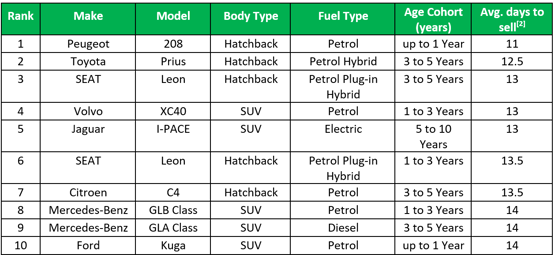

The Peugeot 208 is the UK’s fastest-selling used car, with petrol models up to 1 year-old taking an average of just 11 days to leave retailers’ forecourts - two and a half times faster than the national average, according to the latest data from Auto Trader.

May marks the second consecutive month a Peugeot has taken the top spot; in April the 208’s larger counterpart, the 3008, took an average of 12 days to sell.

At 28 days, used cars generally are selling three days faster than in May 2023.

And at a model level, this month sees the return of the SEAT Leon (petrol plug-in hybrid, 3-5 years) onto the national top 10, rising from the 7th fastest selling used car in April, to the third fastest in May to date.

In fact, the Leon makes two appearances this month, with the slightly younger 1-3-year-old version currently the nation’s sixth fastest.

In contrast to April, which saw alternatively fuelled vehicles dominate the top 10, petrol models, including the 208, make up most of the current fastest sellers, whilst four alternatively fuelled vehicles and one diesel make up the rest.

This reflects the wider used car market, where petrol is now selling faster than any other fuel type, taking around 27 days. Hybrids have seen their average speed of sale slow from 26 days in April (making it the previous fastest selling fuel type) to 29 days so far this month, whilst diesel has remained flat, also taking 29 days to sell.

Just one used electric vehicle (EV) made it onto the current top 10 list; the Jaguar I-PACE (5-10 years), which is currently taking an average of 13 days to sell.

Across the UK, EVs are selling within 29 days, which is a slight acceleration on the 31-day average recorded in April.

However, when looking at the data at a more granular level, used EVs aged three-five years are flying off forecourts, taking an average of just 24 days. Due to the recent surge in supply, their nearly new counterparts aged less than a year-old, are taking around 35 days to sell.

More broadly, demand growth for used electric cars on Auto Trader (based on the volume of searches and advert views on site), is soaring way ahead of their petrol counterparts, increasing 54.9% and 7.8% year-on-year (YoY) respectively.

This disparity is highlighted even more dramatically in the 3–5-year-old segment, where demand for EVs of this age cohort has rocketed 132.3% YoY versus just 1.6% for petrol.

Looking at age cohorts more broadly, the 3-5 segment of the market is recording the fastest pace of any other age group, with cars of this age taking an average of just 24 days to sell. At the other end of the scale, used cars of a slightly greater vintage, those aged between 10-15 years, are lingering on forecourts the longest, taking an otherwise respectable 30 days to sell.

Auto Trader said it is worth noting that supply of this age group is currently up around 12.5% on this time last year, whilst stock levels of 3-5-year-old cars have fallen nearly -19% over the same period.

Commenting, Richard Walker, Auto Trader’s data & insights director, said: “The speed at which used cars sell is a key indicator of the underlying strength of the market. Since the New Year, we’ve tracked very robust levels of consumer demand, and whilst the average speed of sale has softened slightly on the record pace we saw in March, the market continues to carry some real momentum behind it.

Cars are selling faster than last year, retail prices are stabilising, and importantly, with average sales up over 6% in April, more are also being sold. It should give retailers confidence as we approach the summer months.”

Current fastest-selling used cars (all fuel types)

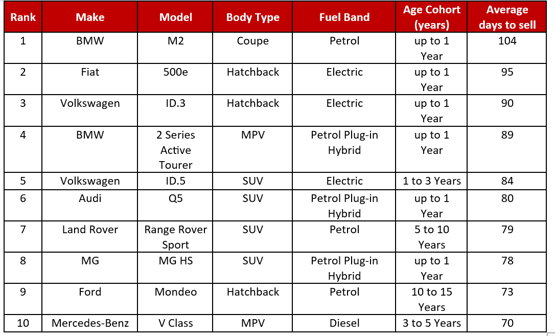

Current slowest-selling used cars (all fuel types)

Login to comment

Comments

No comments have been made yet.