturers means brand loyalty can no longer be taken for granted, according to a survey of over 5,000 European car buyers.

Research by European online classified group Adevinta reveals significant shifts with the EV transition levelling the playing field.

It reports that while brand reputation remains crucial in purchasing decisions - with 45% of respondents citing it as the top consideration and 31% historically buying vehicles from the same brand - many consumers are willing to switch brands.

For instance, 28% are more likely to purchase an EV from a new or unfamiliar brand compared to a petrol or diesel vehicle.

Barriers to adoption like battery range, affordability, and availability are prompting consumers to consider unfamiliar brands.

Nearly 40% of surveyed consumers would consider buying an EV from a new brand if it offered superior range. Over a third (35%) would switch for a more affordable EV, and 26% would do so if the vehicle could be delivered more quickly.

Ajay Bhatia, CEO of mobile.de and head of Adevinta’s global mobility portfolio, stated: "In the fast-evolving EV market, established manufacturers can no longer rely on brand loyalty alone. They must build trust by addressing key concerns such as cost and battery range to stay relevant to new EV buyers."

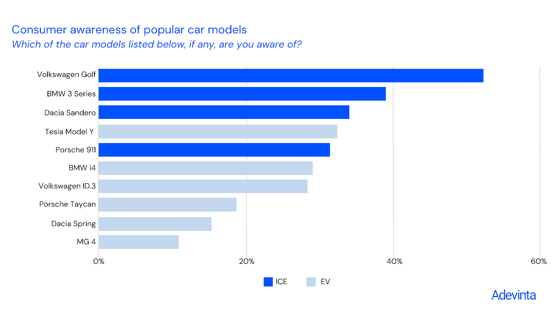

Consumer awareness of EVs remains low compared to petrol or diesel equivalents. For example, the Volkswagen Golf (52%), BMW 3 Series (39%), and Dacia Sandero (34%) are the most widely recognised models. In contrast, only 28% recognise Volkswagen's ID.3, 29% are aware of BMW’s i4, and just 15% know the Dacia Spring.

With the European Federation of Transport and Environment predicting that one in four EVs sold in Europe this year will be made in China, Adevinta believes building a reputation in the that market remains challenging for these incoming marques due to the consumer tendency to associate quality with legacy brands.

Nearly 30% of surveyed consumers don’t trust that vehicles from new brands are reliable or well-built. Among ten brands surveyed, consumers view Volkswagen (41%), BMW (40%), and Tesla (27%) as the most trustworthy. Emerging brands like Polestar (6%), MG (4%), BYD (4%), and Lynk & Co (3%) rank lower in trustworthiness.

When asked about the strongest reputation as EV manufacturers, Tesla topped the list with 48%, followed by Volkswagen and BMW at 26% each. In contrast, other EV-focused brands like Polestar and BYD - 2022’s best-selling EV manufacturer - are seen as reputable by just 11% and 9% of respondents, respectively.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.