“If you build it, they will come” is a line from the 1989 Kevin Costner movie Field of Dreams.

Essentially, it means that if you create something that everybody needs, they will come to you rather than you having to go to them.

It is apt when considering Northern Ireland’s capacity to meet its decarbonisation targets and many are questioning whether the foundations underpinning that transition are in any way ready.

“If you build it, they will come” is a line from the 1989 Kevin Costner movie Field of Dreams.

Essentially, it means that if you create something that everybody needs, they will come to you rather than you having to go to them.

It is apt when considering Northern Ireland’s capacity to meet its decarbonisation targets and many are questioning whether the foundations underpinning that transition are in any way ready.

According to Northern Ireland Statistics and Research Agency (NISRA), the automotive retail sector employs around 14,000 people including those working in the sale and repair of motor vehicles across the region.

The National Franchised Dealers Association Northern Ireland division (NFDA NI) represents major players such as the Donnelly Group, Agnew Group, and Charles Hurst Group.

The NFDA NI is concerned that without regulatory reform in terms of charging infrastructure Northern Ireland will be hobbled and that automotive businesses employing those 14,000 people will simply decline.

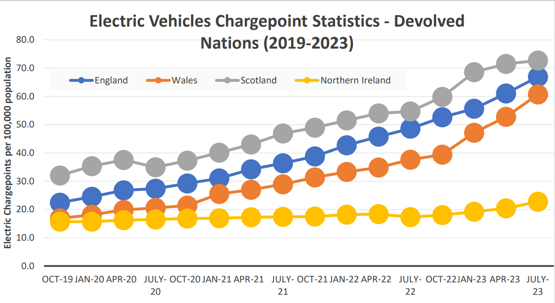

“In terms of chargers per 100,000 population, compared to the other home nations which are on the upward curve, we're pretty much static,” says NFDA NI spokesman Brian Robinson, franchise director at Belfast-based Agnew Group, speaking at the dealership group’s Boucher Rd headquarters in Belfast.

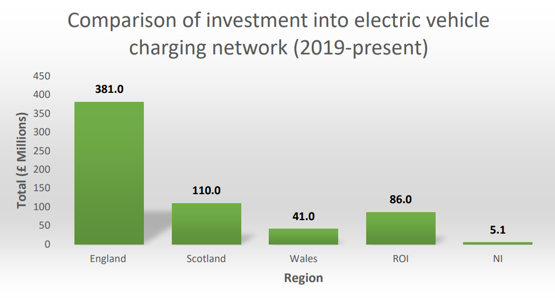

Northern Ireland is simply falling behind the rest of the UK in EV sales and charging infrastructure. Between 2012 and 2020, EV sales registration grew by 52% in NI compared to 88% across the UK. As of 1 April 2024, public charging devices per 100,000 people are also lower in NI (29) than the UK average of 89, with many existing charge points needing upgrades.

With 545 chargers in NI, as of 1 April 2024, which represents less than 1% of the total UK charging infrastructure, the mandated 28% of EV sales from January 2025, could lead to the system coming under severe strain.

“We should be around 2.5% of the population so we're seriously lagging behind,” says Robinson.

The NFDA has lobbied for an urgent overhaul of the electricity system's legislative framework which is vital to support EV uptake and network improvements.

What is needed, it insists, is a shallow connection charging regime to generate investment, and improve grid service and coverage.

A shallow connection charging regime is a way to allocate electricity network charges that socialise more of the costs through use-of-system fees, while keeping connection costs lower. Most countries, including the UK, use a form of shallow connection.

The NFDA says that a negligible levy per person of £3 annually is an acceptable trade-off if Northern Ireland is to not fall further behind in EV adoption and miss its net-zero targets.

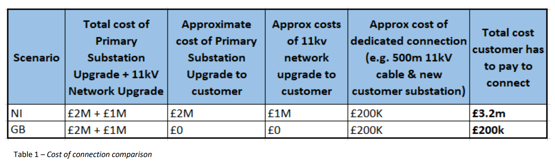

“Whilst there’s definitely been activity to invest in charging points, your current costs will include the supply to the site as well as the above-ground infrastructure,” says Robinson.

Indeed, under the current system, some NFDA members have faced quotes ranging between £50,000 and £200,000, creating a 'first-mover disadvantage' where early investors are simply enabling competitors to exploit the location without bearing any of the costs of improving the grid.

Robinson says that at this stage proposals to introduce the socialisation of that cost are still with the regulator although no change is anticipated in the immediate term.

Northern Ireland, characterised by rural communities and longer drive times, also suffers high connection costs due to the additional infrastructure work involved such as road digging.

Ironically, Robinson points out that Northern Ireland probably had some of the best charging infrastructure of the four nations 10 years ago but has since fallen behind due to the neglect of the infrastructure.

“There was a public-private initiative to get charging on the map and it was successful,” explains Robinson, “but those charge points were handed over to a provider to manage although they were not maintained and developed to the level that was needed.”

ZEV mandate

Critical infrastructure is only one of the agenda items that has been stymied by political instability in Northern Ireland. As a devolved policy, Northern Ireland’s Department for Infrastructure’s (DfI) efforts to launch the ZEV mandate were not resumed until the NI Assembly was restored in February.

“It is a devolved policy for the NI Assembly and whilst there has been some discussion recently, we need clarity and direction from government to build the necessary confidence required to support this change,“ says Robinson who points out that the industry’s shift to zero-emissions represents of the biggest transformations ever faced by the automotive industry.

On 22 May, Stormont’s Committee for Infrastructure held sessions which included discussions from DfI officials on the potential implementation of the ZEV mandate – three hours later the General Election was announced and so the item was put on ice.

The ZEV mandate has already launched in England, Wales and Scotland in January 2024. The intention of the DfI remains that Northern Ireland will join the mandate when the NI Assembly can pass the required legislation. “In the interim, Northern Ireland will retain an appropriately scaled version of the existing CO2 emissions regulation for new cars and vans,” it says.

The ZEV mandate has already launched in England, Wales and Scotland in January 2024. The intention of the DfI remains that Northern Ireland will join the mandate when the NI Assembly can pass the required legislation. “In the interim, Northern Ireland will retain an appropriately scaled version of the existing CO2 emissions regulation for new cars and vans,” it says.

“We were expecting that once the Assembly reconvened the mandate was going to be on the agenda quite early on. The mood music was that it was going to be passed and would come into play at the start of the year rather than midway through,” says Robinson.

The ZEV mandate will require manufacturers to sell an increased EV percentage of 28% in terms of their new car sale mix from 2025 although uncertainty remains over whether that 28% is a single ZEV target for the United Kingdom or whether it is regional.

“We don’t know whether we will form part of a 28% number or will NI land on 24% and Scotland on 27% with England achieving 33% before being averaged out?” he says.

“The responsibility sits with the manufacturer to hit the big number. If the manufacturer is not performing, that is when we as dealerships will feel the pleasure or pain. The concern though, would be that if your brand is struggling to sell enough qualifying products then you would expect the supply of ICE vehicles to become restricted.”

Read More: Agnew director Brian Robinson on navigating Northern Ireland's car repair challenges

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.