The Auto Trader summer briefing provided a comprehensive analysis of the electric vehicle (EV) market, underlining the critical role of affordability and strategic discounting in shaping consumer behaviour.

Affordability will remain a serious barrier, however, despite manoeuvring by EV manufacturers in their quest for greater market share.

Auto Trader’s leadership team highlighted these aspects in detail, offering a deep dive into the current dynamics influencing the EV market.

The Auto Trader summer briefing provided a comprehensive analysis of the electric vehicle (EV) market, underlining the critical role of affordability and strategic discounting in shaping consumer behaviour.

Affordability will remain a serious barrier, however, despite manoeuvring by EV manufacturers in their quest for greater market share.

Auto Trader’s leadership team highlighted these aspects in detail, offering a deep dive into the current dynamics influencing the EV market.

Marc Palmer, the online marketplace’s head of strategy and insights, provided a perspective on the fluctuating interest level in EVs so far this year:

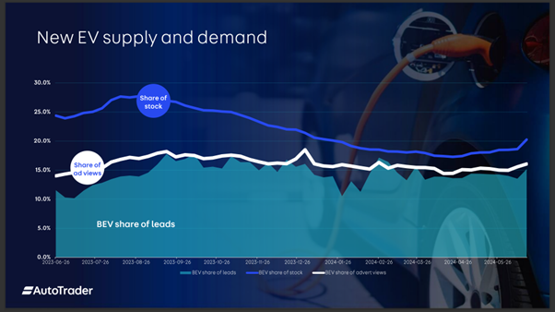

"The share of new electric cars advertised for sale on Auto Trader picked up at 28% only to go down through the early part of the year. Now, however, it's creeping up again."

For context, he pointed out that in the summer of 2022, leads on Auto Trader were riding high at 25% meaning one in four inquiries for a new car was for an electric model.

External factors such as petrol prices were significantly impacting consumer interest in EVs at this point.

“It was pretty much all about costs as the price per litre at the pumps was nearly £2. When prices of petrol go up, so does interest in electric cars and we saw that drop off quite rapidly under the mini-budget and suddenly electric cars became more expensive."

"In February this year, we saw petrol prices stabilise at about £1.50-£1.60 a litre and consequently, interest in new electric cars was quite flat. It does blip at the end of February and into early March and that was driven by a couple of manufacturers who were heavily discounting.”

“What we deduce from this data is that when manufacturers apply discounts, then interest goes up. It is really sensitive to price more than anything else in the market."

In addition to wresting market share from competitors, Palmer also noted manufacturers' strategies to achieve targets under the ZEV mandate,

"We saw Honda go very early with a retail offer in March and we've seen some manufacturers dip their toe in with tactical offers and, anecdotally, we're hearing that other sales channels are being used to reach volume.

“Registrations of electric cars within Motability have gone up hugely, which is good news for that organisation and potentially for their drivers."

However, he warned that there were complexities and costs involved in such strategies. "It's not yet necessarily in the interest of OEMs to spend money on the retail channel to stimulate the market when there are fiscal benefits that help them get to the price points that can make it attractive for users to buy those cars, even if they have good discounts on a Motability car and into rental companies and so on.

“Separating markets for the moment works for manufacturers, but they will now need to be pushing harder into the retail market."

Ian Plummer, Auto Trader commercial director, also addressed the long-term implications and strategies for manufacturers who have to meet 22% of EV sales in their overall mix by the end of this year.

"Bear in mind the weighting of the CO2 benefit that manufacturers can include in their ZEV calculation reduces over time so next year it is going to get that much harder for everybody. People have talked about brands potentially reducing their ICE production although it's very hard to imagine brands turning off the tap of delivering vehicles into the UK.

“To do that there would have to be an assumption that they can divert product products into France, Germany, Italy, but we are the second biggest car market in Europe and we're on the verge of probably being the biggest EV market in Europe - not in terms of penetration percentages, but in terms of volume of sales.

“Brands need to sell their cars whether they're ICE or EVs and they can't just turn that tap off their production facilities and people - so it's going to be a costly shift. Even so, they certainly don't want to pay fines, but they're probably even more loathe to pay money to a competitor, so I think we're likely to see more tactical activity."

Plummer here underscored the gap between consumer desire and actual purchasing behaviour driven by affordability issues.

"43% of people say they want to make their next choice of car an electric one. But clearly, we aren't looking at 43% of people who actually will buy an EV because too many of them are seeing that there's an affordability gap between the desire and the ability to translate that desire into actual intent.

“When a brand makes a key move and particularly one like the Honda eny1 offer that went from more than £400 a month down to £200 a month, that shows really that people would like to buy electric vehicles when they're more affordable."

Plummer stressed the need for broader affordability measures: "In the pure retail market, the share has been stuck at around 16% for the last couple of years so it needs an affordability boost and not by specific products but across the broad market."

He conceded however that manufacturers would struggle to provide this boost, faced as they were by the need to balance any siginificant consumer price push with their baked-in production costs. Plummer also noted the challenges related to the price gap between new and used EVs, noting "The industry often thinks the new car market works in isolation to the rest of the world. In many cases when people are looking at a new volume EV but for the same price, they could be looking at a two year old premium EV.

Plummer also noted the challenges related to the price gap between new and used EVs, noting "The industry often thinks the new car market works in isolation to the rest of the world. In many cases when people are looking at a new volume EV but for the same price, they could be looking at a two year old premium EV.

"That's the kind of equation people are making but that's not going to help anybody sell more EVs because of the pricing issue we've got. 31% is the current price gap between an ICE and an EV even on an equivalent basis."

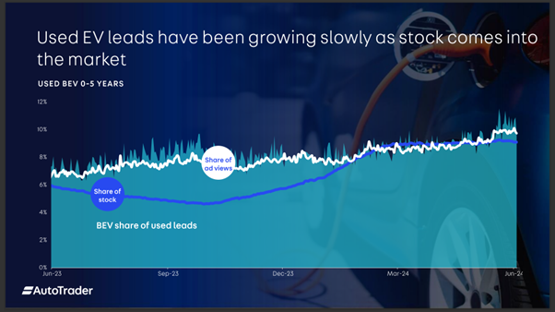

He noted that the retail used car market last year grew 5% and that so far this year Auto Trader data indicated 9% growth.

“The new car market is simplistically around 2 million - half of which is retail. The used market is around 8 million so there's a pricing issue that OEMs will have to look at if they're looking to drive the market.”

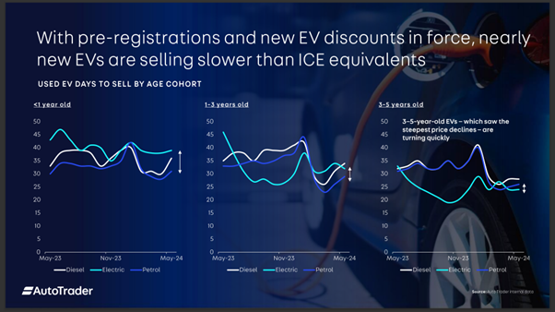

Depreciation on new EVs is also problematic. On a 36-month 30,000 miles comparison basis EVs depreciate very quickly in the first year compared to an ICE equivalent, although this narrows siginifcantly by the time it is two years old.

“Depreciation is very high,” he said, adding, “and the problem really is that the start point of the depreciation curve is too high.”

Plummer also pointed out that oversupply issues are affecting the speed of nearly new EV sales in particular which is a key issue for many dealerships. Further, it was not an issue that looked to resolve as new supply is currently exceeding demand.

"For cars under one, we're seeing electric are now 10-12 days slower to sell than petrol. And the reason for that is because there's oversupply," he said, adding that this was the knock-on effect of greater pre-registration by manufacturers in order to hit their numbers sround the year-end combined with pricing strategies.

"Speed of sale is the biggest single determinant of your return on investment,” he noted. “Fundamentally, if you turn an asset that you're buying in quickly and efficiently, then you will have an efficient and profitable business."

"Speed of sale is the biggest single determinant of your return on investment,” he noted. “Fundamentally, if you turn an asset that you're buying in quickly and efficiently, then you will have an efficient and profitable business."

"Those vehicles have been some form of short cycle business done by a manufacturer and their retail partners. That could mean the retailer taking the vehicle as a demonstrator into their own fleets or it could mean that the manufacturer has done some rental business, which is usually a six-month cycle. Alternatively, they could be their own management cars which they then remarket within their networks.

“In these cases, prices are not being realigned sufficiently competitively or aggressively in order to get to a price parity point with their ICE equivalents in order to stand out from the new EV that is being advertised and compared to these products.

“That is a looming problem. Those vehicles, because they're staying in stocks longer, will end up becoming further discounted to get to the point where they do sell better, because retailers can't hold them for very long."

Palmer added: "In the past it was a bit of horse trading where the retailer used their instinct and would know that if they took 25 Corsas they would be gone in a month or two months. Now if they take 25 Corsa Electrics, they need to know what price do they need to be at before they go in three months."

In terms of EV manufacturer sales strategies going forwards, Palmer noted that will likely become more visible soon: "It's been interesting especially in 2024 so far because even if we look at this by brand, you can see the volatility and performance as they start to do certain things in the market.

“What will the picture look like by September if a manufacturer is looking to try and achieve their share of their sales as BEV? By the last quarter, they'll know what the job is to be done.

“At the moment, we're seeing a slight uptick but we're seeing nothing fundamental. So I would imagine that the private sale share of BEVs will be about the same in July, August, September as it is at the moment. What we'll start to see however is the manufacturers starting to put their foot down on discounts through Q3."

Richard Walker, data and insights director at Auto Trader, remarked on the speed that the impact of such discounting has on consumer behaviour in the EV market: "It's instantaneous. When those offers come, it's literally the next day and people will switch brands quite happily."

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.