In the latest of AM's '10 minutes with...' supplier insight interviews, drivvn chief executive Peter Brown discusses online car sales, the omnichannel customer journey and the influence of the agency retail model.

I understand that drivvn was born out of the Summit business. What is the background to its formation?

I understand that drivvn was born out of the Summit business. What is the background to its formation?

In August 2020 we came into being. Summit had been working with automotive clients for four-and-a-half-to-five years. I guess at the end of 2019 (owner)TTC Group looked at what it was doing and saw that it had two quite different businesses working in one entity. The decision was taken to split that up. I joined in February 2020, and we moved the platform and clients across from Summit. We’ve always behaved as a start-up, with that agile mentality, but we actually started out with several OEM clients from day one. I joined from the marketing and tech company Unlimited Group. As a partner there I had been running one of the units, Prophecy, which was about customer acquisition and retention. My first impression was that we had a strong business that could be better. I didn’t think we were working in strong enough partnerships with our clients. I wanted to change that to make relationships work better on a strategic level as well as delivering the best customer journey we could. We needed to look very closely at the omnichannel journey between online, the OEM and the retailer.

The business seems to bring together quite a few strands of online retail. What are its core products?

We have two. At the front, we’ve got comparator that helps customers, particularly those looking at the EV (electric vehicle) transition and the cost of ownership versus ICE (internal combustion engine). You can do very small things like get answers to the question “is an EV right for me?” right through to selecting any model, from any brand, and comparing prices and scrutinising the cost of ownership. We then step into our e-commerce stores. Basically, as soon as you start to choose a model on a brand website, we can then support the whole journey, right from configuring the vehicle to setting up finance and buying the vehicle online. Our stores appear within the wider brand website, but we’re just in control of the configuration and that retail journey.

Are any of your client relationships with car retailers?

All of our relationships are with OEMs and NSCs (national sales companies), but we’ve all worked in various aspects of tech and automotive and what you have to recognise is that having the OEM and the retailer working together, as one, is vital. The OEMs are driving towards agency – some faster than others – and we’re helping to make sure that the customer is getting what they want out of any new process. We’ve done a lot of work with Vauxhall, and it is going great guns selling cars online. There is no right or wrong way of doing it, but we wanted to really understand the role of the retailer.

What is the key to true omnichannel retail?

Throughout the process we are data agnostic. We will take data feeds and push that to wherever the client needs it. What we have been working on with Stellantis is an assisted-selling model. This means that, as soon as someone starts to input some personal data and starts to configure a vehicle, that data is shared with the retailer teams. What we don’t want is a lot of people doing things online and the retailers not getting that intelligence. Various brands are now using that ‘assisted sale’ model. Whether it’s a direct sales platform operated by the NSC, or by the retailer, they can all get that same view of the customer. That helps attribution around remuneration models and things of that kind. That single customer view is central to the omnichannel relationship between the OEM and the retailer because, without it, you are always going to be fighting over the customer. It’s really about giving the customer what they want.

Did drivvn see the agency model coming along and decide to focus on OEM clients as a result?

I’d like to say that we saw the shift to agency coming along and went for it but, in reality, we wanted to stay focused and single-minded and that’s just the route we took.

What is the make-up of the business?

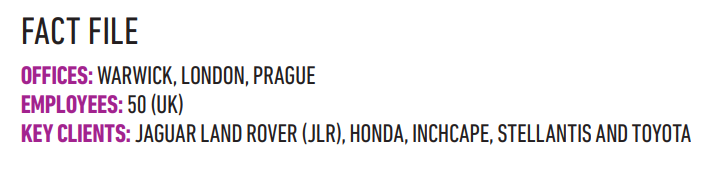

Our workforce is primarily technical, with about 70% in product development and engineering, with a delivery team responsible for client relationships and liaising with their digital teams. The rest is in commercial, finance and HR roles. We have 50 employees in the UK and some in the Czech Republic.

What are the key issues that you encounter when trying to streamline OEMs’ online retail process?

The thing that most people forget is that most of these OEM businesses are more than 100 years old. They were set up to manufacture products for multiple markets and they have a complex make-up. Now they find themselves moving into becoming mobility companies with the increased importance of software as they embrace the concept of the connected car, telematics and autonomous driving aids. They are also having to account for disruptors, including in those Tesla and the likes of Cazoo and cinch. Looking behind the scenes at an OEM and seeing the volume of legacy systems that have to be negotiated it soon becomes apparent that there are many hurdles to truly omnichannel retail.

And the key hurdles for customers trying to transact online?

We get a lot of people doing multiple visits within the finance space. Part-exchange is generally more straightforward. We see fewer blockages there. Take it further back up the funnel and we are spending more time trying to simplify the number of choices that have to be made when buying a new car. At a dealership there is scope to have the customer taken through the configuration process, but, online, things need to be far simpler. It’s very hard for people to understand that if you opt for a certain option pack then you automatically can’t have this or that other option. Another consideration is that it has to be the case that whatever channel you go down you must be offered the same price, that goes for a vehicle sale or a part-exchange. We want to make sure that however a customer chooses to buy a car they get the same journey. It’s important that these journeys look and feel the same, that products are described in the same way, whether the advisor is employed by the retailer or a direct sales channel.

To what extent have you seen customers embrace online retail through your OEM stores?

In 2020, we published the number of sales we had seen. At that time, it was £382m and we’ll absolutely smash that in 2021 from a sales point of view. From an OEM point-of-view the push today is to shift more of the car retail journey online and we have quadrupled our number of online stores. If you look at the wider retail environment today, I think it’s about 31% online. I think that’s going to be above 50% by 2025. We are looking at the ambition to be at 30% of our sales online, with certain OEMs, by 2025. Some will be ahead of that, some behind. If we can get to that point that will reflect well on the value we have been able to provide. Along the way there will always be a focus on the role of the retailer, though, they will remain vital component and a beneficiary.

Some reports suggest online car buyers will spend more on a vehicle. Have you found this to be the case?

It’s really important not to draw too much of a conclusion from that. The fact is that the early adopter is a very different prospect to the normal customer. Their approach to risk might be very different, they may not require answers to every question and, ultimately, they may be inclined to spend more.

What do you enjoy about working in the online car retail space?

The key thing for me is just understanding the nuances of the different stages of the journey. It’s fascinating to see the results of the A/B testing that we do on tiny little bits of the journey, figuring out how we can simplify processes by reducing clicks. The other wonderful bit about online retail – but also the thing that can drag you down – is that there is so much data. We have been working with clients to try to surface the data in a real-time way where we can. That’s not only benefitting the sales team, but also the product team because they can see that customers buying a Corsa – just for example – will automatically gravitate to the same spec and colour.

What does success look like for drivvn in 2022?

We did well last year in terms of new clients and we’re just about to announce another very soon. They are the long-standing heritage OEMs that we all know, but there are conversations with other emerging OEMs. They come with their own set of challenges, but not the issues with things like legacy systems. Right now, we’re live in 17 countries. There’s still plenty of scope for growth for us.

Login to comment

Comments

No comments have been made yet.