A US-based start-up called Fair is rolling out a used car finance app that connects customers with dealers’ approved used car stock online and is looking at launching in the UK next year.

The Fair app gives customers access to approved-used cars from their phone that can be returned whenever they like as customers are not locked in to a long-term finance deal.

The offer sits somewhere in between a loan, a lease and a rental and Fair guarantees its monthly price can’t be beaten by a comparable rival finance offer or lease.

The company has signed up over 300 dealers in the US after launching in autumn 2017 and is planning to be nationwide by Q3 this year before launching in Europe next year with the UK one of its priority launch markets.

Georg Bauer, Fair's president - a former BMW Group chief executive of global financial services and a director at Tesla - said the global automotive retail industry is still waiting for that Netflix moment.

Unlike a traditional lease, when a customer signs for a car Fair buys it from the dealer as a tax-exempt retail sale and pays the dealer on the same day. Similar to a lease, the customer is registered to the car and added to the title as lessee.

Bauer, the co-founder and president at Fair, said: “The car has always been the star since its invention. It’s always been about production and engineering, but where has the customer been in all this?

“What we are proposing is a dramatic change. There have been incremental improvements in the car buying process since the 1980s, but I think we’re still waiting for that really disruptive moment to come. That Netflix or Spotify moment.”

Fair customers choose cars from what they can afford by monthly payment; make a one off “start payment” and then pick up their car with a dealer handover at whichever showroom happens to stock the vehicle they have chosen.

The entire process is paperless, with digital signing technology through smart devices.

All used cars come with extended warranty, roadside assistance and routine maintenance (oil change, filter change, tyre rotations and safety inspections) included in the price. Fair can also arrange insurance for an optional fee.

Bauer said: “Customers are going into debt, all for a depreciating asset. It’s not sustainable and it’s not meeting the needs of customer.”

Bauer said he’s not “dealer-bashing” and acknowledges his past working for vehicle manufacturers. However, he said: “Manufacturers and dealers have to look at how consumer behaviour is changing. We’re not anti-dealer, we’re collaborating with dealers.”

Dealers do not currently have to pay a fee to stock their used car feeds through the app. It is also offering one-day business funding on every transaction.

Bauer told AM: “We’re ambitious and the model is scalable. The UK used car market is mature but there’s nothing like what we’re doing right now.”

After Fair buys the used car from the dealer, it earns a margin on the finance customers are paying on the car.

With the Financial Conduct Authority (FCA) looking closely at affordability in the automotive finance industry an app that gives customers instant access to a vehicle through their phone may ring alarm bells.

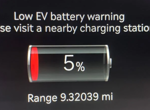

Bauer said: “As there is no minimum term it means customers can hand a car back if their ability to pay changes.

“They’re not locked in, so I think that affordability question might be a bit different for us. We don’t have that classic kind of situation where customers are defaulting on payments compared to what might happen when someone is locked in to a 48 month finance offer.”

Login to comment

Comments

No comments have been made yet.