An influential environmental group is urging the government to strengthen its commitment to its zero emissions goals by focusing financial support on small and affordable EV models to ensure all segments of society get to benefit.

T&E advocates for government incentives to target small- to medium-sized EVs priced at £30,000 or less which fall into the A, B, and C segments.

The group argues that prioritising affordability of these segments - which are only now scaling up in production - would expand access to EVs for middle- and lower-income households.

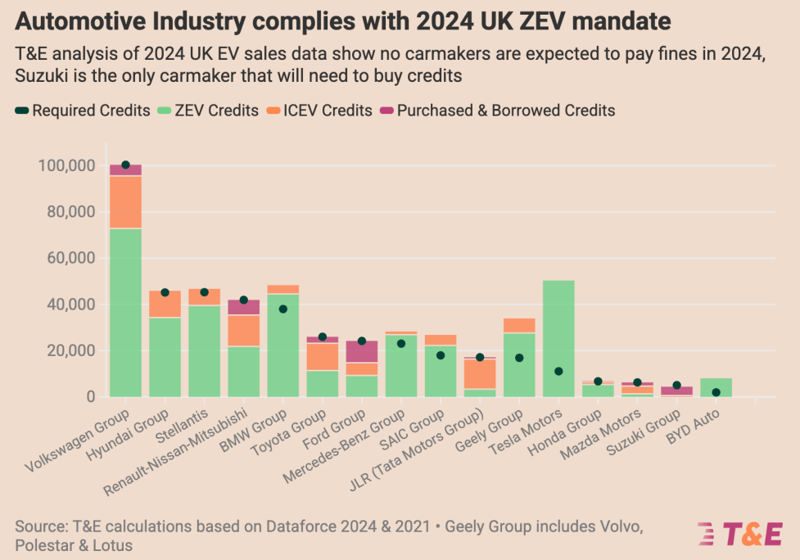

“Ford, which has a long-standing reputation of selling affordable, smaller cars such as the popular Ford Fiesta now has a significant gap ZEV credits - which needs to be made up by borrowing or purchasing - have focused their electric offering on the premium market,” it noted.

“All three Ford EV models available in the UK at the end of 2024 cost at least £40,000 all were premium, large SUVs. This year Ford is bringing the Puma Gen-E to the market in 2025, costing around £30,000 as the carmaker pivots to more affordable options for 2025 ZEV compliance.”

T&E forecasts that in 2026 Ford will have an excess of credits and based on production forecasts and will comply with the ZEV mandate due to increased EV sales through fielding a wider range of models.

It said that between 2024-2027, the ZEV mandate is expected to bring over a dozen new EV models priced at £23,000 or less to the UK market.

Some models in this price bracket are already available such as the Dacia Spring priced at £14,995 and the Citroen e-C3 priced from £21,990.

“To ensure these affordable models arrive, at volume, on the market as planned, keeping the ZEV mandate unchanged is key. Any weakening will give car makers the signal to prioritise affordable volumes to markets with strong regulation - hurting UK consumers access to cheaper EVs,” it said.

The T&E recommends capping incentives available on EVs at sub-£30,000 models to ensure that lower-income families can benefit in addition to the launch of a social leasing scheme to provide government-backed affordable EV leases for low-income, car-dependent families.

Car manufacturers insists that they have "pulled every lever" to try and achieve the 2024 target, with discounting totalling more than £4.5 billion in 2024, an amount that, Mikes, chief executive of the SMMT siad is not sustainable in the long term.

"Billions of pounds of investment in new technologies and products over the past decade have delivered a record 132 ZEV models to the UK market, up 38% since 2023 to account for a third of all models available, with an average range of almost 280 miles – more than two weeks’ of driving for most people."

T&E also warned that any weakening of the ZEV mandate could have serious consequences, insisting that reduced ambition could limit consumer access to affordable EVs, as manufacturers might prioritise supplying cheaper models to markets with stronger regulations.

Further, a dilution of the mandate could jeopardise the £23 billion in EV investments committed to the UK between 2020-2023 and the £6 billion pledged for charging infrastructure by 2030, undermining the UK’s credibility as an investment destination for clean technology.

Login to comment

Comments

No comments have been made yet.