The silence was stunning. At a recent meeting of the Automotive Fellowship International, Steve Nash, the CEO of the IMI, was chairing a debate on the future of the franchise system in Western Europe and asked: “What do you think the implications of Brexit would be for the retail automotive sector in the UK?”

The silence continued, one or two people checked their emails, while others stared at the stunning tapestries in Luton Hoo’s Wernher Room. After a while, Nash moved the conversation to another topic.

From my perspective, the implications of Brexit for our sector did not appear to have been argued or articulated. I started to ask around, first at the conference and later, some legal friends. The answers were really interesting.

Brexit would be an almost unique event. The scenario – a country that has been applying the legal requirements of a particular jurisdiction removing itself from that regime overnight – has not happened often in world history. Most changes are negotiated and agreements set in place over a long period of time, such as the handover of Hong Kong to China, and even then problems occurred. This situation is so different, there are very few precedents in place.

What does it mean for automotive retailers?

European legislation has come in a range of formats for our sector, but probably one of the most interesting aspects appears to revolve around the Block Exemption Regulations (BER) that have affected both the ability to have protected market areas and the sharing of technological information.

Brexit raises a range of questions that need to be answered:

- Do manufacturer/dealer contracts that have been written under the existing European rules have legality if the parties are no longer part of that jurisdiction? If not, what would then happen?

- Do new dealer contracts need to be put in place? Removing the restrictions of BER could potentially lead to a restructuring of the franchise system.

- Would the removal of the requirement for manufacturers to share technology with approved service providers stop in the UK, causing the independent sector to be disadvantaged?

- For some dealer groups operating in both the UK and Europe, there is the potential expense of having to change systems to run under different rules in both jurisdictions.

When I asked the head of one of the UK national sales companies what would happen if we withdrew from Europe, he suggested that the Office of Fair Trading would have to step in and either maintain the status quo or introduce new regulations. This would make logical sense, but how long it would take for the organisation to make the decisions, bearing in mind that it would be facing challenges from many sectors other than our own?

Some commentators have argued that leaving Europe would mean a relaxation of the emission rules and that this may delay the demise of diesel. However, the Climate Change Act (2008), which made the UK the first country to establish a long-term legally binding framework to cut carbon emissions, contains a target requiring emissions reductions of 80% by 2050. If anything, restrictions put in place by the UK Government are likely to be tighter than those currently put in place by Brussels. This could lead to restrictions on the importing of certain vehicles.

More recent pronouncements came this January when transport secretary Patrick McLoughlin launched the ‘Go Ultra Low City Scheme’ whereby Nottingham, Bristol, Milton Keynes and London will share a £40 million fund to introduce cutting-edge technology such as charging hubs and street lighting that doubles as charge points.

McLoughlin has stated: “The UK is a world leader in the uptake of low-emission vehicles and our long-term economic plan is investing £600m by 2020 to improve air quality, create jobs and achieve our goal of every new car new car and van in the UK being ultra-low emission by 2040.”

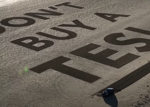

We need to debate the possible impact of Brexit

Much of the above is speculation and it is highly likely that the Government would try to make any transition as easy as possible should the vote be to leave Europe. However, it is worrying that our industry appears to be slow in debating the issue and the potential outcomes.

The decision to stay or go will be made on June 23 by the general public, who will not be considering the impact on our sector. We can’t control the outcome, but I think that we should at least be trying to work out some of the potential implications.

Now, please vote in AM's poll on the EU referendum

Create your own user feedback survey

Login to comment

Comments

No comments have been made yet.