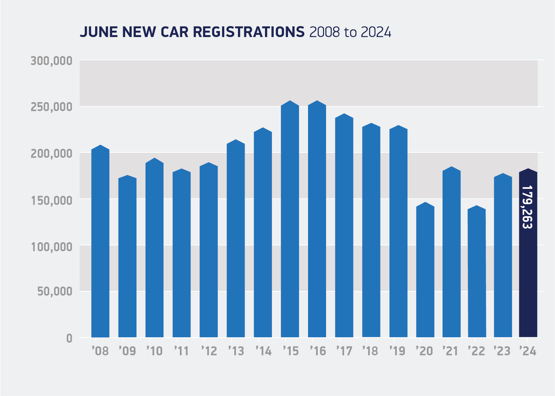

The UK new car market has hit the million sales in the first half of the year for the first time since 2019

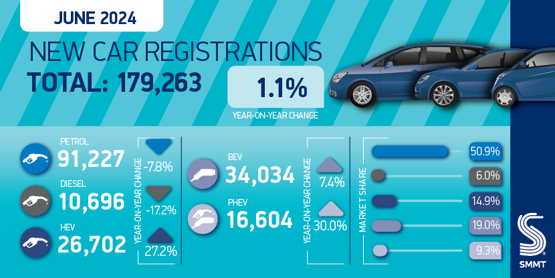

Even so, June saw a modest growth of 1.1% in new car registrations, reaching 179,263 units, according to the Society of Motor Manufacturers and Traders (SMMT).

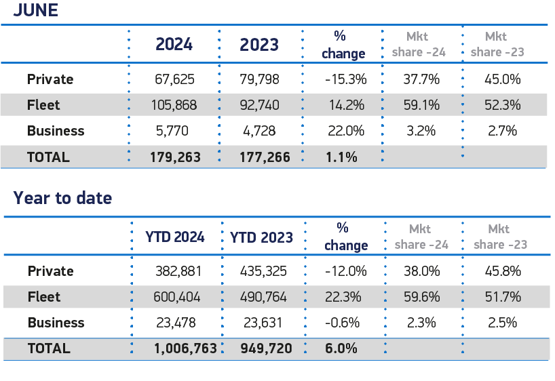

So far in 2024, a total of 1,006,763 new cars have been registered, marking a 6.0% increase from the previous year, though still 20.7% below 2019 levels.

The UK new car market has hit the million sales in the first half of the year for the first time since 2019

Even so, June saw a modest growth of 1.1% in new car registrations, reaching 179,263 units, according to the Society of Motor Manufacturers and Traders (SMMT).

So far in 2024, a total of 1,006,763 new cars have been registered, marking a 6.0% increase from the previous year, though still 20.7% below 2019 levels.

June's market growth was driven by the fleet sector, which saw a 14.2% increase in uptake, while private retail demand continued to decline for the ninth consecutive month, dropping by 15.3%. Private buyers accounted for less than 40% of new car registrations (37.7%).

Electrified vehicle uptake saw strong growth in June. Plug-in hybrid (PHEV) volumes rose by 30.0%, capturing a 9.3% market share, while hybrid electric vehicles (HEV) increased by 27.2%, achieving a 14.9% market share. Battery electric vehicle (BEV) growth was more modest at 7.4%, though it reached its highest monthly share of the year at 19.0% of all new registrations.

Despite this, private BEV uptake has softened, falling by 10.8% year-to-date, with fewer than one in five new BEVs purchased by private buyers. BEVs now comprise 16.6% of the new car market this year, slightly up from 16.1% in the same period last year, but still below government mandates.

Despite this, private BEV uptake has softened, falling by 10.8% year-to-date, with fewer than one in five new BEVs purchased by private buyers. BEVs now comprise 16.6% of the new car market this year, slightly up from 16.1% in the same period last year, but still below government mandates.

As the UK heads to the polls, the automotive industry is urging the next government to support consumers in the transition to zero-emission vehicles. Proposals include halving VAT on BEVs for three years, potentially adding 300,000 private BEVs to the road over the next three years and cutting road transport CO2 emissions by 175 million tonnes by 2035.

Revisions to Vehicle Excise Duty are also suggested, classifying zero-emission vehicles as essential rather than luxury, and reducing VAT on public charge point use from 20% to 5%, aligning it with home charging and supporting wider ZEV adoption.

Mike Hawes, SMMT chief executive, said: "The year’s midpoint sees the new car market in its best state since 2021 – but this belies the bigger challenge ahead. The private consumer market continues to shrink against a difficult economic backdrop, but with the right policies in place, the next government can re-energize the market and deliver a faster, fairer zero-emission transition. All parties are agreed on the need to cut carbon, and replacing older fossil fuel-based technologies with new electrified powertrains is essential to achieving that goal."

June signals a twenty-third month of consecutive growth for the new car market, concluding a positive first half of the year” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT new car registration figures.

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) said: “Although the new electric vehicle market has seen another month of growth, the overall year-to-date market share of electric vehicles remains well below the 22% target stipulated by the Zero-Emission Vehicle Mandate. Private demand continues to lag behind fleet, making it clear that revitalising the private electric vehicle market is a pressing issue that must be addressed immediately.

“Despite the new car market’s resilience, with nearly two years of continuous growth, NFDA urges the next government to avoid complacency. Numerous challenges remain, as detailed in NFDA’s General Election manifesto, including the need to reinvigorate the private electric vehicle market as well as address the ongoing skills shortage.

Commenting, Richard Peberdy, UK head of automotive for KPMG, said: “New car sales are above levels seen this time last year, with fleets continuing to be the driver of growth in the market. The industry has its eyes firmly on the outcome of the election and what that means for automotive policy and attracting continued and further investment over the coming years.

“Increasing new electric vehicle sales is imperative to UK car makers, who are now mandated to ensure that annually increasing percentages of the cars that they manufacture are electric. Increasingly players in the industry are talking about how this is best achieved, including the likes of increased incentives for consumer purchases of new EVs. Incentivising businesses to make new EV purchases has been a key contributor to growing UK EV sales in recent years.”

Ian Plummer, commercial director, Auto Trader, said: "June marked the 8th consecutive month of decline in retail sales - quite a contrast to the months of huge demand we've been tracking in the used car market. With average new car prices rising almost 40% over the last five years, it’s clear cost is the culprit. Manufacturers are responding with discounts but they're failing to keep pace, which is forcing many buyers to opt for a used alternative.

“Whoever forms the next government needs to address electric car affordability and provide long term stability for the market, securing the future of the salary sacrifice and Benefit in Kind schemes is essential as these drive the majority of new electric car uptake and it will be very difficult to scale without these. The market for used EVs is much stronger, which shows drivers are willing to go electric when the price is right.”

Philip Nothard, insight director at Cox Automotive, said: “The SMMT’s latest new market figures continue to paint a generally positive picture overall, but as always, the real story is in the details. Battery electric cars are gaining ground, but their overall adoption remains steady rather than soaring and most registrations stem from fleets rather than private buyers.

"The low proportion of private registrations shows the levels of caution still evident amongst consumers. The industry unanimously calls on the next government to support the automotive sector and consumers with the transition to EV. The critical question now is whether we will see action. We’re otherwise unlikely to see a significant shift in the market performance this year."

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.