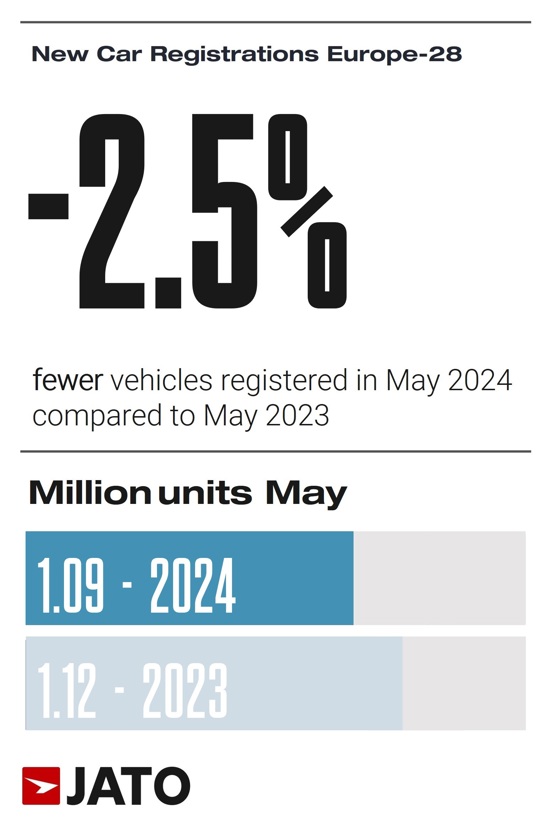

New passenger car registrations in Europe totalled 1,087,699 units in May, marking a 2.5% decline compared to the same month last year, according to JATO Dynamics.

Registrations however remained higher than in May 2022 and 2021, which saw 943,405 and 1,082,934 units respectively.

Felipe Munoz, global analyst at JATO Dynamics, commenting, said: “Since the global pandemic, the European car market has only recovered to 75%-80% of its original size. As a result, many factories across Europe are not operating at full capacity, giving Chinese OEMs a unique opportunity to sell across Europe while avoiding tariffs.”

New passenger car registrations in Europe totalled 1,087,699 units in May, marking a 2.5% decline compared to the same month last year, according to JATO Dynamics.

Registrations however remained higher than in May 2022 and 2021, which saw 943,405 and 1,082,934 units respectively.

Felipe Munoz, global analyst at JATO Dynamics, commenting, said: “Since the global pandemic, the European car market has only recovered to 75%-80% of its original size. As a result, many factories across Europe are not operating at full capacity, giving Chinese OEMs a unique opportunity to sell across Europe while avoiding tariffs.”

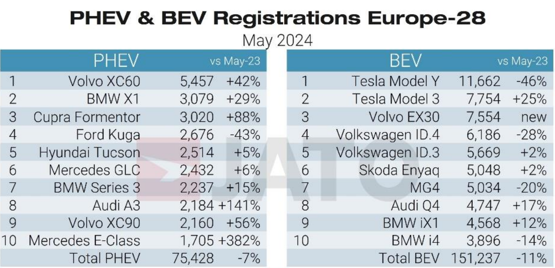

The overall decline is partly attributed to a 10% drop in registrations of battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs). Registrations of these vehicles fell from 250,530 in May 2023 to 226,665 in May 2024. BEVs experienced the largest decline, with registrations falling 11% to 151,237 units, while PHEVs saw a 7% decrease.

Munoz added, “This negative result comes as a result of high BEV and PHEV prices, with these cars still unaffordable for the masses.”

Despite the downturn, some BEV models performed well. BMW saw significant traction with its iX1, as well as the new i5 and iX2, achieving BEV volumes approximately 1.6 times higher than those of Audi or Mercedes. Volvo's EX30 also performed strongly, securing third place among the top-selling BEVs both in May and year-to-date.

Despite the downturn, some BEV models performed well. BMW saw significant traction with its iX1, as well as the new i5 and iX2, achieving BEV volumes approximately 1.6 times higher than those of Audi or Mercedes. Volvo's EX30 also performed strongly, securing third place among the top-selling BEVs both in May and year-to-date.

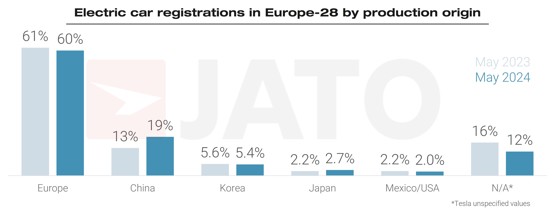

Registrations of Chinese-made BEVs rose by 25% year-on-year, reaching nearly 28,000 units in May.

Munoz noted: “The Volvo EX30 is just one example of a China-made vehicle that is doing extremely well across Europe.” In contrast, electric vehicles manufactured outside of China saw a 16% decline in registrations year-on-year.

“The market share of Chinese-made BEVs jumped from 13.2% to 18.5% year-on-year, with two Chinese models securing places in Europe’s top five best-selling BEVs for May.”

Volvo, BYD, and Smart saw the most significant increases in BEV registrations, while MG, BMW, Dacia, and Polestar lost ground.

MG's internal combustion engine (ICE) offerings outperformed its BEVs, with volume increasing by 47% in May and by 61% since the start of the year. Munoz explained, “MG is turning its attention to non-electric cars to maintain ground in Europe. This is likely a response to the European Commission’s probe and incoming tariffs.”

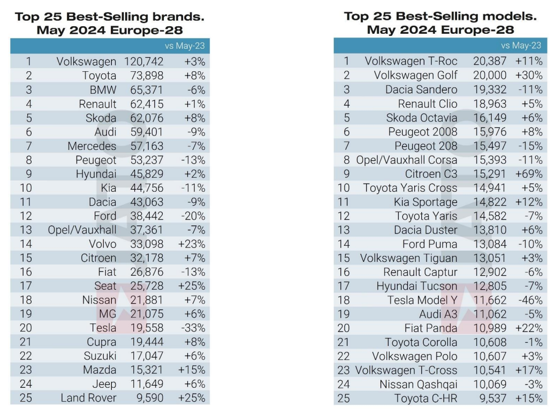

The Volkswagen Golf registered 20,000 units in May, becoming the second most-registered car behind the Volkswagen T-Roc. The Golf’s volume increased by 30%, driven by higher fleet and business registrations, securing second place in the overall model ranking year-to-date.

Other notable models in May included the Citroen C3, supported by deals on its previous generation. The Cupra/Seat Leon, Toyota RAV4, Seat Ibiza, Opel/Vauxhall Astra, and Jeep Avenger also posted strong year-on-year growth.

Among new models, the Volvo EX30 performed well with more than 7,500 units registered. Other significant performers included the Lexus LBX with over 2,100 units, the BMW i5 with almost 2,000 units, the new Renault Scenic with 1,631 units, and the Mercedes CLE with 1,581 units.

Additionally, Fiat registered 1,515 units of the 600, Volkswagen registered 1,239 units of the ID.7, BMW registered 1,144 units of the iX2, Mitsubishi registered 1,058 units of the Colt, and Renault registered 1,003 units of the Rafale.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.