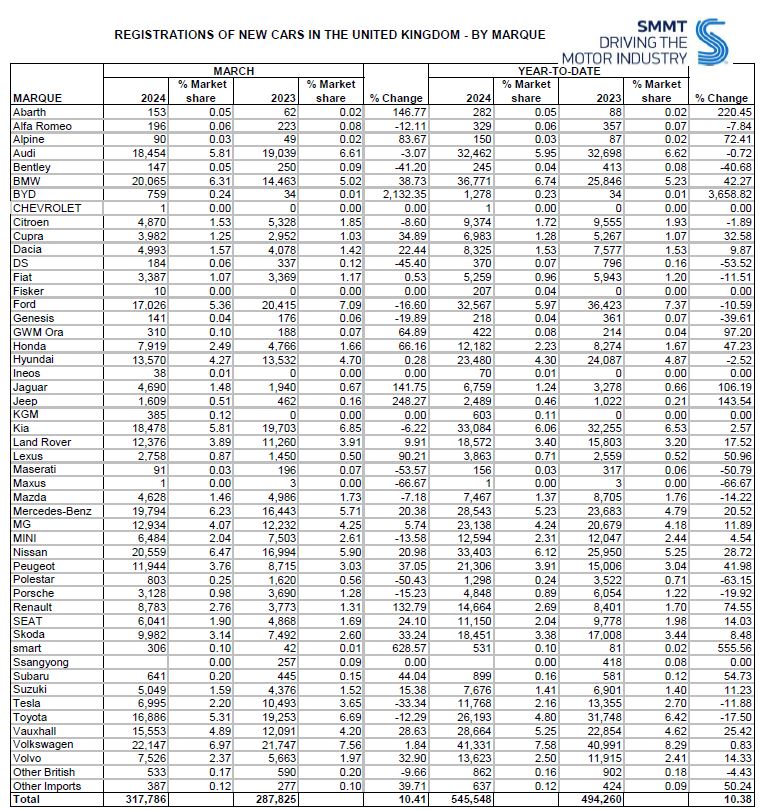

The March registration figure of 317,786 (up 10.4%) was the highest since 2019. However, to put that into perspective, it was also the same as the market in March 2009, when the country was struggling in the global financial crisis. It is also way below the 500k-plus March figures for 2016 and 2017.

The growth in the first quarter has come from the fleet market (up by 28.9%), as companies re-fleet after supply chain shortages. However, the underlying weakness of the economy is shown by sales to private buyers, which were down by 9.2% YTD.

Equally worrying, the market share of BEVs stalled at 15.5% YTD, which is a very long way from the government’s mandate of 22% in 2024 and 28% in 2025. Companies that fail to meet the mandate will either have to buy allowances from other manufacturers who have exceeded their target, or pay £15,000 per car. That could be lucrative for Tesla who can sell credits, but it won’t be great for UK manufacturers who will struggle to meet that figure.

The March registration figure of 317,786 (up 10.4%) was the highest since 2019. However, to put that into perspective, it was also the same as the market in March 2009, when the country was struggling in the global financial crisis. It is also way below the 500k-plus March figures for 2016 and 2017.

The growth in the first quarter has come from the fleet market (up by 28.9%), as companies re-fleet after supply chain shortages. However, the underlying weakness of the economy is shown by sales to private buyers, which were down by 9.2% YTD.

Equally worrying, the market share of BEVs stalled at 15.5% YTD, which is a very long way from the government’s mandate of 22% in 2024 and 28% in 2025. Companies that fail to meet the mandate will either have to buy allowances from other manufacturers who have exceeded their target, or pay £15,000 per car. That could be lucrative for Tesla who can sell credits, but it won’t be great for UK manufacturers who will struggle to meet that figure.

The development of market share between PHEV and BEV is something of a conundrum. In the first quarter of 2022, PHEV sales were only up 12%, compared to a growth in BEV sales of 102%. It seemed that that, as a bridge technology to BEV, PHEV would soon have done its job, and BEVs would take over. Yet in the first quarter of 2024, PHEVs grew by 34%, while BEVs only grew by 11%.

It now seems that the BEV early adopters have all adopted, and BEVs are struggling to broaden their appeal to the mainstream, writes David Francis.

Meanwhile PHEVs offer big tax advantages, if rather smaller CO2 advantages.

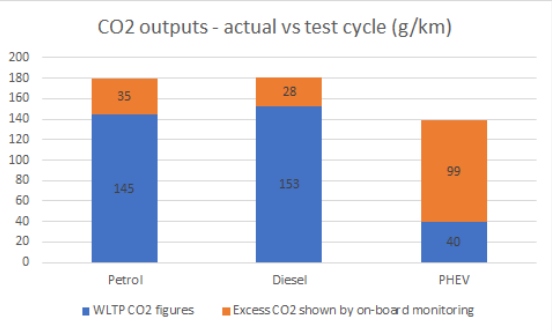

The latest figures from the EU say that the average PHEV emits 3.5 times more CO2 in real world use (measured via on board monitoring) than it does on the test cycle (see chart). The reason for the gap is that the test cyle assumes that PHEVs operate on batteries for over 70% of the time – presumably the officials that agreed to that also believe in fairies.

Naturally, car manufacturers are taking note of the market, and are announcing a shift in planned production from BEV to PHEV. BEVs are still very hard to make a profit on, so anything that requires a smaller battery is an attractive proposition.

Naturally, car manufacturers are taking note of the market, and are announcing a shift in planned production from BEV to PHEV. BEVs are still very hard to make a profit on, so anything that requires a smaller battery is an attractive proposition.

Meanwhile, at a manufacturer level, the market has been experiencing almost as much turmoil as at the environmental level. The table of the top five manufacturers looks like someone has accidentally jumbled the order. Apart from VW in a predictable first place, the positions of second to fifth are hardly what one would expect: BMW, Nissan, Kia and Ford respectively. In particular, BMW has had a stellar quarter, with sales up 42.3% (see table).

Nissan will also be celebrating, having got back above 6% for the first time since 2017. Being the best-selling non-German brand in the UK is also a welcome tonic for what is, globally, a somewhat beleaguered company.

Just outside the Top 10, the best performances have come from French manufacturers (not a comment that we have made for quite some time). Renault is up 74.6% thanks to increased sales of the Clio and Kadjar, while Peugeot is up by 42.0%, with growing sales of the 208 and 2008. Indeed, Peugeot’s parent company, Stellantis, is doing very well. Cynics might say it is a collection of brands no-one else would want (e.g. Citroen, Fiat, Vauxhall), but the fact is that Stellantis has a 14.4% profit margin, and has a stock market valuation higher than VW.

Indeed, Stellantis can be seen as the anti-VW: it has less than stellar brands, but brilliant cost controls give good profit margins, while VW has excellent brands, but terrible cost control at its German HQ. VW’s profit margin is 6.9% – Carlos Tavares, the boss of Stellantis, would not get out of bed for that.

At the segment level, the A segment (city cars) is fading fast. As the cost of meeting safety standards rises, most manufacturers have pulled out, leaving essentially just Fiat (500/Panda), Toyota (Aygo X) and Hyundai/Kia (i10, Picanto). Market share is just 2.8% YTD, down from 3.9% YTD 2023.

The biggest growth has come from the C-segment (Golf/ Qashqai size). This is taking 42.6% of all sales, the first time one segment has taken more than 40% of the UK market since at least the 1950s. One is tempted to say that the British car buyer can choose any car they want, so long as it is a C-segment crossover.

Given the size of something like a C-segment Kuga, it is no surprise that the D-segment is now little more than a rounding error. The best-selling model, the Skoda Superb, has still not reached 1,000 sales this year. Even including large MPVs like the VW Transporter, market share is only 0.9%.

The only “traditional” large or premium segment that is doing reasonably well is Compact Executive. Currently, there are only five serious models – BMW 3/4 Series, Audi A4, Mercedes C-Class, Tesla Model 3 and Polestar 2. Despite the limited choice, the segment takes a respectable 4.0% of the market, which gives good profits to those manufacturers.

The only “traditional” large or premium segment that is doing reasonably well is Compact Executive. Currently, there are only five serious models – BMW 3/4 Series, Audi A4, Mercedes C-Class, Tesla Model 3 and Polestar 2. Despite the limited choice, the segment takes a respectable 4.0% of the market, which gives good profits to those manufacturers.

In fact, the market is now so concentrated that Compact Executive is the fourth largest segment, behind family cars, superminis and premium SUVs. The three biggest segments now take a record 89.9%. There are ever more manufacturers competing in the market (mainly because of the Chines entrants), and a huge number of new models, but an ever-shrinking variety of the types of car we buy.

Looking forward, the SMMT expects anaemic market growth of 3.2% in 2024 (1.97 million) and 3.8% in 2025 (2.04 million). Given current sales, those forecasts look pretty reasonable. The SMMT also has forecasts for BEV share of 21% in 2024 and 26% in 2025, which seems more of a stretch. It will be interesting to see if the SMMT maintains those figures in its next forecast.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.