Used electric vehicles were the only fuel type not to enjoy price growth with average prices dipping -0.4% MoM in April, according to Auto Trader

In contrast, both petrol (£14,955) and diesel (£14,659) cars saw average prices increase 1.3%, recording demand of 8.4% and -5.7% respectively.

At granular level the data demonstrated that younger EV models performed better with the average price of 1–3-year-old EVs increasing 2.5% on March, whilst petrol cars of the same age increased 2.3%. 1-3-year-old diesel cars rocketed 4.3%.

The average price of a used EV was £27,884 in April.

The difference in month-on-month performance in different segments of the market played out again a background of exceptionally robust levels of consumer demand which was up 56% YoY.

Richard Walker, Auto Trader’s data & insights director, said: “2024 got off to a strong start, and it’s very reassuring to see it continue so confidently into Q2, with very robust demand helping retailers to sell more stock, more quickly.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), noted that despite the robust start of the used car market continuing which indicated a pot return to pre-pandemic levels, it was notable that whilst younger EVs are outperforming the market, “used electric vehicles were the only fuel type not to record price growth demonstrating that the used electric market is still maturing.”

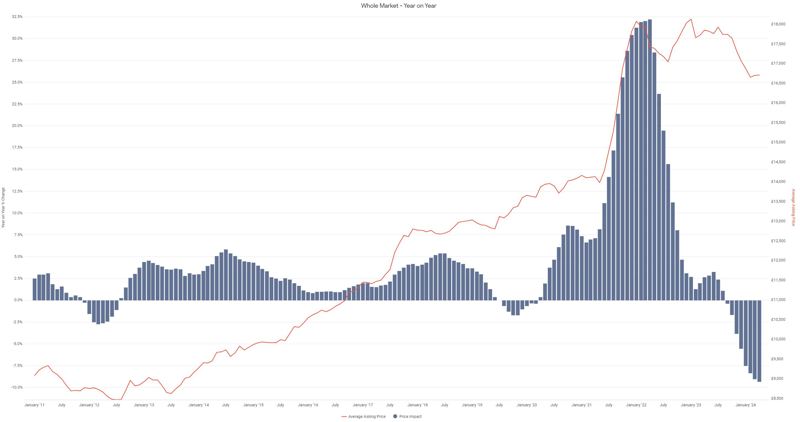

According to Auto Trader data, April recorded growth in consumer demand, transactions, and retail prices. with the market recording a 1.1% uptick on a like-for-like basis - the first month-on-month (MoM) increase in a year.

It said that although slightly behind the pre-COVID average of around 2.2%, it offers a positive sign of the market returning to historic norms.

Although retail prices remain down on 2023 (-9.3%), the month-on-month uptick is being fuelled by favourable market dynamics. Indeed, whilst the volume of used cars entering the market fell -1.1% year-on-year (YoY) last month, the first contraction in supply levels since the summer, consumer demand on Auto Trader was up around 9%, which is the highest rate of growth since December.

As a result, Auto Trader’s Market Health metric, which assesses potential market profitability, rose over 10% over the same period, also marking the largest increase this year.

The strong demand is reflected in the speed in which used cars were sold. It took an average of just 27 days for a used car to leave retailers’ forecourts in April, which is one day slower than March (the fastest pace ever recorded), but two days faster than the same period last year.

Used car transactions increased around 6.3% year-on-year in April with consumer research pointing to sustained demand, with circa 80% of in-market car buyers surveyed claiming to be as confident in their ability to afford their next car as they were last year.

What’s more, 81% of the car buyers surveyed said they were intending to buy their next car within the next 6 months, which is up from 77% the month prior.

Auto Trader’s Walker concluded: “Disappointingly, prices do remain down year-on-year, but the month-on-month growth and return to seasonal norms is another positive sign of the retail market stabilising.”

Top 10 used car price growth (all fuel types) | April 2024 vs April 2023 like-for-like

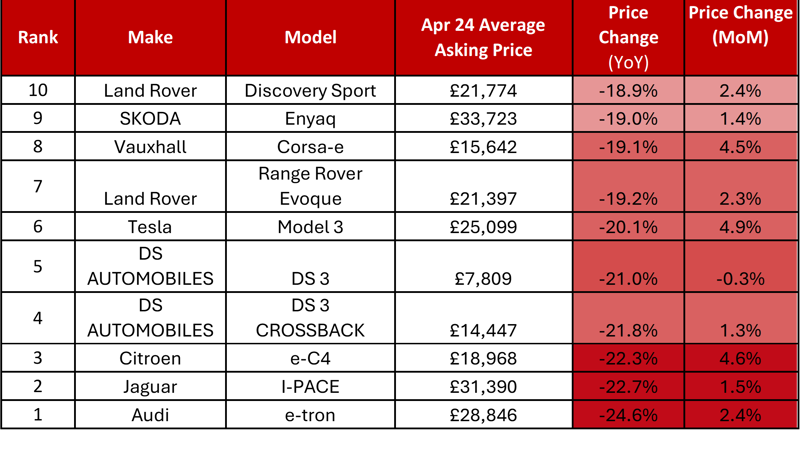

Top 10 used car price contraction (all fuel types) | April 2024 vs April 2023 like-for-like

Top 10 used car price contraction (all fuel types) | April 2024 vs April 2023 like-for-like

Login to comment

Comments

No comments have been made yet.