Cox Automotive is restating its "optimistically realistic" outlook for the used car market in 2024, warning against assuming that first-half continue to the year-end.

The company's latest Insight Quarterly report presents a revised forecast, predicting a modest slowdown in the third and fourth quarters, driven by a combination of factors that are expected to dampen both wholesale supply and consumer demand.

Despite the anticipated deceleration, Cox Automotive's updated forecast projects a slight increase in the total number of transactions for the year.

Cox Automotive is restating its "optimistically realistic" outlook for the used car market in 2024, warning against assuming that first-half continue to the year-end.

The company's latest Insight Quarterly report presents a revised forecast, predicting a modest slowdown in the third and fourth quarters, driven by a combination of factors that are expected to dampen both wholesale supply and consumer demand.

Despite the anticipated deceleration, Cox Automotive's updated forecast projects a slight increase in the total number of transactions for the year.

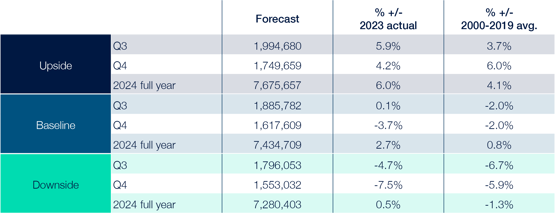

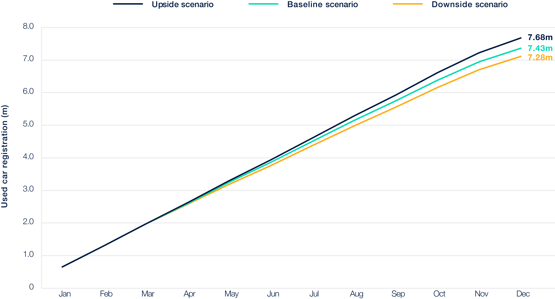

The company now expects 7,434,709 transactions to be completed by year-end, marginally higher than its previous forecast.

This figure represents a 1.2% increase from its earlier projection, a 2.7% rise compared to 2023's total transactions, and a 0.8% uptick from the 2001-2019 average.

The forecast breaks down to 1,885,782 transactions in Q3, followed by a decrease to 1,617,609 in Q4.

Philip Nothard, insight director at Cox Automotive, noted that the revised forecast reflects strong performance in the first two quarters, but cautioned that several challenges could impact the market in the latter half of the year.

"While the used market showed remarkable resilience in the first half, we expect a cooling in volume as supply tightens, competition in the new car market intensifies, and consumer confidence remains low," Nothard said. "Our baseline forecast for the full year remains the most likely scenario."

Nothard identified several key factors that will shape the used car market through the end of 2024 and into 2025.

These include the rapid changes in the new car market, particularly the declining availability of in-demand internal combustion engine (ICE) vehicles, the volatility in electric vehicle (EV) values, and consumer sensitivity to rising prices.

"We must keep an eye on the new car market, which is currently experiencing significant volatility," Nothard explained.

Nothard also highlighted the ongoing impact of the 3.1 million "lost" registrations from 2020-2023, vehicles that would typically be replenishing dealer inventories now. "The absence of these vehicles is palpable, and securing a steady supply of in-demand models remains a significant challenge for dealers," he added.

Despite these headwinds, Nothard expressed confidence in the resilience of the used car sector. "The automotive industry is known for its ability to navigate challenges, and the used market is no different. While we anticipate significant hurdles in the second half of 2024 and into 2025, the continued demand for used vehicles suggests there are still opportunities for profit."

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.