The first NFDA survey of consumer attitudes following the introduction of the Zero Emissions Vehicle (ZEV) Mandate in January has revealed that cost remains the primary barrier to buying an electric vehicle (EV).

NFDA’s annual Consumer Attitude Survey (CAS) provides a snapshot of public perceptions of franchised dealers as well as understanding consumer behaviour.

NFDA commissioned JudgeService which conducted a representative sample of 1,500 motorists on a variety of topics ranging from electric vehicles to dealer satisfaction between 31 May and 5 June.

The first NFDA survey of consumer attitudes following the introduction of the Zero Emissions Vehicle (ZEV) Mandate in January has revealed that cost remains the primary barrier to buying an electric vehicle (EV).

NFDA’s annual Consumer Attitude Survey (CAS) provides a snapshot of public perceptions of franchised dealers as well as understanding consumer behaviour.

NFDA commissioned JudgeService which conducted a representative sample of 1,500 motorists on a variety of topics ranging from electric vehicles to dealer satisfaction between 31 May and 5 June.

In the context of the country's shift towards electric vehicles following the implementation of the ZEV mandate which stipulates that 22% of new car sales must be zero-emission or face penalties, consumers were asked, “why wouldn’t you consider an electric vehicle?”

Cost remains the primary barrier to EV adoption, cited by 55% of respondents who put ‘too expensive’, followed by ‘concern about the battery life’ (43%). ‘concern about the vehicle range’

‘Concern about the charging infrastructure’ was cited by 40% of consumers. Additionally, 21% expressed ‘concerns over various EV issues reported in the media’, while 9% said they would wait due to the Government pushing back the phase-out date on the sale of non-electric vehicles.

NFDA which represents franchised car and commercial vehicle retailers across the UK, said it had repeatedly lobbied the Government on many of these issues affecting consumers, insisting cleaner, greener vehicle types must become more accessible to the less well-off.

When compared to the 2023 edition of the CAS, this year’s edition however does show a slight drop in anxieties surrounding cost and charging infrastructure, showing there has been some progress in this respect.

The NFDA said that, interestingly, when examining this metric and dividing it into different categories, various stories emerge, including:

Age: In the 17-25 age group, 81% selected 'yes’ whilst the 76+ age group saw 45% respond ‘yes’. Since the 2023 CAS, interest in electric vehicles has steadily grown across all age groups.

Region: London, with 76% responding ‘yes’, has the highest proportion of consumers willing to consider an electric vehicle, followed by the West Midlands (71%) and the North-West (67%). The regions with the lowest proportion are the West Country, with 50% responding ‘yes’, and North-East & Cumbria (52%).

Gender: A marginally higher proportion of males (63%) would consider an electric vehicle compared to females (61%).

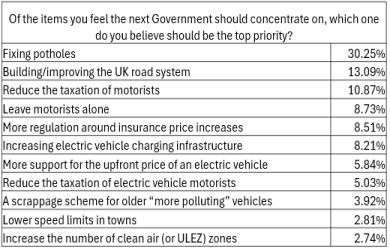

In the run-up to the recent General Election, respondents were also quizzed about the key areas they think the new government should prioritise.

‘Fixing potholes’ (30%) is the priority issue for the new government with respondents asked ‘of the items you feel the next Government should concentrate on, which one do you believe should be the top priority?’

The CAS also revealed that 92% of respondents are satisfied with franchised dealers.

A ‘franchised dealer’ was by far the most popular retailer type from which respondents purchased their current vehicle (694 respondents or 46%) - more than double the number who purchased from the second most common choice, an ‘independent dealer’ (22%).

Overall satisfaction with franchised dealers was high, with 92% of respondents selecting either ‘very satisfied’ or ‘fairly satisfied’.

Sue Robinson, chief executive of NFDA, said: "It is positive to see that overall satisfaction with franchised dealers remains high and that many consumers rely on the trusted expertise and knowledge of dealerships when purchasing their vehicles. It is also important to note that many younger consumers are utilising online channels highlighting the evolving landscape of our sector and how dealerships are effectively adapting to this transition.

“With the Zero Emissions Vehicle mandate having come into law earlier this year, it is concerning that cost remains the primary barrier to electric vehicle adoption. NFDA has repeatedly urged government, including the new government, to introduce price incentives to address this issue and restimulate private demand. Through our Consumer Attitude Survey, consumers across the UK have also clearly indicated the issues they want the new government to address.

“NFDA’s 2024 CAS has given a unique perspective into consumer behaviour and their interactions with dealerships and competitors. NFDA members, as the front-facing end of the industry, remain at the forefront, investing heavily during the transition to electric and providing consumers with experienced guidance and information, through schemes such as NFDA’s successful Electric Vehicle Approved Scheme.”

Neil Addley, founder and managing director of JudgeService, also commented: “It is good to see the resilience of UK consumers and worth noting the steady improvement in consumer consideration of electric vehicles. It will be interesting to track how this attitude changes as more people are exposed to BEVs in everyday life.”

Key Points From The Survey

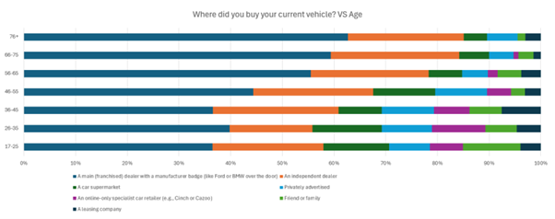

Where Did You Buy Your Current Vehicle?

Among the 1,500 motorists surveyed:

694 (46%) selected a ‘main (franchised) dealer’

329 (22%) selected an ‘independent dealer’.

142 (9%) selected a ‘car supermarket’.

120 (8%) selected ‘privately advertised’.

When breaking this down by age, a distinct divide appears between younger and older respondents. In the youngest age brackets of 17-25, 26-35, and 36-45, fewer than 40% of respondents cited a ‘main (franchised) dealer’. In contrast, between 50-60% of respondents in the age groups of 56-65 and 66-75 purchased from a ‘main (franchised) dealer’, while 63% of those aged 76+ did the same.

Interestingly, a ‘main (franchised) dealer’ was the most popular choice for all powertrains but this retail type was considerably higher for ‘battery electric vehicles’ (BEVs). 68% of respondents who purchased a BEV did so from a ‘main (franchised) dealer’, a considerably higher proportion than ‘petrol’ (47%). Dealerships were also the preferred choice for hybrid vehicles, with 67% of consumers utilising dealers for 'mild hybrid (MHEV)'. 62% of consumers looking to purchase a ‘self-charging hybrid’ did so from a dealer and 59% for a ‘plug-in hybrid (PHEV)’.

The CAS illustrates that franchised dealerships play a pivotal role for consumers during the transition to electric, providing trusted expertise and knowledge on this evolving technology as well as with hybrids. ‘Independent dealers’ followed through in second in most powertrains apart from in ‘MHEV’, ‘self-charging hybrids’ and BEVs where ‘car supermarket’ scored 14%, 8% and 11% respectively.

Why Not a Franchised Dealer?

When respondents were asked why they chose an alternative to a ‘main (franchised) dealer’ for their current vehicle, cost was a significant factor with 56% citing ‘the main dealer was too expensive to buy a car and to save money’. This was followed by ‘the alternative had the vehicle I was looking for’ (20%) and ‘I trust the person I am buying from’ (13%).

Looking at age, among those in the 17-25 age bracket, 76% noted cost, compared to 42% in the 56-65 bracket and 38% in the 76+ bracket. While cost was the primary consideration when choosing alternatives to a ‘main (franchised) dealer’ across all age groups, its influence decreased with age.

Customer Satisfaction

Overall satisfaction with the ‘main (franchised) dealer’ was exceptionally high with 59% of respondents selecting ‘very satisfied’ and 33% ‘fairly satisfied’ – totalling 92% citing either option.

Additionally:

‘Customer service in sales’ – (55% scored ‘very satisfied’ and 34% scored 'fairly satisfied’).

‘Deal offered by the main dealer’ (37% scored ‘very satisfied’ and 43% scored ‘fairly satisfied’.

Satisfaction with franchised dealers is significantly higher than last year’s edition of the CAS. Whilst it is positive to see many consumers were ‘very satisfied’ in overall satisfaction with their main franchised dealer, there is certainly some room for improvement in the deals offered.

What Do You Expect From a Franchised Dealer?

Consumers were also asked, “Even if you have never bought from a main (franchised) dealer, what would you expect from one?” Similarly to the 2023 CAS, good customer service remains one of the greatest expectations of consumers as well as test driving capabilities.

‘Good customer service’ was cited by 67% of respondents, followed by the availability of ‘vehicles for test drives’ (59%) and the ‘latest vehicle models’ (47%) as the top three expectations.

Why Choose a Main Dealer?

Conversely, when consumers were asked ‘Why would you choose a main dealer’, the question was divided into two segments: one addressing ‘if you were looking for an EV’ and the other ‘if you were looking for a petrol or diesel vehicle’.

Positively, 24% of those looking for an EV, selected ‘the dealer is NFDA Electric Vehicle Approved (EVA) demonstrating its growing importance during the transition to electric.

‘Warranty’ was the most popular option for both consumers of electric and petrol/diesel. A positive sign for dealers frequently offering generous warranty schemes to consumers.

Government Priorities

With the General Election having been called for 4 July, NFDA included a section that asked questions on various issues during the buildup to the General Election, collecting responses throughout June.

Respondents were asked – ‘Of the items you feel the next Government should concentrate on, which one do you believe should be the top priority?’

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.