The European Automobile Manufacturers' Association (ACEA) has shifted its stance, no longer pushing for a two-year delay in the EU's 2025 CO2 reduction targets.

Instead, ACEA is now calling on the European Union (EU) to take urgent action to address the growing challenges in meeting these targets, as the market share for battery electric vehicles (BEVs) continues to decline across the bloc.

The association highlights that the industry is facing substantial risks, including potential billion-euro fines, production cuts, job losses, and a weakened supply chain if the 15% CO2 reduction target, set for 2025, cannot be achieved.

Recent EU car registration data shows that the market for BEVs continues to shrink, signalling that the transition to zero-emission vehicles is facing major obstacles.

ACEA points out that while European car makers have invested heavily in electrification, key factors needed to support this transition - such as sufficient charging infrastructure, hydrogen refuelling stations, affordable green energy, and secure supply chains for raw materials - are still missing.

Consumer acceptance and trust in the necessary infrastructure also remain low.

The organisation expresses concern over the EU automotive industry’s declining competitiveness, exacerbated by recent geopolitical and economic shifts.

ACEA points to the Draghi report which highlights the growing challenges faced by European manufacturers, especially as they face increased competition from other regions.

According to the association, current regulations are ill-equipped to adjust to these new realities, making the 2025 CO2 targets increasingly difficult to meet.

In response, ACEA is calling on the European Commission to bring forward the scheduled reviews of the CO2 regulations for light-duty and heavy-duty vehicles, currently set for 2026 and 2027, to 2025.

This earlier review would allow the industry to recalibrate and address the practical difficulties in meeting the EU’s ambitious decarbonisation goals.

ACEA stresses that delaying these reviews will only further jeopardise the industry's ability to stay competitive and meet the transition deadlines.

ACEA is also pressing for immediate relief measures to help the industry meet the 2025 targets. Without such measures, it said car makers face the possibility of massive fines, which could otherwise be used to invest in the zero-emission transition.

The association warns that failing to act now could result in unnecessary production cuts and job losses, further weakening Europe’s supply and value chains in the face of fierce international competition.

“The industry cannot afford to wait for the review of the CO2 regulations in 2026 and 2027, we need urgent and meaningful action now to reverse the downward trend, restore EU industry competitiveness and reduce strategic vulnerabilities. For heavy-duty vehicles, an earlier review will also be absolutely critical to ensure vital conditions like infrastructure for trucks and buses are scaled up in time,” it said.

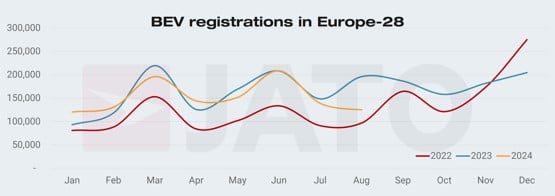

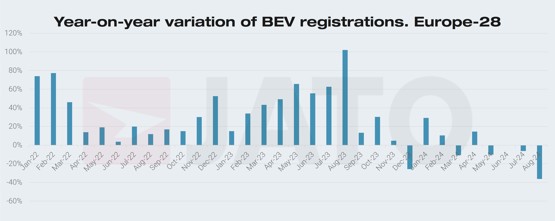

According to JATO Dynamics’ data for 28 European markets, 753,482 new cars were registered in August. This marks a 16% decrease on the 899,881 units registered in the same month last year, and the biggest year-on-year drop since June 2022.

The decline in demand for battery electric vehicles (BEVs) had a significant impact on the performance of the overall market.

A total of 125,070 units were registered in August, marking a 36% fall in year-on-year sales. This is the largest drop the segment has experienced since January 2017, when registrations were first recorded

Due to this performance, the market share of BEVs fell from 21.8% in August 2023 to 16.6% last month.

Login to comment

Comments

No comments have been made yet.