The European Commission will impose additional tariffs of between 17.4% to 38.1% on electric cars produced in China.

The move follows preliminary findings from its anti-subsidy investigation which confirmed its suspicions that Chinese state support is distorting prices.

Now UK auto industry observers will watch to see if the UK takes similar steps.

The European Commission will impose additional tariffs of between 17.4% to 38.1% on electric cars produced in China.

The move follows preliminary findings from its anti-subsidy investigation which confirmed its suspicions that Chinese state support is distorting prices.

Now UK auto industry observers will watch to see if the UK takes similar steps.

"The value chain of Chinese electric cars benefits from unfair subsidisation, which poses a threat of economic injury to EU battery electric vehicle producers," stated EU Commission vice-president Margaritis Schinas, announding the tariff plan.

"When our partners breach the rules, we will assert our rights," added executive vice-president Valdis Dombrovskis who said the anti-subsidy investigation is based on clear evidence under the global system of trade rules.

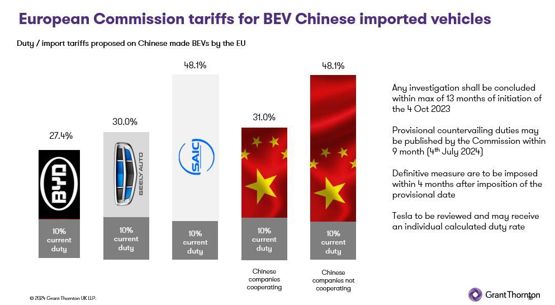

The duties will vary by car maker with Chinese state-owned manufacturer SAIC - which owns the MG Motor and Maxus brands, among others - facing the highest level of additional duty at 38.1%, Geely at 20%, and BYD at 17.4%.

Other manufacturers who cooperated but were not sampled, which includes most, will be subject to an additional 21% surcharge, and the remaining who did not cooperate will face an extra 38.1%.

Western brands producing electric cars in China, such as Tesla, Dacia, and BMW, will face a 21% duty.

Although these EU tariffs are set to be formally imposed on 4 July, the announcement remains preliminary. "We will now engage with Chinese authorities and all parties to finalise this investigation," said Dombrovskis.

Negotiations with China could potentially alter or even scrap theses tariff rates before a final decision in November which will be subject to a vote by the European Council, requiring a qualified majority of at least 15 countries representing 65% of the total population.

The investigation arose from suspicions that China was flooding the EU with cheaper EVs due to overcapacity and reduced domestic demand.

European Commission president Ursula von der Leyen last month said that "the world cannot absorb China’s surplus production." declaring that the EU would steadfastly protect its industries and jobs.

The Rhodium Group consultancy tells AM that it had expected the commission to impose duties in the 15-30% range but noted that even at the higher end of this range, some China-based producers would still be able to generate comfortable profit margins on the cars they export to Europe because of their substantial cost advantages.

“Duties in the 40-50% range - arguably even higher for vertically integrated manufacturers like BYD - would probably be necessary to make the European market unattractive for Chinese EV exporters,” it said.

Owen Edwards, an automotive industry expert at Grant Thornton, agreed, questioning whether EC tariffs significantly lower than this would be effective: “Will this be enough or is it half measures? “ he asked.

However, he noted the impact on Tesla and said the US carmaker’s owner Elon Musk could potentially cut the price of a Tesla further to ensure that he is in line or below the market.

“He needs to maintain market share and growth for his share price and salary and this could cause a price war in Europe if we are not careful,” he said.

China has long maintained that it does not subsidise its automotive sector and that its exports help Western countries meet their environmental targets. Western governments meanwhile argue that China could easily adjust its strategy, absorb tariffs and compete fairly.

Auto Trader has branded the EU's decision "disappointing" and the UK's biggest car sales marketplace fears it might give a green light to the UK following suit.

Ian Plummer, commercial director of Auto Trader, said: “The European Union’s decision to impose tariffs on Chinese electric vehicles is disappointing, and we hope the UK isn’t tempted to take similar action.

“UK drivers already face a lack of affordable choices when it comes to electric cars, so it doesn’t make sense for us to limit those options even further for consumers. We need to bring more buyers into the market by cutting down the "green premium" which means EVs are usually 35% more expensive than diesel or petrol cars. We'll only do that with open competition to foster innovation, not by reducing choice for consumers."

Chinese brands such as BYD, Omoda and Skywell are beginning sales in the UK through franchised dealer networks.

He added: “Chinese entrants are already partnering with UK retailers to deliver a quality, affordable product and they will have an important role to play in the UK’s ongoing transition to electric vehicles.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.