While finance houses are continuing to offer payment deferrals due to the second coronavirus lockdown, manufacturer support is back to pre-COVID-19 levels.

According to the latest Q4 statistics from Automotive Services International (ASI), the pricing and offers data analysis company, car manufacturer support has

steadied back to Q1 levels with average deposit contributions at nearly £3,000.

The average monthly price also dropped by 5.3% quarter-on-quarter from £371 to £351 in Q4.

However, finance houses will be feeling the pressure of the second wave as they will now be required to offer further deferrals for customers under financial

pressure from now and potentially into the middle of 2021.

The Financial Conduct Authority (FCA) guidance says that all lenders should offer customers at least a new full three-month payment deferral if they are

experiencing temporary difficulties meeting finance or leasing payments, and that finance companies should not take steps to repossess vehicles or end contracts

during this time.

At the end of the initial three-month payment deferral period, for those requesting help for the first time, if the customer indicates that they still remain in temporary payment difficulties and cannot resume full payments, lenders should offer a full or partial payment deferral to reduce payments for a further period of three months to a level the customer indicates they can afford.

Tashfin Osmani, senior analyst at ASI, told AM: “The FCA can be applauded for speedily announcing new guidance on payment deferrals to help millions of customers. However, this announcement has put finance firms under pressure with the potential for six-month deferrals.

“Given the severe shock of a second lockdown on the economy and the real possibility of increasing unemployment, lenders are worried that some people will try to continue deferring payments and accruing debt to their extreme detriment.”

From the lenders’ point of view, Osmani said the UK Government extension of the furlough scheme until March 2021, raises the prospect that many more customers may have no option but to ask further payment deferrals further down the line, putting put more pressure on the finance firms.

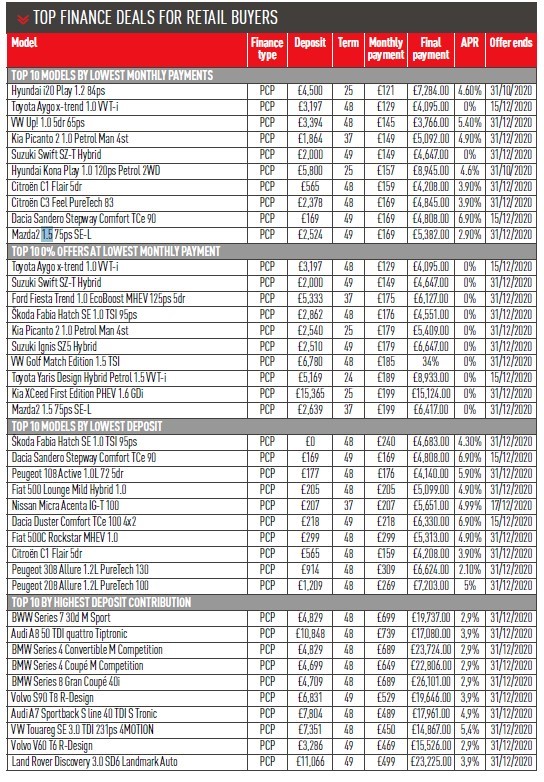

It goes without saying that the more expensive the model, the more scope there is for discounting and it’s clear that some premium manufacturers are offering big cuts to move metal in Q4. BMW and Audi are offering big deposit support running in the tens of thousands on some of its more niche premium models, while Volvo and Land Rover are also offering discounts of more than £7,000 on the V60 and Discovery.

Even when looking at the more affordable end of the spectrum, there are still strong discounts available with £3,000 off a Citroën C1, £2,500 off a C3 and £1,750 off a Hyundai Kona.

According to ASI’s data, the Hyundai i20 takes the prize as the most affordable model in Q4 by lowest monthly payment at £121 and the Toyota Aygo is close

behind with a 0% deal at £129 a month. The Škoda Fabia was the only model in ASI’s data that is available with no deposit in Q4, while the majority of the lowest deposit models can all be accessed for less than £300.

Login to comment

Comments

No comments have been made yet.