Dealers are being warned that claims made through self-funded warranties could well exceed the any funds set aside.

WSG reviewed over 50 admin schemes it manages for dealers and found that nearly a quarter (22%) lacked adequate funds to cover claims over a 12-month period based on their average claim rates and amounts – which could mean severe cash flow issues if their self-funded pools are insufficient to cover annual warranty claims.

Some dealers will need to replenish their claim funds within the next year, in some instances by as much as £20,000, to meet obligations.

Dealers are being warned that claims made through self-funded warranties could well exceed the any funds set aside.

WSG reviewed over 50 admin schemes it manages for dealers and found that nearly a quarter (22%) lacked adequate funds to cover claims over a 12-month period based on their average claim rates and amounts – which could mean severe cash flow issues if their self-funded pools are insufficient to cover annual warranty claims.

Some dealers will need to replenish their claim funds within the next year, in some instances by as much as £20,000, to meet obligations.

John Colinswood, CEO of WSG, said that while self-funded schemes appear to offer significant savings on warranty costs, its research indicates that the reality can be quite different.

“The funds we examined include a diverse range of dealers from small independents to multi-site franchises. The findings reveal that many dealers will face considerable shortfalls in their claim funds in the coming months, a problem exacerbated by the increased cost of warranty claims over the last year due to global parts shortages and rising labour rates.

“In such cases, a stream of claims—or even a single large claim—can quickly deplete any chassis profit the dealer has made. It’s a substantial financial risk that they have little control over and can seriously impact cash flow.”

The data also revealed that the average claim under these schemes was £559.78, which is £87 higher than WSG’s national average of £472.12 under its dealer warranty programmes.

Additionally, nearly a quarter (24.32%) of all claims were made within the first 30 days, with almost 10% (9.31%) occurring within the first 10 days, likely due to inadequate pre-sale vehicle preparation.

Colinswood continued: “The cost analysis of admin schemes can be limited due to insufficient statistical data, especially if dealers aren’t capturing detailed cost breakdowns of each claim or the division of their fund. This supports the notion of ‘running with an open checkbook.’

“Without visibility into key data, dealers often have little understanding of how their scheme is performing or what it will ultimately cost.”

Colinswood added: “Using a reputable warranty provider instead of an admin scheme transfers the risk, significantly reducing the chance of large warranty claims consuming profits and impacting cash flow.

“Moreover, if a retailer upsells to longer terms, they could reduce their warranty costs or, depending on the success of their upselling strategy, eliminate them entirely.

“In addition, they can even create a healthy profit. Many of our dealers have been able to grow their profit per vehicle by as much as 25% through upselling.”

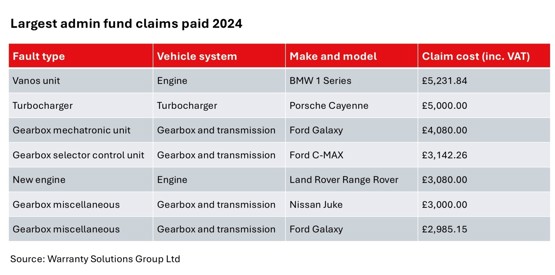

The table below shows the seven largest admin fund claims managed by WSG during the first quarter of 2024.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.